China has not only set a goal of short-term economic acceleration in 2023 compared to the pandemic period but also a clear strategic economic target for 2035. At the 20th Party Congress the latter was stated as reaching the level of a “medium-developed country by 2035”. Slightly earlier, in 2020’s discussion around the 14th Five Year plan, it was concluded that by 2035 for China: “It is entirely possible to double the total or per capita income”. These two goals are essentially the same. This target requires an average annual growth of GDP of at least 4.6% a year by 2035.

Recently, however, a series of concerted Western attempts have been made to claim that China cannot achieve this target. The IMF report on China for 2023, for example, projects that’s China’s growth will decline to only 3.4% a year by 2028 and to 3.1% a year by 2031.1 Blackrock published a report stating: “the potential growth rate of the Chinese economy… could fall… to around 3% by the turn of the decade.”2

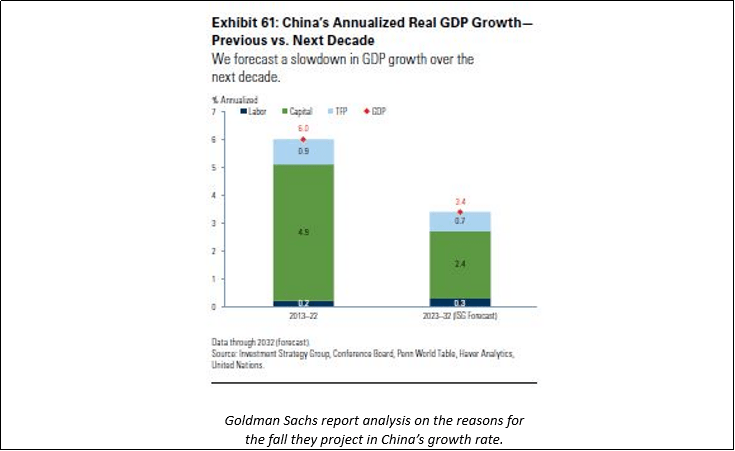

The consequences of such a slowdown are evident – China will fail to achieve its 2035 goals. In many of these analyses it is claimed China will remain a middle-income economy. Thus the Financial Times carried an article, with the self-explanatory title, “The implications of China’s mid-income trap”, claiming that: “China has now found itself in a classic middle-income trap, a term the World Bank invented back in 2006 to describe the phenomenon of emerging economies that never, well, actually emerge.“3 The most comprehensive statement of this position is a report by Goldman Sachs also with a self-explanatory title of “Middle Kingdom: Middle Income” – i.e. China will not be able to achieve the level of a “medium-developed country” but will remain a middle income one. The basis of this claim is that the Goldman Sachs report claims: “China’s growth rate will slow to 3.5% by 2027 and 2.5% by 2032 for a 10-year annualized growth rate of 3.4%.”4

Despite what will be seen are quite erroneous conclusions the Goldman Sachs does have one virtue which is absent from other similar claims. Instead of basing itself on a series of anecdotes, or assertions which do not show how cited facts create the effects they are alleged to have, i.e. the unserious method of many of these Western claims, the Goldman Sachs report does attempt to give a seriously quantified basis for the links between its claims and their supposed effects. Therefore the Goldman Sachs report is analysed here not because it is the worst, but because it is the most serious of such studies. But what such analysis actually shows is that the Goldman Sachs report anticipates that China will commit economic suicide under the influence of Western economic ideas! As the confusions in vulgar Western economic ideas involved in this are sometimes repeated in sections of the Chinese media, examining the errors of the Goldman Sachs report therefore is highly educative as it shows the mistakes of such Western economic thinking contained in many similar analyses and their dangers for China.

The method of distortion

First the Goldman Sachs report carries out the most typical forms of distortion. That is, it combines statements which are simply not true, purely invented material, i.e. “fake news”, with huge distortion of the relative weight of real factors in the situation – i.e. claims that factors which do not have great weight on the outcome are in fact the most important in deciding it. Thus, for example the more than 100-page Goldman Sachs reports devotes dozens of pages to claims such as that that China “will curtail growth and innovation.” 5That: “Policy uncertainty… hampers innovation.” 6 That: “China’s population is largely uneducated.” 7 That: “We believe China will remain a middle-income country, not only because of its weakening growth, but also because of its low rankings across key metrics that boost productivity… ranks below many emerging market economies.” 8

It is easy to refute these specific charges. Far from hindering innovation China is the only economy in the world which is a serious competitor to the U.S. in high technology industries, China has the highest growth of total factor productivity (TFP) of any major economy. Regarding labour productivity, China has the fastest GDP growth of any major developing country, and as China’s working age population has been slightly declining since 2015, reflected in a fall in the total number of hours worked in the country, all of this increase in increase in output has come from factors increasing labour productivity etc.

But examination shows that the easy refutation of such errors is really not the point because the Goldman Sachs report’s own data, which it is forced to include because otherwise the study would be openly unserious, shows that in reality even if all these charges were true, which they are certainly not, they would not at all be decisive. The Goldman Sachs report’s own data shows that the overwhelming reason they project China’s economic growth to fall to the level they claim is simply due to the one fact. This is of a projected decline in the share of investment in China’s economy, as shown in Goldman’s chart below – this causes 92% of the fall in GDP growth.

To be precise, on the Goldman Sachs reports calculations, China’s GDP growth is projected to fall from an annual average 6.0% in 2013-2022 to 3.4% in 2023-2032, that is a decline of 2.6%. But the reason for this is because of the overwhelming effect of the single fact that the annual increase in GDP growth created by capital investment s projected to fall by 2.4% – from 4.8% to 2.4%.9 As this fall in capital investment accounts for 92% of the decline in the GDP growth rate, only 8% of the decline the Goldman Sachs report projects, or 0.2% GDP growth a year, is attributable to factors other than the decline in investment. Without the investment decline, the Goldman Sachs report’s data shows that China’s annual GDP growth would only fall from 6.0% to 5.8% – a level which would easily allow China to exceed its own targets for 2035. In short, the Goldman Sachs report spends large numbers of words on charges which are untrue but also which its own data shows wouldn’t make much difference even if they were true! Only the decline in investment makes a decisive difference. Therefore, most of the Goldman Sachs report is simply a form of distortion “by smokescreen” – to list a series of things which their own data shows wouldn’t make much difference.

When it comes to the reasons for this fall in the contribution of capital investment to GDP growth the Goldman Sachs report says that this is because “Investment as a share of GDP is forecast to decline from 42% in 2022 to 35% by 2032.” 10 Undoubtedly a 7% of GDP decline in investment in a 10-year period would lead to a big fall in China’s growth rate – as analysed below. But why should China carry it out? That is why should China commit economic suicide by such a huge cut in investment?

China and other Upper Middle-Income Economies

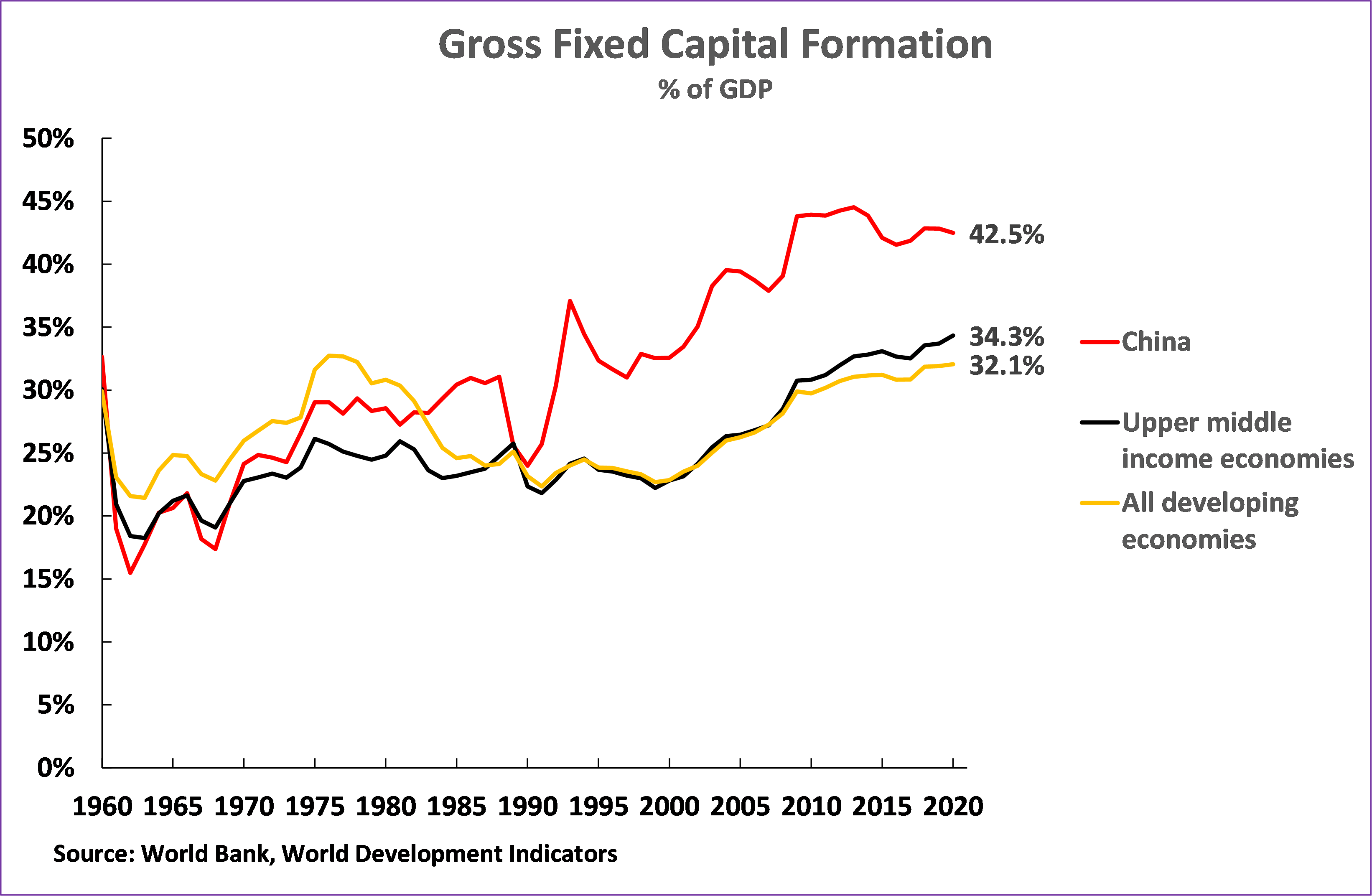

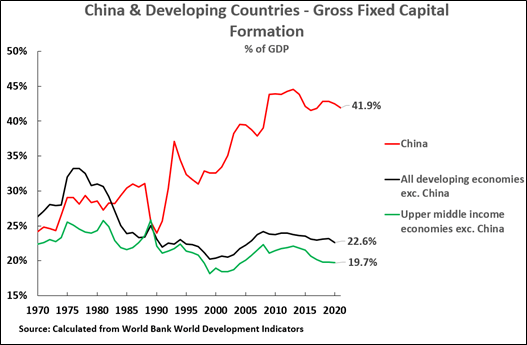

The report believes that the reason that China will cut investment in this economically suicidal way, ensuring China cannot achieve the goals it has sent for 2035, is because average “Investment as a share of GDP in upper-middle-income countries is 34%.”11 This average 34% of fixed investment in GDP in upper middle income economies is shown in Figure 1.

But, first, this is a bizarre logic. China has far outperformed other upper-middle-income economies, so why should it wish to abandon a path which has been the most successful and adopt one that has been less successful? On the contrary the logical thing would be that other upper-middle-income economies should adopt the China path.

But apparently for the Goldman Sachs report the most successful country should adopt the policies of the less successful ones! Imagine if Goldman Sachs applied that to their advice regarding companies. Then it would call for the most successful company to abandon its strategy and instead adapt the strategy of the less successful ones. If that were the type of advice Goldman Sachs gave out regarding companies, it would lose all its clients in almost no time! But regarding countries it precisely advocates this bizarre logic that the most successful country, China, should adopt the approach of the less successful ones. Given the relative results, Goldman Sachs should be advising other countries to learn from China.

Figure 1

It is also unclear if Goldman Sachs have actually thought through their research properly. China, at present, itself belongs to the ranks of upper middle-income economies (and developing economies). Indeed, the only reason that the level of fixed investment in GDP in upper middle incomes economies is as high as 34% is because that figure includes China. Excluding China, the percentage of gross fixed investment in GDP is only a total of 20% in all other upper middle-income economies and only 23% in all developing economies – as shown in Figure 2.

In any case the consequences of a sharp reduction in the percentage of fixed investment in GDP are clear. Evidently if the rate of fixed investment in GDP in China were reduced to the average for all developing economies, or that for other upper middle-income economies, then it would be expected that China’s growth rate would also fall towards that of other middle-income economies. As most middle-income economies are not making the transition to high income status that would indeed mean also China would not make the transition to a high-income economy. But, as already seen, the reason for that would be that China cut the percentage of fixed investment in GDP – that is China would not reach the ranks of high-income economies because it had decided to commit economic suicide.

The U.S. forces a cut in investment in successful competitors

In fact, there is also nothing new in the U.S. slowing competitor economies by reducing their level of investment in GDP. On the contrary it is historically the most tried and tested of all U.S. methods of slowing down competitors. In particular it was used on the three previous occasions since World War II when the U.S. found other significant economies growing more rapidly than it was. These were:

- Germany in the 1950s and 1960s.

- Japan in the 1960s, 70s and 80s.

- The East Asian Tiger economies from the 1970s to the late 1990s.

To understand in more detail the methods by which the U.S. sought to, and succeeded, in slowing competitor economies it is necessary to understand the historically new economic situation the U.S. faced after World War II. The U.S. prior to 1914 overtook the previous global economic superpower the UK, due to a higher level of fixed investment in GDP. The U.S. also outgrew, except during the Great Depression, the other claimant to replace declining UK power – Germany.

By the early 1950s, however, the U.S. found itself in a new global economic situation. For the first-time major capitalist economies, initially West Germany and then Japan, achieved far higher levels of fixed investment in GDP than the U.S. and were growing much more rapidly than the U.S..

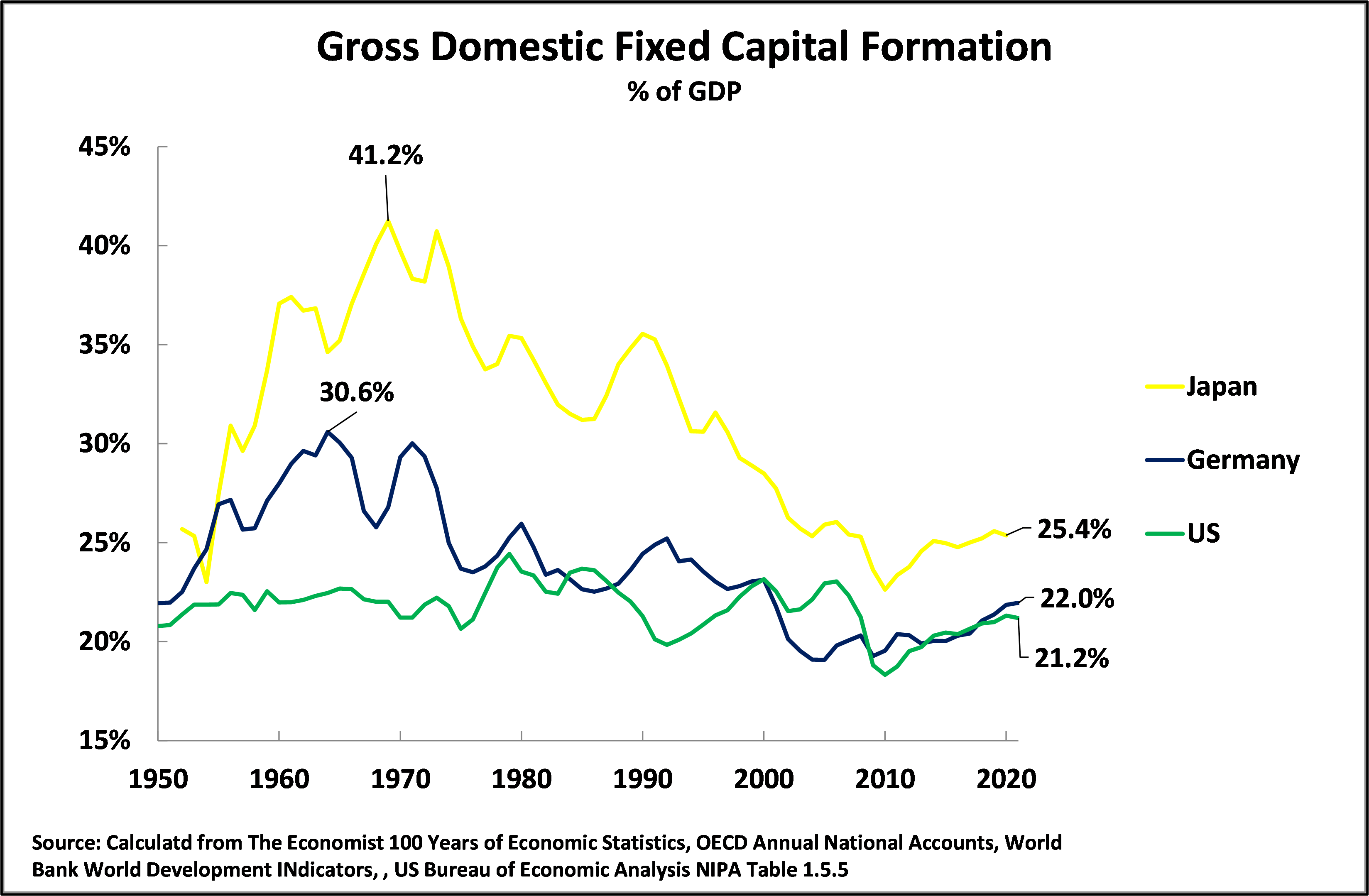

- By 1955 West Germany’s fixed investment was 26.9% of GDP, compared to 21.9% for the U.S., and by 1964 Germany’s fixed investment was 30.0% of GDP.

- Japan’s level of fixed investment in the same year was 34.6% of GDP, compared to 22.7% for the U.S..

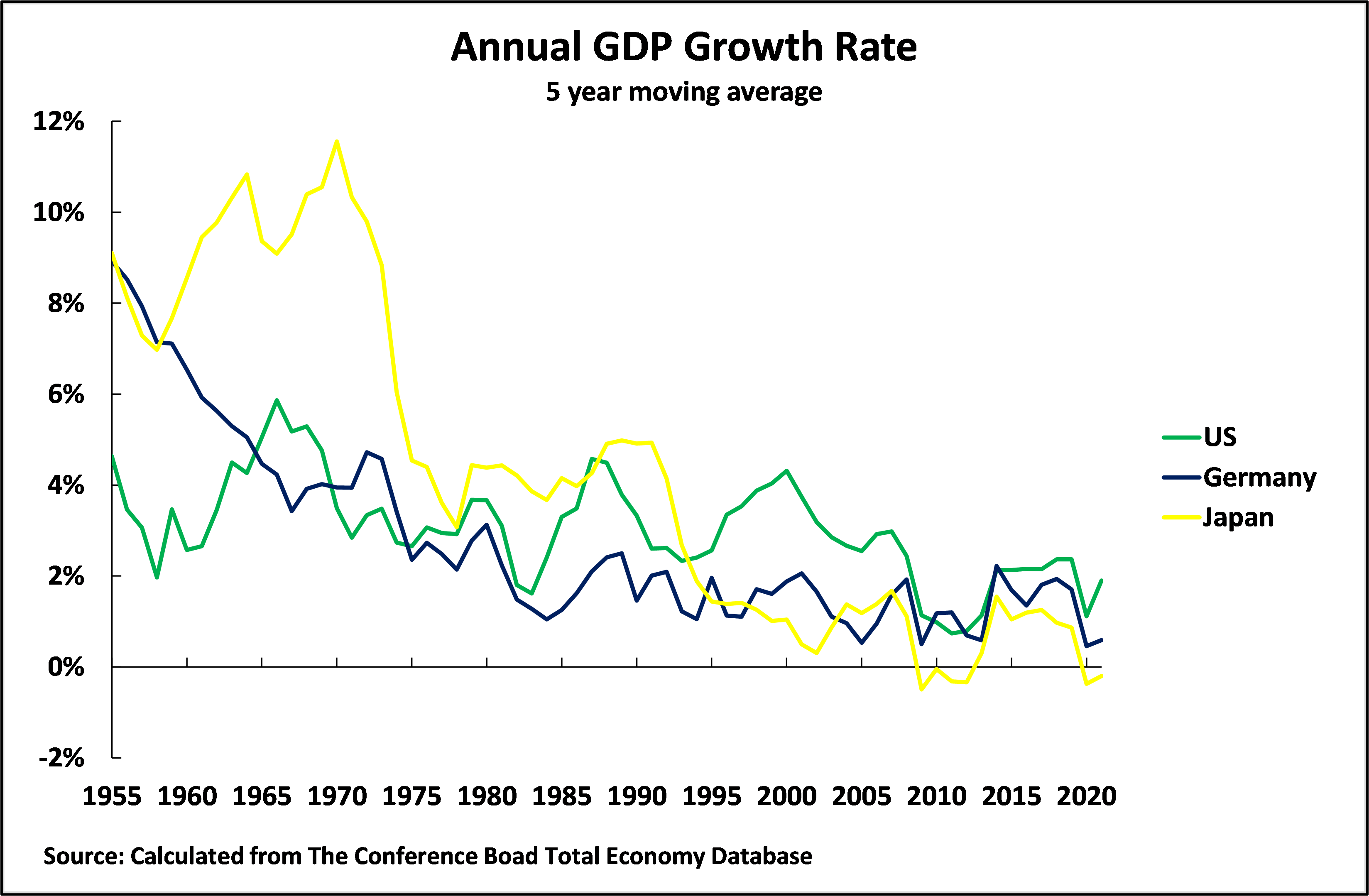

Accompanying this, by 1955 West Germany’s economy was growing at 8.9% a year, compared to 4.6% for the U.S., and by 1965 Japan’s economy was growing at 9.4% a year compared to 5.1% for the U.S..

For the first time in its history the U.S. was therefore being outgrown and outcompeted by other capitalist economies, producing a huge drain on the U.S.’s only significant non-dollar foreign exchange reserves – its gold holdings. Between 1950 and 1971 U.S. gold reserves fell by more than half, from 20,000 metric tons to 9,000 tons.

The U.S., in a pattern that was to be repeated in the future, defeated this competitive threat not by accelerating its own growth but by sharply slowing its competitors. The U.S. used a combination of political and economic means to achieve this. The U.S. was Germany and Japan’s military protector – and therefore the U.S. could use a strong leverage to influence their economic policies. Therefore, in the late 1960s, the U.S. used the power this gave it over Germany to compel Germany to revalue the D-mark, reducing its competitiveness, and to no longer exchange its dollar holdings for gold. The link of U.S. military protection to German economic policy was was made entirely clear in March 1967 in the “Blessing Letter,” named after the then president of Germany’s central bank, which was sent to the head of the U.S. Federal Reserve. This explicitly noted:

“There occasionally has been some concern… that… expenditures resulting from the presence of American troops in Germany [could] lead to United States losses of gold…

You are, of course, well aware of the fact that the Bundesbank over the last few years has not converted any… dollars… into gold…

You may be assured that also in the future the Bundesbank intends to continue this policy.”

However, as even this step proved insufficient to resolve U.S. economic problems, in August 1971 the U.S. proceeded to further unilateral measures against competitors – most importantly Germany and Japan.

Over the weekend of August 13, U.S. suspended the commitment to provide gold to foreign holders of dollars. It imposed a 10% surcharge on merchandise imports. The U.S. informed other countries it would only rescind the 10% tariff if they increased the exchange rate of their currencies against the dollar – thereby reducing their competitiveness compared to the U.S.. In late September 1971 the U.S. similarly unilaterally informed the Group of 10, the wealthiest nations of the time, that the U.S. required a $13 billion improvement in its trade balance, a movement from a $5 billion deficit to an $8 billion surplus, and this demand was non-negotiable. Under such pressure the Smithsonian Agreement of December 1971 increased the exchange rate of other major trading currencies, including the mark and the yen, against the dollar by 11-17%.

These measures did not accelerate the U.S. economy. The long-term U.S. slow growth continued – as Figure 3 shows. But these measures were highly successful in slowing Germany and Japan. By the mid-1970s both German and Japanese economies had decelerated to the point where their economies were no longer growing faster than the United States. Those in the U.S. favouring a confrontational approach had therefore demonstrated that it was possible to win a competitive struggle not by accelerating the United States own economy but by slowing others. It was a lesson which was to be used again – as will be seen.

Figure 3

The precise effect the U.S. achieved to radically reduce Germany and Japan’s growth rate was to cut their level of fixed investment in GDP. Gross fixed investment fell sharply from their peak levels – in the case of Germany from 30.6% of GDP in 1964 to 22.0% of GDP by 2021, and in Japan’s from 41.2% of GDP in 1969 to 25.0% in 2021. Germany’s level of fixed investment was reduced to near the U.S. level of slightly above 20% of GDP and the gap between Japan’s level of gross fixed investment and the U.S. was reduced from a peak of 19.2% of GDP to only 4.2% of GDP. In terms of its relation to the highest level Germany’s of gross fixed investment was reduced by 29% from its maximum rate, and Japan’s was reduced by 39% from its highest level. Figure 4 shows the declines.

Figure 4

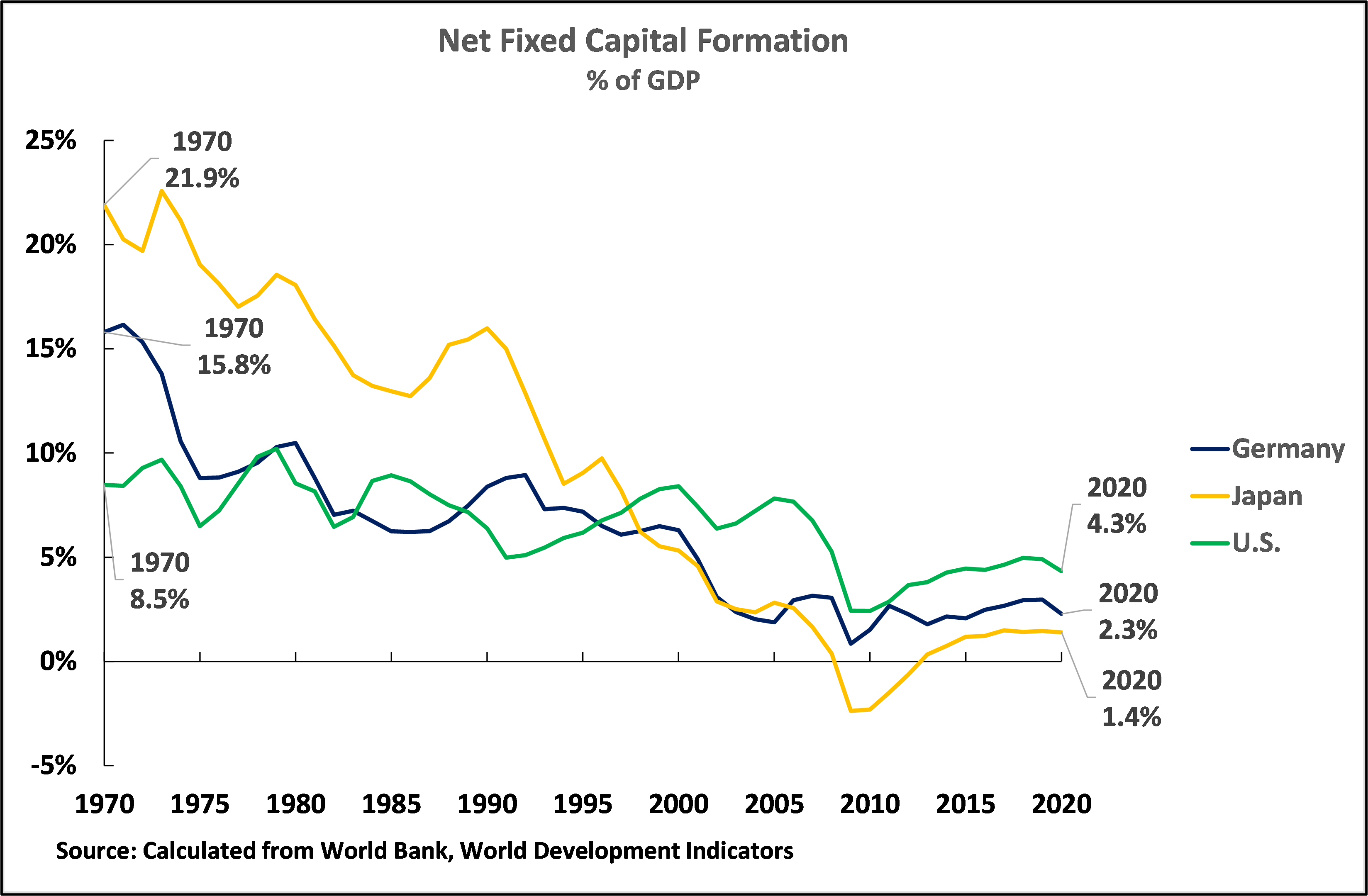

The fall in Germany and Japan’s net fixed investment

But in reality, this data for gross fixed investment considerably understates the significance of the fall in Germany and Japan’s investment because it does not take into account depreciation – that is consumption of fixed capital. A substantial part of gross fixed investment simply goes to replacing worn out/depreciated capital and does not increase the capital stock and the contribution this makes to growth. The data for the level of net fixed investment in GDP for the US, Germany and Japan, that is taking into account depreciation, is shown in Figure 5 – internationally comparable World Bank data for this is only available from 1970.

As may be seen, in 1970, that is before the U.S. launched its 1971 measures against Germany and Japan, Japan’s level of net fixed investment was 21.9% of GDP, Germany’s 15.8%, and the U.S. 8.9%. That is, Germany’s level of net fixed investment, contributing to the increase of its capital stock, was 6.9% of GDP higher than the U.S. and Japan’s was 13.0% of GDP higher. By 2020, the latest internationally comparable World Bank data, the U.S. level of net fixed capital investment was actually higher than both Germany and Japan – as was its annual rate of GDP growth. Between 1970 and 2020 the U.S. level of net fixed investment had been reduced by 4.2% of GDP, from 8.5% to 4.3%, while Germany’s had been reduced by 13.5% of GDP, from 15.8% to 2.3%, and Japan’s had been reduced by an astonishing 20.5% of GDP – from 21.9% to 1.4%. As annual growth in Japan’s capital stock were therefore minimal its prolonged GDP stagnation was entirely explicable.

Put as a proportion of its 1970 level, Germany’s level of net fixed investment in GDP had been reduced to only 15% of its peak level, and Japan’s to only 7%. Inevitably, given the key role played by capital investment in growth, Germany and Japan’s economies sharply decelerated. The U.S. competitive position was consequently restored not by acceleration of its own economy but by deceleration of Germany and Japan caused by the drastic fall in their level of fixed investment.

Figure 5

The U.S. slows the “Asian Tigers”

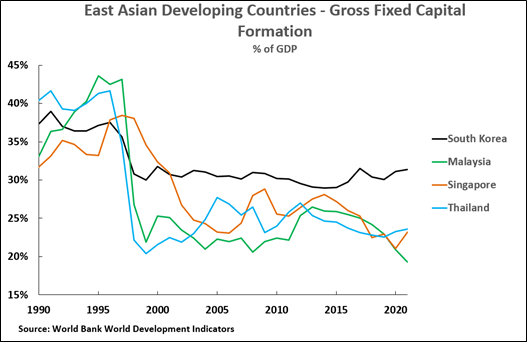

Following the defeat of Germany and Japan’s competition in the period of the 1950s, 60s, and 70s, the U.S. faced a similar phenomenon of economies growing more rapidly than its own, due to higher fixed investment levels. This was from the 1980s with the rapid growth of the ‘Asian Tigers’. Although this competitive challenge, due to the relatively small size of these economies, was of an entirely lower order of magnitude than from Germany or Japan it provides a further example of the means by which the U.S. slowed competitor economies.

The ‘Asian Tigers’ achieved even higher levels of fixed investment than West Germany and Japan – Singapore reaching a peak level of fixed investment of 46.2% of GDP in 1984, and South Korea of 39.0% in 1991. The corresponding result was extremely rapid growth – in 1984 Singapore’s economy was expanding at an annual 8.5% and in 1991 South Korea was growing at 9.7%.

But critical weakness of these economies was that the domestic savings of some of the key East Asian developing economies were insufficient to finance such high investment levels. By 1997 both Thailand’s and South Korea’s domestic savings were inadequate to finance their own domestic fixed investment – they were financing part of their capital accumulation from abroad, including even by short term bank loans. By 1996 $110 billion a year was flowing to Asia, and primarily in the form of interbank loans rather than equity investment or other forms of FDI,12

To facilitate these short-term inflows, a number of East Asian developing economies had been persuaded to liberalise their international capital account. Elimination of capital controls in turn permitted funds to flow out of the East Asian developing economies in 1997 – creating the devastating Asian financial crisis of that year. As Joseph Stiglitz, Nobel Prize winner and former chief economist of the World Bank, noted regarding this: “excessively rapid financial and capital market liberalization was probably the single most important cause of the crisis.”13

While deliberate unilateral U.S. action before and after 1971 directly slowed Germany and Japan’s economies, there are differing interpretations as to whether the U.S. did or did not deliberately precipitate the 1997 crisis to slow the Asian Tiger economies. What is clear, however, is that once the crisis began the U.S. supported policies which made the results worse and opposed steps that would have alleviated it. In particular the U.S. strongly opposed a proposal by Japan to set up an Asian Monetary Fund to provide funds to deal with the crisis.14

For present purposes it is unnecessary to judge U.S. administrations subjective policy intentions in the Asian financial crisis – it is sufficient to note that the result was the same as in the earlier cases of Germany and Japan. Fixed investment levels in the affected Asian economies fell sharply after the crisis and remained lower, and therefore their growth rates necessarily also greatly declined. Taking precise data, as shown in Figure 6, in the period 1996-2021:

- Singapore’s gross fixed investment fell from 37.5% to 23.2% of GDP.

- South Korea’s fixed investment fell from 37.5% of GDP to 31.4%.

- Malaysia’s fixed investment fell from 42.5% to 19.3% of GDP.

- Thailand’s fixed investment fell from 41.7% of GDP to 23.6%.

Figure 6

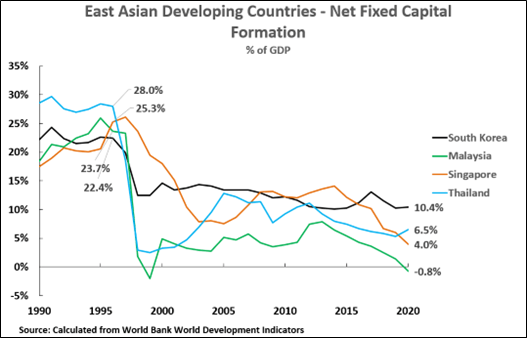

Net fixed investment, under the impact of the falls in gross fixed investment, showed the same pattern. Taking the difference between 1996, the last year before the East Asian financial crisis struck, and 2020, the latest available data, as shown in Figure 7:

- Thailand’s net fixed investment fell from 28.0% to 6.5% of GDP.

- Singapore’s net fixed investment fell from 25.3% of GDP to 4.0% of GDP.

- Malaysia’s net fixed investment fell from 23.7% of GDP to -0.8%.

- South Korea’s net fixed investment fell from 22.4% of GDP to 10.4%.

Figure 7

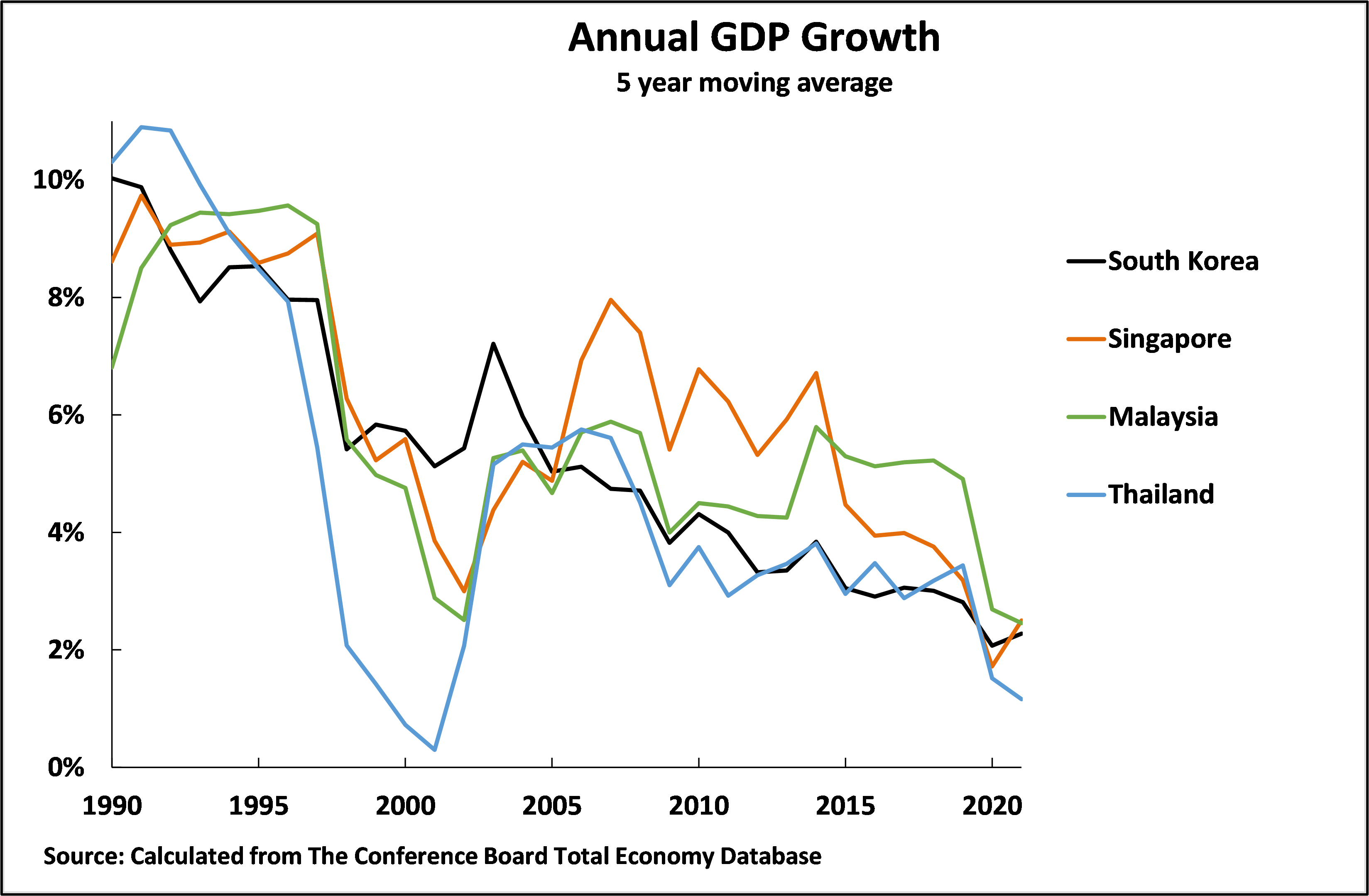

The results in terms of growth were clear. Under the impact of the fall in fixed investment, taking five year moving averages, Figure 8 shows that from 1996 to 2021:

- South Korea’s annual average GDP growth fell from 8.0% to 2.3%.

- Singapore’s annual average GDP growth from 8.% to 2.5%.

- Thailand’s annual average GDP growth fell from 7.9% to 1.7%.

- Malaysia’s annual average GDP growth fell from 9.6% to 2.5%.

Figure 8

Therefore, whether or not the U.S. deliberately initiated the 1997 Asian financial crisis, and whatever the U.S. subjective intentions in the solutions that were imposed on the region, the results were clear. As would be predicted by economic theory, and as was illustrated earlier by Germany and Japan, the Asian financial crisis once again showed that if a country’s fixed investment level could be reduced its economy would necessarily decelerate. Here again the U.S. demonstrated that reducing the level of investment in competitors drastically slowed their growth rates – thereby allowing the U.S. to succeed in competition not by accelerating its own growth rate but by slowing its competitors.

Murder versus suicide

Turning to U.S. policy to China, there is, however, a decisive difference between China on the one hand, and Germany, Japan, or the ‘Asian Tigers’ on the other. Germany, Japan and the Asian Tigers were all politically and militarily subordinate to the U.S. and it could use this to compel them to adopt policies maintaining the supremacy of the U.S. even if it was against those countries national interests. As the U.S. was the military protector of Germany and Japan the U.S. could pressure them to revalue their currencies, thereby lowering their competitiveness, and adopt other damaging policies forcing down the rate of investment in the way that was shown in Figure 8. That is, to express it in these terms, the U.S. could use its domination to “murder” Germany, Japan, and the Asian Tigers economies.

But in contrast China is not militarily dependent on the U.S. and the U.S. has no equivalent politico-military means, as with Japan, Germany, or the Asian Tigers to force China to carry out a damaging scale of currency revaluations or any similar policy that would lower the proportion of China’s economy used for investment. China is also not dependent on inflows of capital to finance domestic investment, as were some of the Asian Tigers – on the contrary, China has run a persistent balance of payments surplus, meaning that its domestic savings are even larger than its domestic investment.

A full-scale military war by the U.S. against a nuclear armed China also carries extreme risks for the U.S. and there is U.S. majority within the U.S., either among the population or military/foreign policy circles for such a policy at present – although the U.S. is prepared to use the indirect consequences of its military strength by carrying out provocations around Taiwan, trying to create a crisis in the South China Sea etc.

This is to say the U.S. cannot “murder” China: China can only be defeated if it can be persuaded to slow or stop its own economic rise. That is China has to be persuaded to commit economic “suicide”.

Economic suicide

On the face of it, the idea that a great state, such as China, can be persuaded to commit suicide might appear ludicrous. But history shows it is not, indeed, the U.S. already successfully achieved this in the case of the former U.S.SR. This suicide was carried out by the undermining of the CPSU, even prior to collapse of the U.S.SR in 1991, by policies pursued by its General Secretary Gorbachev – Gorbachev had the illusion that the U.S. was attempting to aid the U.S.S.R.

Gorbachev, after becoming CPSU General Secretary, allowed the development of currents within the CPSU, led by Yeltsin, who were oriented to restoring capitalism. A collapse of discipline within the CPSU was then permitted that allowed Yeltsin to campaign against the policies of the central government long before he formally left the CPSU in July 1990. Following Yeltsin’s destruction of the U.S.S.R in December 1991 the restoration of capitalism and the privatisation of state-owned companies led in Russia to the greatest peacetime economic collapse in recorded history since at least the Industrial Revolution – the consequences of “shock therapy”. The U.S.SR disintegrated, Russia’s GDP fell by 40% between 1991 and 1998, Russian male life expectancy declined by six years, wars began on the territory of the former Soviet Union that are still continuing more than 30 years later – the war in Ukraine being just the latest and largest of a series of wars.

The Soviet Union might have possessed immensely strong military forces – with essential military parity with the U.S. But in the end, they could not defend the Soviet Union nor prevent historical catastrophe for Russia. The collapse of the U.S.SR – in Putin’s words. ‘the greatest geopolitical catastrophe of the [20th] century” – the victory of separatism, the national humiliation of Russia, the collapse in living standards, the fall in life expectancy, the outbreak of civil wars, the advance of hostile military alliances almost to Russia’s borders, all flowed from this fundamental course of Gorbachev. The U.S.S.R.’s submarines rotted, its tanks rusted, and the military infrastructure collapsed. The U.S.S.R. had collapsed from within. It had not been murdered; it had committed suicide. It was a stunning success for the U.S., an historic catastrophe for Russia. It has long been the hope of the U.S. to find a “Chinese Gorbachev” who could also produce China’s national suicide.

But, it may be said, that the U.S. cannot achieve such an outcome for China for a simple political reason – the CPC is not the CPSU, and Xi Jinping is the exact opposite of a Chinese Gorbachev. Instead of leading China into a disaster socialism is being strengthened in China. This is indeed a formidable obstacle. There is no possibility at present for the U.S. to overthrow and destroy the CPC in the way that it did the CPSU. Therefore, unable to succeed in a central attack, the U.S. aims to pursue flanking attacks – that is the U.S. hopes to attempt to undermine the central political strength of the CPC by the U.S. achieving gains on individual issues by internal and external pressure. Taking only a few, of which some are well known, they include:

- Encouraging separatism – the U.S. provoked riots in Hong Kong, and almost continuously carries out provocations attempting to build up separatist, or potentially separatist, forces in Taiwan (visit of Pelosi to Taiwan, arms sales to Taipei etc).

- Attempts to create regional tension around China – for example for a long period the U.S. has been attempting to create a crisis in the South China Sea. The fact that the U.S. has been unsuccessful in this, because the countries in the region want to get on with their successful peaceful economic development, does not stop the U.S. creating provocations such as sailing warships through the area, trying to create anti-China forces in other countries in the region etc.

- The U.S. encouraging companies to violate Chinese law – the U.S. media, in particular, presented in a distorted and unfavourable way China’s actions against companies attempting to circumvent China’s financial laws.

- Corruption – the U.S. in reality encourages corruption within China by presenting those found guilty by the anti-corruption campaign in China not as criminals but as political victims.

- Tariffs – as is well known since 2018 the U.S. has attempted to pursue a trade war against China by introduction of tariffs against Chinese exports to the U.S..

- Technology sanctions – also as is well known the U.S. is attempting to block China from developing high technology industries by trying to prevent not only its own companies but those of other states from exporting advanced products to China.

But these attacks, while in some cases they can cause short term crises and problems, are not succeeding in preventing China’s national regeneration. The reason for this is contained in the point emphasised by Xi Jinping that it is economic development which is the decisive issue: “The path of Chinese socialism is the only way to achieve China’s socialist modernization and create a better life. This path takes economic development as the central task, and brings along economic, political, cultural, social, ecological and other forms of progress.“15

The U.S. knows from its experience in defeating Germany, Japan, and the Asian Tigers that a decisive way to slow a competitors growth rate is to get it to reduce its level of investment. This is the reality that Goldman Sachs correctly identifies. Indeed, it is true that if China greatly reduces its level of fixed investment in GDP its economy will greatly slow down and it will fail to achieve its 2035 goals. Goldman Sachs does show accurately the way in which the reduction of China’s level of investment in GDP will translate into greatly reduced growth. It rightly identifies the way to greatly damage China’s economic development. But the problem for the U.S. is that it has no means to force China to reduce its level of investment – that is the U.S. cannot economically murder China. Instead, the U.S. has to try to find the ways to persuade China to lower its level of investment. That is the U.S. has to attempt to persuade China to commit economic suicide – just as seen in the Goldman Sachs study.

The means by which the U.S. attempts to do this will form the subject of the second article in this series.

This article originally appeared in Chinese at Guancha.cn.

References

Brazier, A., & Jiang, S. (2022, October 17). China’s growth hallenges go beyond Covid. Retrieved from Blackrock.com: https://www.blackrock.com/corporate/insights/blackrock-investment-institute/economic-insights/2022/10/china-growth-challenges#_edn1

Goldman Sachs. (2022). Middle Kingdom: Middle Income. Goldman Sachs Investment Strategy Group. New York: Goldman Sachs.

International Monetary Fund. (2023). People’s Republic of China – Staff Report for the 2022 Article Iv Consultation. Washington: International Monetary Fund.

Panitch, L., & Gindin, S. (2012). The Making of Global Capitalism. London: Verso.

Stiglitz, J. (2002). Gobalization and its Discontents. London: Penguin.

Wigglesworth, R. (2023, February 27). The implications of China’s mid-income trap. Retrieved from FT.com: https://www.ft.com/content/a998c1bc-7632-47c1-baba-6ccd6aaef96e

Xi, J. (2012 November 17). Study, Disseminate and Implement the Guiding Principles of the 18th CPC National Congress. In J. Xi, The Governance of China (Kindle Edition) (2014 ed., Vol. 1, pp. Location 165-449). Beijing: Foreign Languages Press.

1. (International Monetary Fund, 2023, p. 65).

2. (Brazier & Jiang, 2022)

3. (Wigglesworth, 2023)

4. (Goldman Sachs, 2022, p. 69)

5. (Goldman Sachs, 2022, p. 1)

6. (Goldman Sachs, 2022, p. 14)

7. (Goldman Sachs, 2022, p. 13)

8. (Goldman Sachs, 2022, p. 16)

9. (Goldman Sachs, 2022, p. 69)

10. (Goldman Sachs, 2022, p. 69)

11. (Goldman Sachs, 2022, p. 69)

12. (Panitch & Gindin, 2012, p. 254)

13. (Stiglitz, 2002, p. 89)

14. For a detailed analysis see (Stiglitz, 2002, pp. 89-132)

15. (Xi, 2012 November 17, p. Location 219)