The reason for the interrelation of these two issues is simple. Modern Western economic research, without having any intention to, and while being developed for quite different reasons, confirms the correctness of economic concepts in which China’s economic reform was developed. These Chinese formulas, as was recently stressed again by Xi Jinping, were developed in Marxist and not Western economic terms. I want to explain that process in Western economics, how it intersected with my own personal activity, and its relation to the development of China’s economy and recent discussion in China.

Theory and facts

A famous Chinese phrase is ‘seek truth from facts’ – which correctly expresses the relation between any theory and the facts and which is the basis of any scientific method. If facts contradict the theory then the theory must be changed, because the facts will not alter.

This also helps determines how a subject develops. If a theory and the facts coincide frequently no great step forward in understanding is made – investigations confirm the existing theory. But frequently the greatest steps forward are made when facts and theory contradict each other.

When such a contradiction of facts and theory develops science and dogma take the opposite approach. Dogma attempts to deny the facts to cling to a wrong theory: science demands that the theory must be changed in to fit the facts.

This can be illustrated by two of the greatest steps forward in understanding in human history – but it will be seen it also applies in economics.

Copernicus’s systematic study of the observations of the heavens made by unaided human eyes, before the invention of the telescope, led to the conclusion that the earth circled the sun – not the reverse as was virtually unanimously believed by humanity throughout its previous existence. Finally when Galileo used the newly invented telescope to discover moons orbiting Jupiter the theory that all heavenly objects circled the earth definitively collapsed. In this case an improvement in measurement, the telescope, sustained a revolutionary change in theory.

Darwin’s detailed observations of species on the Galapagos islands showed that there was a gradual change in species across the islands. He therefore clearly ascertained species were not fixed, they changed and modified – and the theory of evolution was born.

In the last 20 years a similar official revolution in the study of economics has taken place – we may in that sense call it a ‘Copernican revolution’ in economics.

I will trace this process and its interrelation with my professional history.

Maddison

The 1960s and 1970s saw great progress in economic statistics. In particular, the creation of the OECD led to enormous improvements in data. With this data the OECD’s head of statistics, Angus Maddison, carried out among the first systematic comparative studies of advanced economies. These were later summarised in his book Dynamic Forces in Capitalist Development.

These studies led to a classic contradiction between facts and theory. Western economic theory, as developed in the 1950s by Solow, the creator of modern ‘growth accounting’ claimed that inputs of labour and capital into the economy made only a small contribution to growth and greatest part of growth was due to Total Factor Productivity (TFP) – that is the growth not explained by inputs of capital and labour. The problem was that the facts assembled by the OECD, and analysed by Maddison, demonstrated the opposite – that the overwhelming part of growth was due to inputs of capital and labour, and in particular capital. Changes in TFP, which were smaller than the other causes in growth, were in turn importantly accounted for not only by technology but by factors such as international trade, scale of production etc. This data can be studied in Dynamic Forces in Capitalist Development.

Maddison himself did not attempt to make a developed theoretical explanation of these findings. Instead he studied a different question – the study of growth over very long periods of time, producing his masterpiece Statistics on World Population, GDP and Per Capita GDP, 1-2008 AD. Almost every advanced economics textbook today draws on this data.

These studies symbolised by Maddison played a decisive role in my life. Studying them I arrived at the conclusion that these facts were irrefutable. If the economic theories of the 1970s claimed the opposite, then this merely showed that these theories were wrong. I decided to develop all future analyses based on the facts discovered by Maddison and others. This method was applied to both the Western economy and to China. It led directly, combined with my greater knowledge of China’s economy, to my most important economics article before The Great Chess Game – my article written at the beginning of 1992 ‘Why the Economic Reform Succeeded in China and Will Fail in Russia and Eastern Europe’?

This article, and shorter ones summarising its conclusions, may be said to have created something of a sensation when published in Russian. The analysis that China’s economic reform was correct and Russia’s ‘shock therapy’ was wrong was opposed by more than 90% of Western economists – who held the view, in technical terms, that growth based on TFP was the key to Russia’s success. Instead, I pointed out ‘shock therapy’ would produce a catastrophe.

My analysis led to public conference discussions between myself and the Vice-President of Russia and with the chief economic adviser to President Yeltsin. It led to a meeting with Russia’s foreign minister and other high officials. Its conclusions were circulated to all members of the Russian Parliament by order of the chairman of the parliament.

Obviously I failed to persuade the Russian government in 1992 not to follow ‘shock therapy’ and instead to draw lessons from China’s economic reform – something I very much regret. But personally that article was a huge success. Despite it being opposed by 90% of Western economists in 1992 facts each month confirmed its analysis. Companies read in the newspapers predictions by Western economists that shock therapy would be a success but my predictions it would lead to an economic disaster. As companies required accurate analyses and my predictions were confirmed they paid me money for analysis and advice. ‘Seek truth from facts’ in this case became ‘make money from facts’! It might be said I made money from the errors of Solow and instead reliance on the facts.

Most important of all, of course, the facts of the two decades later confirmed the analysis that shock therapy would be a catastrophe in Russia. Following 1991 Russia’s economy contracted by almost 40%, male life expectancy dropped by six years to only 58 by 1998, and in 2013 Russia’s population was still 4.6 million less than in 1991. Russia’s GDP growth over the period from 1991, the last year of the USSR, to 2013 was 1.0% a year – compared to 10.2% in China. In Ukraine, the second largest state of the former USSR, the result was worse. In 2013, U

kraine’s GDP was still 23% below its level in 1991 – i.e. Ukraine experienced net negative growth over a 22 year period.

Analysis based on knowledge of China’s economic reform, combined with the facts established by Maddison, therefore led to a correct analysis whereas refusal to ‘seek truth from facts’, and instead clingingly dogmatically to Solow’s theory TFP was the largest factor in economic growth, produced in ‘shock therapy’ in Russia the greatest economic decline in peacetime history.

Young, Vu & Krugman

A second major development in the West in the 1990s, involving these same fundamental economic issues, was about the ‘Asian Tigers’ – also termed Newly Industrialised Countries (NICs). Rapid growth by the ‘Asian tigers’ attracted the West’s attention. It was therefore analysed using the ‘growth accounting’ framework established by Solow. However, by this time it was known that the original framework of Solow’s growth accounting contained a fundamental error in failing to take into account changes in the quality of capital (age of capital stock, length of periods of depreciation etc.) and in the quality of labour (education, skill, age etc.). This is roughly the same error as attempting to calculate growth of real wages without taking into account inflation.

Therefore, analysis of the Asian Tigers was carried out controlling for changes in the quality of labour and capital – most famously in Alwyn Young’s The Tyranny of Numbers: Confronting the Statistical Realities of the East Asian Growth Experience. The conclusion arrived at was clearly in line with earlier studies of advanced economies by Maddison. It showed the Asian Tigers extremely economic development was not due to rapid TFP growth. TFP growth by Asian Tigers was the same as other more slowly growing economies. The very rapid growth of East Asian economies, their rapidly catching up with the most advanced economies, was therefore due to their huge inputs of capital and labour.

Young demonstrated that over the period starting in the 1960s until the beginning of the 1990s: ‘it is not particularly difficult to find either developed or less developed economies whose productivity performance, despite considerably slower growth of output per capita, has approximated or matched that of the NICs. While, with the exception of Singapore, productivity growth in the NICs is not particularly low, it is also, by postwar standards, not extraordinarily high.’

Young’s famous paper studied growth in the Asian Tigers from the 1960s to the 1990s. It is therefore particularly important that a major new study by Vu Minh Khoung using modern statistical techniques confirms this analysis and updates it by 20 years. Vu’s The Dynamics of Economic Growth: Policy Insights from Comparative Analyses in Asia is one of the most important books published in recent years – it is a major problem that this extensive factual data is not available in Chinese. Vu’s statistical conclusion was clear and confirms Young: ‘the secret of the Asian growth model lies not in achieving high TFP growth but in sustaining reasonable TFP growth despite the intensive mobilization of factor inputs over extended periods.’

The analysis of the Asian Tigers gave a classic example of dogma as opposed to science. In 1994 US economist Paul Krugman published an entirely wrong article ‘The Myth of Asia’s Miracle’ in the US journal Foreign Affairs. This strongly restated Solow’s theory that economic growth must be based on TFP growth. As the data clearly showed Asia’s rapid development was not based on TFP growth Krugman therefore argued that the significance and potential of Asia’s economic rise was overstated. Krugman argued ‘from the perspective of the year 2010’ claims regarding Asia’s rise would seem as ridiculous as exaggerated claims in the 1960s by the USSR’s Khrushchev. Krugman claimed enthusiasm concerning Asia’s growth ‘deserves to have some cold water thrown on it’ and ‘future prospects for that growth are more limited than almost anyone now believes.’ Krugman particularly criticized China and Singapore, which grew due to ‘perspiration rather than inspiration,’ and represented ‘the most extreme’ case of this erroneous Asian approach.

The facts in the following twenty years devastatingly judged Krugman. Taking the two countries Krugman particularly criticized, China’s growth rate was the fastest in the world while Singapore overtook the US in per capita GDP – achieving 103% of the US level at current exchange rates and 144% at Parity Purchasing Powers. Singapore proved that the ‘Asian growth model’ could produce a higher level of development even than the US.

Young’s analysis which followed the method of ‘seek truth from facts’ was vindicated, Krugman’s placing what turned out to be a wrong theory ahead of facts was entirely refuted.

Jorgenson and official changes the method of calculating economic growth

It was already noted that the factual evidence accumulated from the 1960s was clearly in contradiction with Solow’s theory that TFP was the main source of economic growth. Maddison and others were however primarily concerned with accumulating evidence. The task of resolving the contradiction between the facts and the theory was primarily led by Dale W Jorgenson of Harvard University. This has now led to formal changes in the method of calculating economic growth and its causes by the US, the OECD, and the UN. A succinct account of this is given in the Introduction to Jorgenson’s The Economics of Productivity.

As Professor Jorgenson summarised: ‘The approach to growth accounting in my 1987 book with Gollop and Fraumeni and the official statistics on multifactor productivity published by the BLS in 1994 has now been recognized as the international standard. The new framework for productivity measurement is outlined in Measuring Productivity, a manual published by the Organisation for Economic Co-Operation and Development (OECD) and written by Paul Schreyer (2001). … The transition to the new framework for productivity measurement, represented by Jorgenson, Ho and Stiroh (2005) and the studies in this volume, has been very abrupt. This has precipitated the sudden obsolescence of earlier productivity research employing the conventions of Kuznets and Solow.’

Application of modern methods of economic measurement

The results of all these official changes in the methods of calculating economic growth and its causes have now corrected two fundamental errors in Solow’s original formulation of growth accounting. In the new official methods of economic calculation

- Changes in the quality of capital and labour are now controlled for

- The error of Solow in not including intermediate products in his formulation of growth accounting has been corrected.

Once these modern statistical methods are adopted what is the pattern of growth of the US and other economies shown to be?

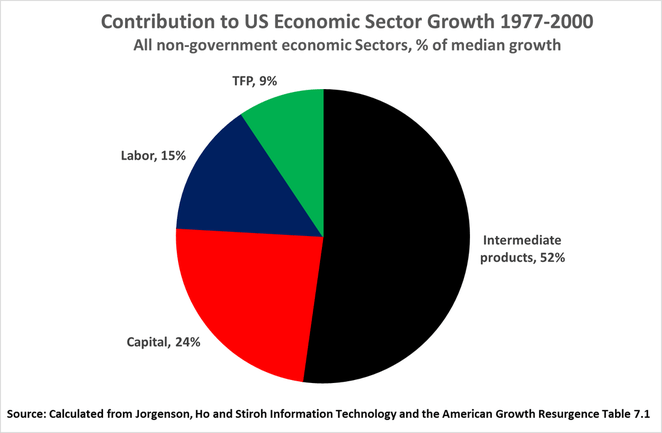

Taking first the most advanced economy, the US, Jorgenson, Ho and Stiroh in the most comprehensive study found that the average percentage contribution to growth in economic sectors was intermediate products 52%, capital 24%, labour 15%, TFP 9% – see Figure 1. This data is particularly striking as it covers the period 1977-2000 when the US ICT boom was at its peak – and it might have been supposed that the contribution of TFP to US growth would be particularly high.

This trend was not a change from earlier periods of US growth. Analysing the US economy in the earlier post war period of 1948-79 Jorgenson, Gollop and Fraumeni found: ‘the contribution of intermediate input is by far the most significant source of growth in output. The contribution of intermediate input alone exceeds the rate of productivity growth for thirty six of the forty five industries for which we have a measure of intermediate input… the predominant contributions to output growth are those of intermediate, capital and labour inputs.’ A similar pattern can be found in all other economies for which data for intermediate products exists – a clearly conclusive finding. However, as such data does not yet exist for all countries, to deal with global patterns only data for capital investment, labour and TFP exists and will be outlined here. It should be remembered, however, that for all countries for which data exists the growth of intermediate products is an even more powerful factor in economic development than capital investment.

The decisive role of capital investment

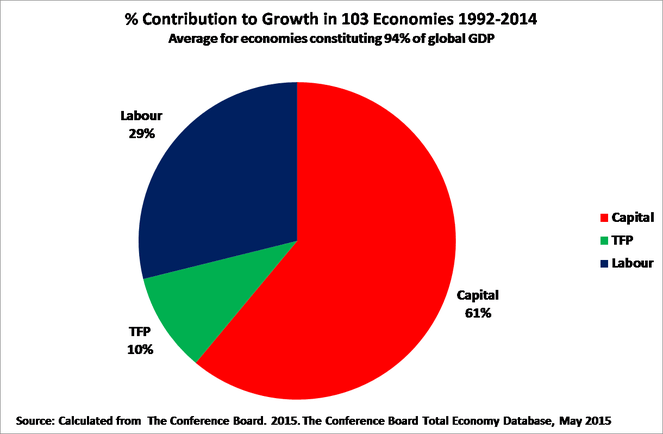

Turning to global trends, on average, as shown in Figure 2, for 103 countries, accounting for 94% of global GDP for 1992-2014, the data shows that capital investment accounted for 61% of economic growth, labour inputs 29%, and TFP was only 10% – confirming the decisive role played by fixed investment.

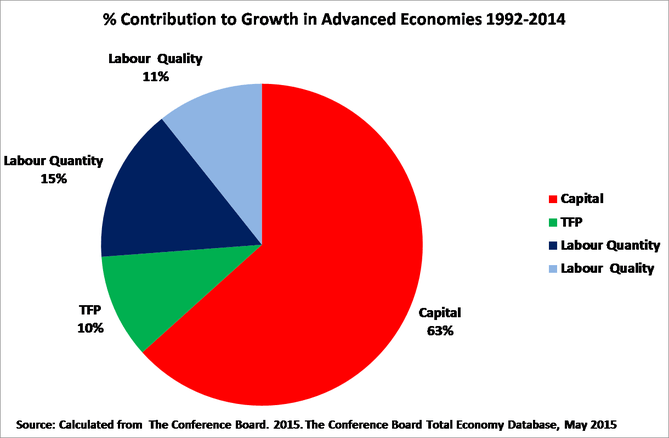

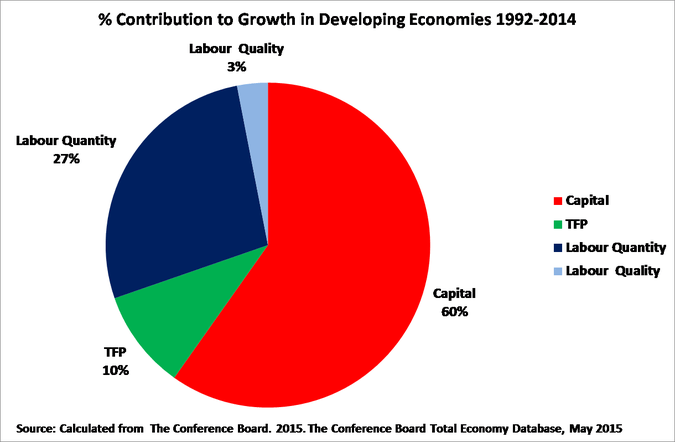

It is notable fixed capital investment plays a somewhat larger role in advanced economies than in developing economies. In advanced economies fixed investment accounts for 63% of GDP growth compared to 60% in developing economies. In large economies fixed investment also plays a more decisive role than in small economies – in the world’s 20 largest economies fixed investment accounts for 67% of GDP growth.

The facts and theory now coincide again

It may therefore be seen that by the beginning of the 21st century the gap between the facts and economic theory that had been created in the 1960s had been overcome in the correct way. Economic theory had been corrected to reflect the facts. The facts originally found by Maddison, Young and others have now been theoretically explained and official changes made to the methods of calculation of economic growth and its causes due to the work led by Jorgenson. The path of ‘seek truth from facts’ was followed.

Naturally I feel very vindicated by this. The decision I made in the 1970s to ‘seek truth from facts’ led to correct predictions and made my career – even if I never imagined at that time it would lead to working in China at Chongyang Institute. But I care deeply about economic theory and pay close attention to it. I therefore feel very pleased economic theory has officially caught up with the facts.

Implications for China’s supply side reform

Finally, all this has direct implications for China’s supply side policies. The laws of economics are objective; they cannot be cheated by any country including China. To use an analogy, a ship cannot be navigated accurately and safely if an inaccurate map is used. This leads directly to correct and false concepts of ‘supply side’ reform in China.

The quantitative power of different factors on the supply side of the economy may therefore be summarised:

(i) The most powerful factor in economic growth is the development of intermediate products – a direct reflection of increasing domestic and international division of labour.

Given this decisive role played by intermediate products and services, development of conditions for effective division of labour in this factor of production is therefore vital for the supply side. This requires numerous practical conditions ranging from adequate transport and communications infrastructure, to rigorous standards for products, to permit rapid and effective economic exchanges. As noted at the time of the November 2013 Third Plenary Session of the Party’s 18th Central Committee, Xi Jinping made the decision on deepening reform noting that: ‘the market order is not standardized, improper means to reap economic benefits is widespread; factor market lags behind , and a large number of idle elements of effective demand cannot be met coexist; market rules are not uniform, local protectionism and departmental protectionism abound; inadequate market competition, hinder the survival of the fittest and structural adjustment, and so on.‘

The interrelation of this domestic division of labour/socialisation of labour with a fundamental feature of China’s post-1978 economic reform, China’s international ‘opening up’, is evident and well known. ‘Opening up’ makes possible a larger development of the market and production, and therefore greater division/socialisation of labour. Not merely Marxist theory but all major Western statistical studies show the positive correlation between ‘openness’ and rapid economic development – it is therefore unnecessary to cite all evidence for this well-established conclusion here. The consequence of the fact that ‘opening up’ is a fundamental expression of division/socialisation of labour is noted in Xi Jinping conclusion: ‘Reform and opening up is a long-term and arduous cause, and people need to work on it generation after generation.’ Or, as put even more clearly in the title of Xi Jinping’s speech of 31 December, ‘Reform and Opening Up is Always and Ongoing and Will Never End.’

(ii) The second most powerful factor of production is capital investment – accounting for approximately 60% of the growth which is due to ’Solow factors’ of production.

The focus of fixed investment must therefore be on embodying new technology, and innovation in production upgrading, in line with Xi Jinping’s analysis of innovation: ‘The 18th CPC National Congress put forward an important plan for the implementation of an innovation-driven strategy, and emphasized that scientific and technological innovation is pivotal to improving social productivity and the comprehensive national strength…

‘In face of the new trends of scientific and technological innovation, the world’s major countries are seeking to make new scientific and technological breakthroughs and gain competitive edges in future economic as well as scientific and technological development. We cannot afford to lag behind in this important race. We must catch up and then try to surpass others…

‘China has entered a vital period, when new industrialization, application of information technology, urbanization and agricultural modernization are forging ahead simultaneously, in parallel or interactively…

‘The direction of our scientific and technological development is innovation, innovation and more innovation. We should attach great importance to breakthroughs in basic theories, step up the construction of scientific infrastructure, continue to push ahead with basic, systematic and cutting-edge research and development, and provide more resources for independent innovation. We should actively integrate and make good use of global innovation resources. In response to our current and future needs, we should selectively participate in the construction and use of the world’s major scientific appliances, and research and development bases and centers.’ [1]

(iii) Labour inputs account for approximately 30% of GDP growth due to ‘Solow factors’ of production – but with increases in labour quality rising significantly compared to labour quantity as an economy becomes more developed.

With economic development a major change in the quantitative balance between labour quantity (hours worked) and labour quality (training and education) takes place – shown in Figure 2 and Figure 3. In developing economies on average 27% of GDP growth is due to increase in total hours worked by the labour force and only 3% to increases in labour quality, whereas in advanced economies only 15% of growth is accounted for by increases in hours worked and 11% by improvements in labour quality. Therefore, as an economy becomes more advanced, the role played by increases in total hours worked falls while the role played by improvements in education and training moves from being small to being a significant growth factor. In summary the role played by education, training etc. becomes significantly more important as the economy become more developed – a classic example of socialisation of labour as the increase in labour quality is due to the work of teachers, training schemes etc.

Research and development constitutes a further, indeed one of the clearest, examples of ‘socialised labour’. Modern technological innovation is not created by ‘isolated geniuses’ but by enormous allocation of resources – the conclusion R&D success is proportional to the inputs allocated to it is fully factually confirmed both historically and by contemporary studies.

It of course follows from Xi Jinping’s overall analysis that the greatest attention should be paid to research and development as the indispensable basis for innovation in developing the economy’s supply side: ‘We should improve the infrastructure of scientific and technological innovation, build and improve the national scientific and technological reporting system, and make innovations in the survey system, and national scientific and technological management information system as soon as possible, so as to maximize resource sharing. We should deploy the innovation setup around the industrial setup as well as the capital setup around the innovation setup. We should focus on national strategic goals and pool resources to tackle key scientific and technological problems pertaining to the national economy and the people’s livelihood.’[2]

(iv) TFP plays only a relatively small role in economic growth – accounting for about 10% of growth due to ‘Solow factors’ of production.

The above data immediately shows why the views of some of those in China claiming to stand for ‘supply side’ economics are wrong. For example, Liu Shengjun claims that the key factor in economic growth is individual ‘entrepreneurship.’ The data on economic growth clearly shows this is entirely false.

The impact of individual ‘entrepreneurship’ would be part of the growth that is not created by quantitative increases in intermediate products, capital or labour i.e. it would be measured as part of TFP growth. But as already seen TFP increase even taken as a whole is a small part of economic growth – in both advanced and developing economies total TFP increase accounts for only 10% of economic growth. Furthermore, TFP growth is no higher in advanced economies, where individual entrepreneurship is supposedly concentrated, than in developing economies. Consequently, even if the role of ‘individual entrepreneurship’ accounted for the whole of TFP growth in advanced economies, which is a wholly unreasonable assumption given the key role of technology, scale of production, R&D and other factors, it would be only one third as important as growth in labour inputs and only one sixth as important as growth in capital investment.

Therefore, attempting to create economic growth based on TFP increases, let alone ‘individual entrepreneurship,’ is like attempting to drive forward a machine using only a tiny gear wheel, while not attempting to shift it using the far larger gear wheel of capital investment or even labour inputs. For simple quantitative reasons such a strategy evidently cannot succeed.

China’s and the rapidly growing Asian economies therefore developed because they were based on the most powerful supply side factors. It is because of its entirely wrong analysis that ‘individual entrepreneurship’ was the main force of economic growth that the ‘supply side’ economics of Reaganism led to the beginning of a serious decline of the US economy – as I have analysed in other articles. [3]

Conclusion

Finally, data shows clearly that the contribution of factors which represent inputs from socialised labour/division of labour (circulating capital/intermediate products, fixed investment, labour inputs) account for 90% of economic growth. In contrast the factor held by modern neo-classical economics to be decisive for growth, ‘individual entrepreneurship’, accounts for less than 10% of economic growth – exactly how much less would depend on a more detailed analysis of the factors accounting for TFP, as TFP includes various factors which are themselves products of socialised labour. Inputs of socialised labour therefore account for over nine times as much of the increase in production as the factor held to be decisive by neo-classical economics – detailed analysis of TFP would certainly show that ratio of 9 to 1 was an underestimate. This makes it clear that the decisive quantitative factors in economic development are those of socialised labour as analysed by Marx.

The findings not only of Marxism but of modern Western economic research therefore entirely confirm Xi Jinping’s conclusions regarding the correctness of Marxist economics and emphasis on the supply side. It is ‘socialised labour’, the working class, that is overwhelmingly the most powerful force in developing production. It is for this reason that supporters of neo-liberal and neo-classical economics, that is anti-Marxists, in China are desperate to avoid using precise (indeed frequently any!) numbers in their articles and analyses but confine themselves to general phrases and empty formulas – or try to quote statistical methods that have now been officially replaced even in the West.

As Xi Jinping notes the Marxist economic theory in which China developed its economic reforms is therefore correct. It flows that, as Xi Jinping notes: ‘The working class… represents China’s advanced productive forces and relations of production.’ [4] It follows that the leading force of China’s national renewal is the Chinese working class – whose political representative is the CPC. This fundamental analysis of course lies at the core of Xi Jinping’s conclusion regarding the working class and China’s national renewal: ‘The Chinese working class should take it as its mission to rejuvenate the nation, unleash its great creativity, carry forward its glorious tradition of acting in the overall interests of the country, maintain political stability and unity, and remain the core force for building up China’s strength.’[5]

Naturally the Western economists who produced these step forwards did not do so because they were adherents of Chinese economic ideas. Nevertheless, several were familiar with China – Maddison was an acknowledged expert on China’s economic statistics and Jorgenson also studied China. I had the advantage that I followed closely both China’s economic thinking and developments in Western economics.

What these developments show is that the method of ‘seek truth from facts’ is the key not only to China’s economic thinking but developments within Western economics. I have tried to reflect both that Chinese economic thinking and the Western in The Great Chess Game.

Thank you.

[1] Xi, Transition to Innovation-driven Growth.

[2] Xi, Transition to Innovation-driven Growth.

[3] A more recent outline of the issues of Reaganism may be found in ‘The “Anglo-Saxon” Political Crisis – from Reagan & Thatcher to Trump & Brexit’.

[4] Xi, Hard Work Makes Dreams Come True.

[5] Xi, Hard Work Makes Dreams Come True.