It would therefore at first sight appear evident that the rest of the world would wish to understand the reasons for this success and emulate it. Indeed it would appear extremely important to do so – if the rest of the world could enjoy the same economic development as East Asia then international problems of underdevelopment and poverty would be overcome within little more than a generation.

However, a significant number of authors have adopted an opposite course. The success of Asia’s economies is considered sufficiently contradictory to certain economic theories that the facts of its success have to be denied or treated as temporary or limited. As it is difficult to neglect economic development that has already occurred, this approach has taken the form of attempts to demonstrate that Asia’s growth must come to an end ‘soon’, or at least at levels of income per head which are below those of the US and Europe. The most famous of such critiques probably remains Paul Krugman’s ‘The Myth of Asia’s Miracle’ (Krugman, 1994)

Actual economic development, however, has over a prolonged period failed to correspond to such critiques. Not only has the growth of the East Asian ‘emerging’ economies continued, but the most developed, Singapore, has achieved a GDP per capita higher, in parity purchasing powers (PPPs), than the US. This latter fact might, indeed, be considered ‘revenge of reality over (erroneous) theory’ as Paul Krugman singled out Singapore for perhaps the most comprehensive criticism for relying on an ‘extensive’ pattern of economic growth, dependent on accumulation of factor inputs of capital and labour, rather than on increases in total factor productivity (TFP).

Such critical assessments of the East Asian economies are logically linked to theories of growth of the developed economies. The East Asian economies share with the developed countries, during the post-war period, a rejection of ‘import substitution’ strategies – both groups pursued ‘open’ economic policies with a high and rising percentage of foreign trade in GDP. However, the rapidly growing East Asian countries strongly differed from the developed ones in having a far higher percentage of fixed investment in GDP. Indeed, East Asian economies typically pursued policies which favoured, or consciously aimed at, such high investment levels.

According to various critiques of the ‘Asian growth model’ it was precisely this high level of mobilisation of capital that represented an ‘extensive’ path of development which would allegedly inevitably come up against its own limits and produce inability of East Asian economies to achieve the levels of GDP per capita of developed economies. The expansion of the developed economies, in contrast, was claimed to be based on TFP growth – a model originally associated with Solow and endorsed explicitly by Krugman.

In reality, as facts demonstrated, the East Asian growth model – as confirmed in the most economically developed version by Singapore, Hong Kong, Taiwan and South Korea – has shown itself not only able to achieve extremely rapid rates of growth over prolonged periods but fully able to achieve the level of GDP per capita of developed economies. Furthermore, East Asian economies which have achieved the levels of GDP per capita of developed economies have continued to grow more rapidly than their US, Japanese and European counterparts. Therefore, whether considered from the point of view of growth from developing to developed economy status, or from the point of view of performance after achieving developed economy status, it is the Asian economies which are outperforming Europe and North America, not vice versa.

If there exists a contradiction between reality and a theory, a scientific approach demands that it is the theory that is changed or abandoned, not that the facts should be disregarded. Furthermore, as will be seen, there is an economic theory which coherently explains the facts both of Asian economic development and that of the developed economies. This may be termed the ‘classical’ theory of economic growth – classical in the strict sense that its formulation was by Adam Smith.

The aim of this article, therefore, is to set out the features of this ‘classical’ theory of economic growth, as formulated by Smith himself, and to show its vindication by modern econometrics. The character of this classical theory will be cast in sharper relief by contrasting its key points to alternative theories which have failed to explain the combined phenomena of the growth of the Asian and developed economies.

Distinguishing features of the classical theory of growth

Adam Smith established four fundamental, interrelated, propositions which may be taken to characterise his ‘classical’ theory of economic growth. These are:

- The most fundamental force of productivity growth is increasing division of labour.

- Increasing division of labour requires increasing scale of production and an increasing scale of market.

- Increasing division of labour and scale of production leads historically to an increasing percentage of investment in the economy.

- Technological progress is a product of this increasing division of labour – i.e. it is endogenously and not exogenously determined.

The specificity of this classical theory becomes clearer if contrasted to the alternative views to which it is counterposed.

- In the classical theory, economic growth is driven by division of labour, not by ‘entrepreneurship’, as in Schumpeter’s growth theory for example.

- Smith’s view that the percentage of the economy devoted to investment rises historically was followed by others, including Keynes, but such a conclusion was challenged by Friedman and still does not play a central role in many growth theories – indeed, as noted, an extremely high investment level is seen as a policy error in the development of the East Asian economies.

- In Smith’s analysis technological process is driven by the consequences of division of labour, rather than technology being an external driving force of productivity – as for example in the analysis of views typically deriving from Solow.

Because of the importance of these issues, Smith’s ‘classical’ analysis will therefore be set out in more detail before showing its vindication in the light of modern econometric evidence.

Division of labour

Adam Smith unequivocally establishes division of labour as the fundamental lynch pin of productivity growth by stating it as the first sentence of the first chapter of The Wealth of Nations. This asserts simply:

‘The greatest improvement in the productive powers of labour, and the greater part of the skill, dexterity, and judgement with which it is directed, or applied, seem to have been the effect of the division of labour.’ (Smith, 1776, p. 13)

The whole first three chapters of The Wealth of Nations are devoted to the division of labour. Later, reprising his views after elaboration of further developments, Smith choses to remind his readers ‘perfection of manufacturing industry, it must be remembered, depends altogether upon the division of labour.’ (Smith, 1776, p. 680)

Indeed, Smith formulated his view of division of labour as the driving force of productivity development and economic growth well before writing The Wealth of Nations. In his Lectures on Jurisprudence of the 1760s he noted, in a comparison incorporated wholesale into his magnum opus (1):

‘In yesterday’s lecture I endeavoured to explain the causes which prompt man to industry and are peculiar to him of all the animals… These wants a solitary savage can supply in some manner, but not in that which is reckoned absolutely necessary in every country where government has been some time established…

‘The unassisted industry of a savage cannot any way procure him those things which are now become necessary to the meanest artist. We may see this… in comparing the way of life of an ordinary day-labourer in England or Holland to that of a savage prince, who has the lives and liberties of a thousand or 10,000 naked savages at his disposal. It appears evident that this man, whom we falsely account to live in a simple and plain manner, is far better supplied than the monarch himself. Every part of his clothing, utensils, and food has been produced by the joint labour of an infinite number of hands, and these again required a vast number to provide them in tools for their respective employments. So that this labourer could not be provided in this simple manner (as we call it) without the concurrence of some 1,000 hands.

‘His life indeed is simple when compared to the luxury and profusion of an European grandee. But perhaps the affluence and luxury of the richest does not so far exceed the plenty and abundance of an industrious farmer as this latter does the unprovided… manner of life of the most respected savage…. In what manner then shall we account for the great share he and the lowest of the people have of the conveniences of life. The division of labour amongst different hands can alone account for this.’ (Smith, Lectures on Jurisprudence, p. 341 – English spelling modernised)

Smith was naturally not the first economist to note division of labour.(2) However, he was the first to unequivocally identify it as the most fundamental force of economic development and draw out the conclusions which followed from this.(3) Smith therefore noted as a necessary consequence that the more developed, i.e. the more productive, an economy was the more developed division of labour would have to be:

‘The division of labour, however, so far as it can be introduced occasions, in every art, a proportionable increase of the productive powers of labour. The separation of different trades and employments from one another seems to take place in consequence of this advantage. This separation, too, is generally carried furthest in those countries which enjoy the highest degree of industry and improvement.’ (Smith, 1776, p. 15)

Smith drew the consequent conclusion that economic areas, whether sectors or countries, where division of labour could not be or was not pursued would be less productive.(4)

Scale of production/market

Given that division of labour is the most fundamental and underlying driving force raising productivity, Smith drew the immediate conclusion that the possibilities of division of labour depend on the scale of the market and scale of production. Chapter 3 of The Wealth of Nations is straightforwardly titled ‘That the division of labour is limited by the extent of the market’. In its first paragraph Smith notes:

‘the extent of this division must always be limited by… the extent of the market. When the market is very small, no person can have any encouragement to dedicate himself entirely to one employment, for want of the power to exchange all that surplus part of the produce of his own labour.’ (Smith, 1776, p. 31)

Scale of market is linked to scale of production at numerous levels:

‘There are some sorts of industry, even of the lowest kind, which can be carried on nowhere but in a great town. A porter, for example, can find employment and subsistence in no other place… It is impossible that there should be such a trade as even that of a nailer in the remote and inland parts of the Highlands of Scotland. Such a workman at the rate of a thousand nails a day, and three hundred working days in the year, will make three hundred thousand nails in the year. But in such a situation it would be impossible to dispose of one thousand, that is, of one day’s work in the year. (Smith, 1776, p. 31)

It may be noted from this that Smith has a much wider concept of the advantages of large scale production than the more limited sense in which most frequently the term ‘economies of scale’ is used. The concept ‘economy of scale’ is typically used as relating to a single productive unit, and the cost reductions that may be achieved by large as opposed to small scale production in it. Smith utilises a much wider sense that a large market, and therefore large scale production, makes possible division of labour – which is itself the most powerful force for raising productivity. Therefore, scale of market raises productivity in the entire economy, and not only in a single productive unit. Thus, completing a passage already cited, he notes:

‘The perfection of manufacturing industry, it must be remembered, depends altogether upon the division of labour; and the degree to which the division of labour can be introduced into any manufacture, is necessarily regulated, it has already been shown, by the extent of the market.’ (Smith, 1776, p. 680)

It may immediately be seen from this that the advantages of foreign trade flow from increased possibility of the division of labour, and not some specific virtue of crossing international borders. While The Wealth of Nations is most famous for its advocacy of free trade between countries, this is a by-product of the fact that the fundamental driving force of economic and productivity growth is division of labour – the significance of international trade is that it makes possible a larger development of the market, not that it crosses national boundaries.(6) To illustrate this Adam Smith, for example, in discussing the advantages of reduction in transport costs via water travel, a crucial factor in his day, does not distinguish national and international transport – no distinction is drawn in principle between the trade between London and Newcastle and London and Calcutta:

‘As by means of water-carriage a more extensive market is opened to every sort of industry than what land-carriage alone can afford it, so it is upon the sea-coast, and along the banks of navigable rivers, that industry of every kind naturally begins to subdivide and improve itself, and it is frequently not till a long time after

that those improvements extend themselves to the inland parts of the country…. A broad-wheeled wagon, attended by two men, and drawn by eight horses, in about six weeks time carries and brings back between London and Edinburgh near four ton weight of goods. In about the same time a ship navigated by six or eight men, and sailing between the ports of London and Leith, frequently carries and brings back two hundred ton weight of goods … What goods could bear the expense of land-carriage between London and Calcutta? Or if there were any so precious as to be able to support this expense, with what safety could they be transported through the territories of so many barbarous nations? Those two cities, however, at present carry on a very considerable commerce with each other, and by mutually affording a market, give a good deal of encouragement to each other’s industry. (Smith, 1776, p. 32)

Similarly, discussing China Smith notes the advantage of its very large internal market, and explains the advantages of foreign trade precisely in terms of the expansion of this market still further:

‘the great extent of… China, the vast multitude of its inhabitants, the variety of climate, and consequently of productions in its different provinces… render the home market of that country of so great extent as to be alone sufficient to support very great manufactures. The home market of China is, perhaps, in extent not much inferior to the market of all the different countries of Europe put together. A more extensive foreign trade, however, which to this great home market added the foreign market of all the rest of the world… could scarcely fail to increase very much the manufactures of China, and to improve very much the productive powers of its manufacturing industry.’ (Smith, 1776, p. 681)

Smith also saw the consequences of what, in modern terminology, would be termed effective demand on productivity as operating through increasing the scale of the market and thereby division of labour:

‘The increase of demand, besides, though in the beginning it may sometimes raise the price of goods, never fails to lower it in the long-run. It encourages production, and thereby increases the competition of the producers, who, in order to undersell one another, have recourse to new divisions of labour and new improvements of art which might never otherwise have been thought of.’ (Smith, 1776, p. 748)

Level of investment

If division of labour was the most fundamental force in raising productivity, Smith noted that increasing division of labour required more capital. Where division of labour did not occur significant investment, referred to by Smith as ‘stock’, was not required:

‘In that rude state of society in which there is no division of labour, in which exchanges are seldom made, and in which every man provides everything for himself, it is not necessary that any stock should be accumulated or stored up beforehand in order to carry on the business of society.’ (Smith, 1776, p. 276)

In contrast division of labour required investment:

‘When the work to be done consists of a number of parts, to keep every man constantly employed in some way, requires a much greater capital than where every man is occasionally employed in very different parts of the work.’ (Smith, 1776, p. 343)

Therefore, as the economy developed, as productivity rose, an increasing proportion of the economy had to be devoted to investment:

‘As the accumulation of stock must, in the nature of things, be previous to the division of labour, so labour can be more and more subdivided in proportion only as stock is previously more and more accumulated… As the division of labour advances, therefore, in order to give constant employment to an equal number of workmen, an equal stock of provisions, and a greater stock of materials and tools than what would have been necessary in a ruder state of things must be accumulated beforehand.’ (Smith, 1776, p. 277)

This process of the rising proportion of investment in the economy applied to agriculture as well as to manufacturing and services. Thus Smith notes of ‘the proportion between that part of the annual produce, which… is destined for replacing a capital, and that which is destined for constituting a revenue, either as rent, or as profit’ that:

‘This proportion is very different in rich from that in poor countries… at present, in the opulent countries of Europe, a very large, frequently the largest part of the produce of the land, is destined for replacing the capital of the rich and independent farmer… but antiently, during the prevelancy of the feudal government, a very small portion of the produce was sufficient to replace the capital employed in cultivation.’ (Smith, 1776, p. 334)

Endogenous theory of innovation

Finally, Smith held that it was division of labour that determined technological development – not that technology was an independent factor, or that division of labour was a result of technology . Thus, in modern terminology, Smith had an endogenous, not an exogenous, theory of technological development. His conclusion on this was emphatic, and covered both proximate and ultimate causes of technological progress. Smith noted:

‘The owner of the stock which employs a great number of labourers, necessarily endeavours, for his own advantage, to make such a proper division and distribution of employment, that they may be enabled to produce the greatest quantity of work possible. For the same reason, he endeavours to supply them with the best machinery which either he or they can think of. What takes place among the labourers in a particular workhouse, takes place, for the same reason, among those of a great society. The greater their number, the more they naturally divide themselves into different classes and subdivisions of employment. More heads are occupied in inventing the most proper machinery for executing the work of each, and it is, therefore, more likely to be invented.’ (Smith, 1776, p. 104)

More generally Smith noted:

‘everybody must be sensible how much labour is facilitated and abridged by the application of proper machinery. It is unnecessary to give any example. I shall only observe, therefore, that the invention of all those machines by which labour is so much facilitated and abridged seems to have been originally owing to the division of labour.’ (Smith, 1776, p. 19)

Smith made explicit that this analysis of the development of technology as being a result of the division of labour applied both to direct invention by users of technology and to more specialised scientific research. Thus, regarding immediate research focussed on particular industries:

‘Men are much more likely to discover easier and readier methods of attaining any object, when the whole attention of their minds is directed towards that single object, than when it is dissipated among a great variety of things. But in consequence of the division of labour, the whole of every man’s attention comes naturally to be directed towards some one very simple object. It is naturally to be expected, therefore, that some one or other of those who are employed in each particular branch of labour should soon find out easier and readier methods of performing their own particular work, wherever the nature of it admits of such improvement.’ (Smith, 1776, p. 20)

More generally regarding scientific research:

‘All the improvements in machinery, however, have by no means been the inventions of those who had occasion to use the machines. Many improvements have been made by the ingenuity of the makers of the machines, when to make them became the business of a peculiar trade; and some by that of those who are called philosophers or men of speculation, whose trade it is not to do any thing, but to observe every thing; and who, upon that account, are often capable of combining together the powers of the most distant and dissimilar objects. In the progress of society, philosophy [in Smith’s day no specific distinction was made

between science and philosophy – JR] or speculation becomes, like every other employment, the principal or sole trade and occupation of a particular class of citizens. Like every other employment too, it is subdivided into a great number of different branches, each of which affords occupation to a peculiar tribe or class of philosophers; and this subdivision of employment in philosophy, as well as in every other business, improves dexterity, and saves time. Each individual becomes more expert in his own peculiar branch, more work is done upon the whole, and the quantity of science is considerably increased by it.

‘It is the great multiplication of the productions of all the different arts, in consequence of the division of labour, which occasions, in a well-governed society, that universal opulence which extends itself to the lowest ranks of the people.’ (Smith, 1776, pp. 21-22)

Smith related this principle to the training of labour, that is the improvement of human capital, as well as technology:

‘The difference of natural talents in different men is, in reality, much less than we are aware of; and the very different genius which appears to distinguish men of different professions, when grown up to maturity, is not upon many occasions so much the cause, as the effect of the division of labour. The difference between the most dissimilar characters, between a philosopher and a common street porter, for example, seems to arise not so much from nature, as from habit, custom, and education…

‘By nature a philosopher is not in genius and disposition half so different from a street porter, as a mastiff is from a greyhound, or a greyhound from a spaniel, or this last from a shepherd’s dog.’ (Smith, 1776, pp. 28-30)

Econometric evidence

Having outlined these four fundamental points of Smith’s classical theory of economic growth, it may be noted that modern econometric research has vindicated this analysis.(6) This classical theory of Smith also explains the growth of both the East Asian and the developed economies in a way that alternatives do not. The key points will be briefly considered in turn.

i. Division of labour at a national level – intermediate products

Smith’s analysis of the role of rising division of labour has been strongly confirmed on the national terrain by modern econometric research – as Spengler notes, Smith analysis demonstrates that: ‘in Bohm-Bawerkian terms… production became more roundabout.’ (Spengler, 1959, p. 402). This is strongly shown by analysis of the role of intermediate inputs in production – growth of intermediate inputs being an index of increasing division of labour.

This econometric evidence also indicates a flaw in the original formulation of growth accounting as developed by Solow, that it identified the elements of growth as being capital, labour, plus a residual TFP, but it did not explicitly deal with intermediate inputs (Solow, 1957). The practical significance of such an omission is made clear by the econometric finding that the most rapid increase of inputs in economic growth is neither capital, labour nor TFP but intermediate products and services. Taking account of this, and sub-dividing intermediate inputs into materials, energy and service inputs led to the improved formulation of KLEMS (capital, labour, energy, materials, service inputs) methodology – see for example (Timmer, O’Mahony, & van Ark, 2007)

Regarding factual trends for intermediate products in the most developed economy, i.e. the US, Jorgenson, Gollop and Fraumeni found these were clearly the largest source of growth for economic sectors, noting:

‘the contribution of intermediate input is by far the most significant source of growth in output. The contribution of intermediate input alone exceeds the rate of productivity growth for thirty six of the forty five industries for which we have a measure of intermediate input… If we focus attention on capital and labour inputs, excluding intermediate input from consideration, we find that the sum of contributions of capital and labour inputs exceeds the rate of productivity growth for twenty-nine of the forty-five industries for which we have a measure of productivity growth… the predominant contributions to output growth are those of intermediate, capital and labour inputs. By far the most important contribution is that of intermediate input.’ (Jorgenson, Gollop, & Fraumeni, 1987, p. 200)

Considering such findings for the US in more detail Jorgenson noted:

‘The analysis of sources of growth at the industry level is based on the decomposition of the growth rate of sectoral input into the sum of the contributions of intermediate, capital and labour inputs and the growth of sectoral productivity… The sum of the contributions of intermediate, capital, and labour inputs is the predominant source of growth of output for 46 of the 51 industries…

‘Comparing the contribution of intermediate input with other sources of growth demonstrates that this input is by far the most significant source of growth. The contribution of intermediate input exceeds productivity growth and the contributions of capital and labour inputs. If we focus attention on the contributions of capital and labour inputs alone, excluding intermediate input from consideration, these two inputs are a more important source of growth than changes in productivity…

‘The explanatory power of this perspective is overwhelming at the sectoral level. For 46 of the 51 industrial sectors… the contribution of intermediate, capital and labour inputs is the predominant source of output growth. Changes in productivity account for the major portion of output growth in only five industries. (Jorgenson D. W., 1995, p. 5)

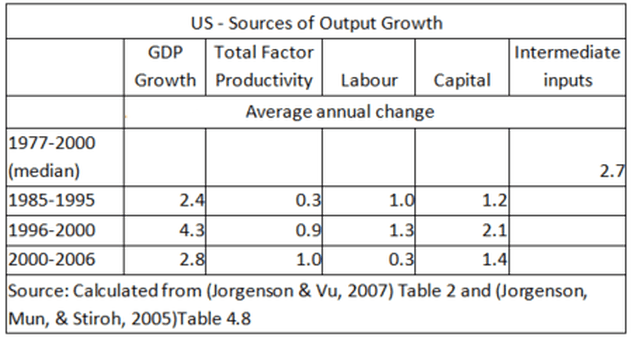

To illustrate this trend, Table 1 shows Solow growth accounting categories – capital, labour, TFP – together with the addition of a column for growth of intermediate inputs. As may be seen over the period 1977-2000 the median rate of growth of intermediate inputs in the US economy was 115% of the rate of growth of US GDP – far higher than any other input.

- Ren and Sun found for China that in the period 1981-2000, subdivided into 1984-88, 1988-94 and 1994-2000: ‘’Intermediate input growth is the primary source of output growth in most industries.’ (Ren & Sun, 2007).

- For Taiwan, analysing 26 sectors in 1981-99, Chi-Yuan Liang found regarding intermediate material inputs: ‘Material input is the biggest contributor to output growth in all sectors during 1981-99, except… seven’. (Liang C.-Y. , 2007).

- For South Korea, Hak K. Pyo, Keun-Hee Rhee and Bongchan Ha found: ‘The relative magnitude of contribution to output growth is in the order of: material, capital, labour, TFP then energy.’ (Pyo, Rhee, & Ha, 2007)

From a theoretical point of view, therefore, the omission of intermediate inputs from the original Solow model led to errors in failing to situate division of labour as the crucial factor in economic growth – for a more detailed discussion see (Ross, 2009)

Considered on a national terrain Smith’s conclusion that increasing division of labour is the most fundamental source of economic growth may be considered as amply confirmed.

ii. Division of labour at an international level

Ideally, to analyse division of labour at an international level comprehensive statistical data on growth of intermediate inputs in production on a global, as well as a national, scale would be available. Unfortunately such data does not yet exist – for an analysis of steps in this direction see (Erumban, et al., 2010). Nevertheless the indirect evidence that division of labour increases at an international level is overwhelmingly strong – improbable processes would have to be postulated in order to justify any argument that international division labour was not increasing.

Most fundamentally the key trends in globalisation – rising share of trade in GDP, rising ratio of foreign direct investment to GDP – plus the studies of particular industries, are powerful evidence of increasing international division of labour. There is no reason to believe that the processes creating the clearly measurable increasing division of labour on a national scale should not operate internationally – Ferreira et al, for example, have provided a theoretical analysis of such processes (Ferreira & Trejos, 2008). Smith’s point that division of labour is the fundamental issue in the effects of foreign trade, and not that of crossing national borders, remains entirely valid. The findings on intermediate inputs within national economies are therefore confirmed by processes that are evident, with lower degrees of statistical rigour, in studies of globalisation.

The correlation of openness of a national economy, which may be a taken as a proxy of participation in international division of labour, with high GDP and productivity growth is confirmed by numerous studies and therefore does not require repeating here. A classic starting point remains Sachs and Warner (Sachs & Warner, 1995).(7)

iii. Rising level of investment

Smith’s analysis that the contribution of capital investment to GDP growth historically rises was shared by other major economists – including Keynes. For the modern period such an hypothesis may be tested by growth accounting – its confirmation by such methods is discussed below. Over a longer historical period, however, as the data necessary for proper growth accounting does not exist, the issue was predominantly analysed in terms of the tendency of fixed investment to rise as a proportion of the economy – a process, as already seen, analysed by Smith.

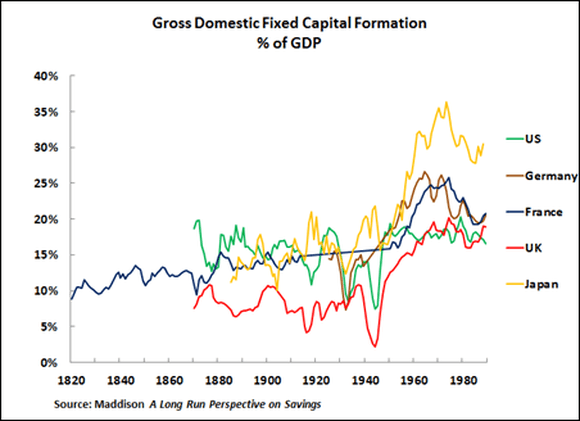

Milton Friedman, In the mid-20th century, challenged the Smith/Keynes analysis of the rising percentage of investment in GDP, on the factual grounds that the proportion of the US economy devoted to fixed investment had not risen with time. (Friedman, 1957). This is the case. However modern econometric findings show conclusively that the US represented an exception, not the overall trend, and that the level of investment in GDP in the other major economies historically rose – for a summary see (Barro & Sala-i-Martin, 2004). Figure 1 shows this trend for the major industrialised economies as calculated by Maddison. (Maddison, 1992)

As may be seen, the data clearly shows a rising trend of investment in GDP, with the US being the exception and not the rule.

- The percentage of fixed investment in GDP in France rose from 9 per cent in 1820, to 15 per cent in 1950, to 21 per cent by 1989.

- In Germany the comparable figures were 15 per cent in 1925, 19 per cent in 1950, and 26 per cent in 1966.

- In Japan the percentage of fixed investment in GDP was 11 per cent in 1885, 18 per cent in 1938, and rising to over 30 per cent in the 1970s.

- In the UK the figures are 8 per cent in 1870, 11 per cent in 1938, and 19 per cent in 1989.

The historically rising proportion of fixed investment in GDP in the main developed economies is therefore clear.

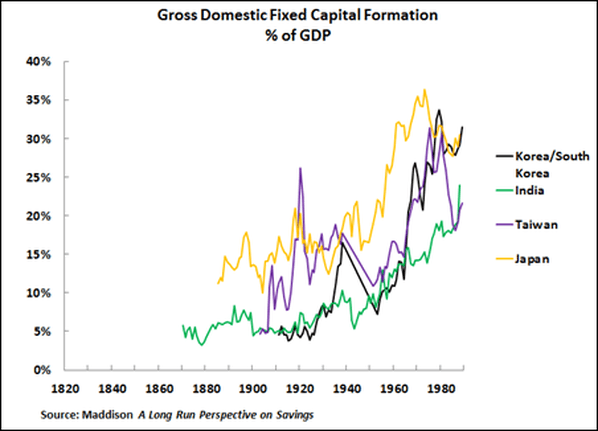

Figure 2 shows the long term data Maddison could calculate for developing economies – India, South Korea and Taiwan – as well as for Japan. Again the upward trend for the percentages of investment in GDP is clear.

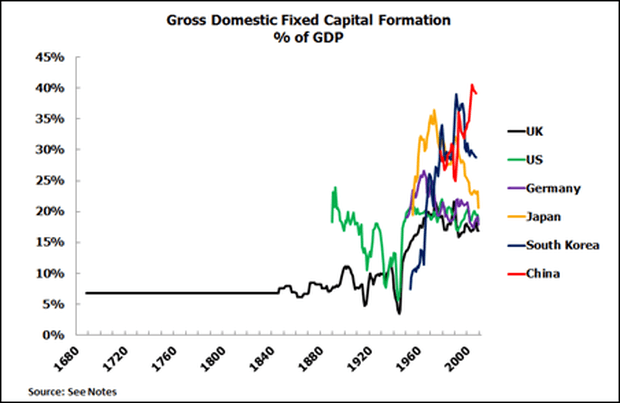

To illustrate this process in a wider historical and geographical context, including in relation to the rapidly growing East Asian economies, the share of fixed investment in GDP for the leading growth economy during successive periods of historical economic development is shown in Figure 3 – these being, in chronological succession, England in the period leading to and following the Industrial Revolution; the US from the second half of the 19th century; West Germany in its post-World War II ‘economic miracle’; Japan in the 1960s and 1970s; the Asian ‘Tiger Economies’, of which South Korea is taken as the example, in the 1980s, and finally China.(8)

The rising trend of fixed investment in GDP, and its correlation with successively higher rates of economic growth, is evident from the data. Considering countries in the chronological order in which a new peak in the proportion of GDP devoted to gross fixed domestic capital formation appeared in the leading growth economy, the following is the historical pattern.

- Immediately prior to the industrial revolution, the proportion of GDP devoted to fixed investment in England and Wales, was 5-7 per cent.(9) This rose slightly, although current estimates are that it did not rise greatly, during the 19th century – peaking at over ten percent of UK GDP prior to World War I. This level of investment was sufficient to sustain the first industrialisation of any country but at a rate of growth which, while historically unprecedented, was slow by present international standards – about two per cent a year.

- From the latter part of the 19th century the proportion of US GDP devoted to fixed investment had risen to considerably exceed that for the UK – reaching a level of 18-20 per cent of GDP by the last decades of the century. A sharp fall in the proportion of the US economy devoted to fixed investment commenced in the late 19th century, and was particularly pronounced during the period between World War I and World War II – being associated with the Great Depression. After World War II the US resumed its pattern of 18-20 per cent of GDP being devoted to gross fixed capital formation. This sustained an average growth rate of 3.5 per cent a year. This investment level and growth rate sufficed for the GDP of the US to overtake Britain.

- In the period following World War II Germany achieved a level of fixed investment exceeding 25 per cent of GDP – peaking at 26.6 per cent in 1964. This period 1951-64 was that of the post-war German ‘economic miracle’ with average growth of 6.8 per cent a year.

- Starting at the beginning of the 1960s Japan achieved a level of gross domestic fixed capital formation of more than 30 per cent of GDP. This reached a peak in the early 1970s, at 35 per cent of GDP, before later sharply falling – during that period the average annual rate of growth of Japan’s economy was 8.6 per cent.

- From the 1970s onwards, South Korea similarly achieved a level of fixed investment of 30 per cent of GDP. During the 1980s this rose above 35 per cent of GDP. The other East Asian ‘Tiger’ economies – Singapore, Hong Kong and Taiwan – showed a similar pattern. South Korea’s economy grew in this period at 8.3 per cent a year.

- From the early 1990s China achieved sustained rates of fixed investment of 35 per cent of GDP with, from the beginning of the 21stcentury, this rising to more than 40 per cent of GDP. The result was average 9.9 per cent a year economic growth over a sustained period.

It may therefore be seen that the East Asian economies high level of investment is not an historical aberration – it is the logical culmination of a centuries long pattern of the rising proportion of fixed investment in GDP. Such data clearly confirms the rising contribution of investment to GDP foreseen by Smith.

For more recent periods, the greater availability of data allows detailed growth accounting to be carried out. The results for this are set out in Table 2 and Table 3.

Table 2 shows annual average GDP growth, together with the percentage contributions of capital, labour, and TFP, for 109 economies, 22 developed and 87 developing, for the ten year period 1995-2005. The calculations are from the data of Vu (Vu, 2007). Subgroups for developed and developing economies are shown. Table 3 sets out similar calculations from the data for periods defined by Jorgenson and Vu in their study forming part of the World Bank International Comparison Programme – i.e. 1989-1995, 1995-2000, 2000-2004 and 2004-2008 . In addition to periodisations, other differences between the two tables should be noted. Table 2 shows unweighted means and medians – i.e. the significance of each country is treated as equal, whereas the data of Jorgenson and Vu in Table 3 is weighted. In Table 2, improvements in labour quality are included in TFP, as in the data presented by Vu (Vu, 2007), whereas in Table 3 improvements in labour quality are included in labour inputs (Jorgenson & Vu, 2007b). There are 109 countries in Table 2 compared to 122 countries in Table 3. As will be seen, however, such differences do not alter the qualitative trends found.

A fundamental finding of Jorgenson and Vu, shown in both Table 2 and Table 3, is the dominance of factor inputs, capital and labour, compared to TFP in international economic growth.(10) Taking all economies in Table 2 the mean percentage of growth accounted for by increases in inputs of capital and labour is 74.8% and the contribution of TFP growth is 25.1%. Taking the four periods defined by Jorgenson and Vu in Table 3 they noted: ‘our first objective is to allocate the growth of world output between input growth and productivity… input growth greatly predominates! Productivity growth accounted for less than one-eighth of world growth during 1989-1995, while input growth accounted for more than seven-eighths… Input growth contributed more than four-fifths of growth in 1995-2000 and nearly five-eighths in 2000-2004 and 2004-2008.’ (Jorgenson & Vu, 2010)

Turning to a more detailed breakdown, the greatest contribution to GDP growth is from increase in capital inputs. Taking all economies in Table 2 the mean percentage contribution of increases in capital to GDP growth is 39.6% and the median contribution is 42.6% – which is above the mean of 35.2% and median of 35.1% for the contribution of increase in labour hours, which itself exceeds the mean contribution of TFP growth of 25.1% and median contribution of 25.1%.

Taking the periods defined by Jorgenson and Vu, the contribution of capital inputs to GDP growth is greater than either labour or TFP in all periods – at 57.4%, 49.9%, 41.6% and 41.0%.

It may also be noted from Table 3 that while the role of TFP increases in the world economy in 2000-2004 and 2004-2008, and the role of both labour and capital declines, this is only due to a shift in the developing economies. There is no significant decline in the contribution of capital to GDP growth in the G7 or non-G7 developed economies – indeed there is an increase in the latter group. The contribution of capital to GDP growth in non-G7 developed economies in successive periods is 51.8%, 45.5%, 60.3% and 59.4%. The contribution of capital to GDP growth in G7 economies in successive periods is 62.0%, 59.5%, 60.0% and 59.9%.

In short capital inputs remain dominant in GDP growth throughout the period up to 2008.

It is also evident, and in line with Smith’s analysis, that there is a distinction in the patterns of growth of developing and developed economies. In Table 2 the mean contribution of capital inputs to GDP growth in developed economies is 52.9%, significantly above the 36.3% in developing economies. The median contribution of capital inputs to growth in developed economies is 50.6% compared to 39.3% in developing economies. Thus the role of capital inputs is greater in developed economies than in developing. This is precisely in line with Smith’s analysis that the role of investment increases with economic development.

In contrast to developed economies ‘capital-intensive’ path of growth, the contribution of labour inputs to GDP growth is significantly higher in developing economies than in developed ones – i.e. in contrast to developed economies, developing economies have a ‘labour intensive’ path of growth. The mean contribution of inputs of labour hours to GDP growth is 38.3% in developing economies compared to only 23.1% for developed economies, while the median contribution of increase in labour hours to GDP growth is 40.6% in developing economies compared to 23.8% for developed economies.

While the capital intensity of growth increases with economic development, there is, as will be seen below, no tendency for the contribution of TFP growth to increase with economic development.

iv. Level of investment and division of labour

While Smith analysed that the contribution of fixed investment to growth increased with time, it is important to note that he analysed that this was a product of division of labour – i.e. division of labour was the most fundamental and determining element, not rising investment. Modern econometrics, as noted above, also finds that the growth of intermediate products is greater than that of capital accumulation during economic growth – capital accumulation is the second most rapidly growing element in economic growth, but one remaining behind growth of intermediate products/division of labour. This is in line with Smith’s analysis.

This order of determination has clear implications against strategies which see increase in the percentage of the economy devoted to investment on the national terrain, without opening of the economy, as the decisive way to achieve growth. This was the strategy pursued, for example, in Stalin’s USSR and in China prior to the 1978 economic reform. It was also attempted in a less extreme form, and using regulated market as opposed to planned economic methods, in a number of developing countries.

It follows from Smith’s analysis of division of labour as the most fundamental force raising productivity that such a strategy of ‘closed economy plus high fixed investment level’ will not succeed – division of labour, including international division of labour, is more fundamental than increasing the level of fixed investment in an economy cut off from large scale, and therefore necessarily international, division of labour. While the USSR collapsed before opening of its economy could occur, the success of China’s ‘opening up’ policy has been stressed by numerous authors – see for example Lardy (Lardy, 1993) and Cao et al (Cao, Ho, Jorgenson, Ren, Sun, & Yue, 2009). The findings regarding this issue are adequately summarised by Ren and Sun:

‘China’s exports have risen from 7% of GDP in the 1979-84 period to 19.3% in 1992-99, and imports have climbed from 7.1% of GDP to 17.3%… Throughout this period of economic integration, China has been experiencing an unprecedented period of sustained high growth. This correlation between economic opening and a higher rate of sustained growth in China was no accident. The international development experience leaves no doubt that causality runs powerfully from economic opening to economic growth.’ (Ren & Sun, 2007, p. 93)

While the evidence is clear that a policy of a high level of fixed investment within a nationally close economy does not succeed, as would flow from Smith’s analysis, the East Asian developing economies strategy of ‘participation in the international division of labour plus a high level of fixed investment’ is entirely in line with Smith’s analysis.

It should also be noted that Adam Smith integrated the concepts of division of labour and rising proportion of the economy devoted to investment as interlinked aspects of the process of economic development. Both consisted of indirect inputs into production, i.e. intermediate products and investment goods, increasing relative to direct inputs. The correlation between high levels of openness to trade of economies to trade and high levels of fixed investment, found for example by Sachs and Warner, is therefore consistent with Smith’s views. (Sachs & Warner, 1995)

v. Relation of division of labour, entrepreneurship and technology

As already noted, division of labour, not ‘entrepreneurship’ or’ technology’, is the driving force of economic development in Smith’s theory – unlike the role played by entrepreneurship in Schumpeter’s analysis or of technology in theories deriving from Solow. This, naturally, did not mean that Smith believed entrepreneurial activity or technological change did not exist, but merely that they were explained by other processes.

In evaluating the role played by entrepreneurial activity in economic growth, a major difficulty in evaluating ‘entrepreneurship’ is the imprecise character of much writing on the issue and the use of invalid statistical arguments. As Audretsch et al note ‘operationalizing entrepreneurship for empirical measurement is difficult’, and they admit ‘the paucity of measures used to reflect entrepreneurial activity.’ (Audretsch, Keilbach, & Lehmann, 2006) Entrepreneurial activity would, however, be measured as part of TFP growth. Regarding technology it has, on occasion, been invalidly taken as explaining the whole of the Solow residual – i.e. TFP growth.

It was already noted above that Smith analyses technological change as being endogenously produced by division of labour. This is consistent with modern research on the contribution of R&D to productivity growth and on the symbiotic relation of universities and technological process – see for example (Jaffe, 1989) (Feldman & Florida, 1994) (Acs, 2002). This, of course, merely expresses a tendency for technological innovation not to come from ‘inspired and isolated geniuses’ but from the application of large resources to R&D and the creation of specialised research institutions! Similarly, as Audretsch et al state regarding modern concepts: ‘unlike the traditional theories of entrepreneurship… opportunities are not to be taken as exogenous, or given. Rather they are endogenously created as the result of targeted and systematic efforts to produce knowledge and new ideas by private firms, universities and research institutes.’ (Audretsch, Keilbach, & Lehmann, 2006) In such an analysis entrepreneurship, as well as technology, is a product of division of labour.

As regards the quantitative extent of the role played by entrepreneurship and technological change on GDP growth, this would be measured within TFP increases. The factual data shows that TFP is a smaller factor in economic growth than, in decreasing order of importance, increase in intermediate inputs, capital accumulation and increase in labour inputs. As already noted, Jorgenson and Vu conclude at a world level: ‘Productivity growth accounted for less than one-eighth of world growth during 1989-1995, while input growth accounted for more than seven-eighths… Input growth contributed more than four-fifths of growth in 1995-2000 and nearly five-eighths in 2000-2004 and 2004-2008.’ (Jorgenson & Vu, 2010):‘

This data, of course, casts further light on why Krugman’s critique of Asian economic development has failed to stand the test of events. For an extensive review of the literature showing that intermediate inputs, capital and labour predominate over TFP in economic growth readers are referred to (Jorgenson, 2009) Overall, as summarised more briefly in Table 2 and Table 3, there is no evidence for Krugman’s claim that economic growth in the developed economies is primarily driven by TFP growth, indeed the opposite is the case. Nor is there evidence that the role of TFP increases with economic development. The mean contribution of TFP to growth in developed countries is 24.0 per cent and the median contribution is 26.0 per cent, compared to a mean contribution of 25.4 per cent in developing economies and a median contribution of 25.0 per cent. The contribution of TFP to economic growth is the same in developing and developed economies. In contrast, as already noted, there is clear evidence that the contribution of capital to economic growth increases with economic development.

Conclusion

As noted at the beginning of this article, a theory in economics, as in any other field, must be judged by its ability to explain reality and events. Adam Smith’s ‘classical’ theory of economic growth both predicts the success of the Asian growth model to date and that its success will continue. It similarly explains growth of the developed economies. In particular:

- Smith’s analysis that division of labour is the most important factor in economic development and productivity is confirmed by econometric analysis of the growth of intermediate inputs in the national economy – these grow more rapidly than factor inputs of capital and labour, which themselves grow more rapidly than TFP. Solow’s original growth model therefore has to be extended to take account of this growth of intermediate inputs, as shown in KLEMs methodology. KLEMs studies show clearly that growth of intermediate products is the largest single source of output growth in the East Asian developing economies.

- As confirmed by numerous researchers, Smith’s analysis of the decisive role of division of labour is demonstrated at the international level by the superior performance of ‘open’ over ‘closed’ economic orientations. The East Asian developing economies based themselves on such open economic orientations – i.e. on integration into and utilisation of the international division of labour.

- The high level of fixed investment in the East Asian economies, accompanying their ‘open’ economic orientation, is not an historical aberration, or an error, but the continuation of an historical trend that has been taking place for over two hundred years and which was correctly foreseen by Smith. Far from being a sign of weakness, this high level of investment, coupled with the open economic orientation, is a decisive strength of the East Asian developing economies. Furthermore, as economies make the transition from ‘developing’ to being ‘developed’ the role played in growth by capital inputs increases. As econometric studies show that capital inputs are, after intermediate products, the most important source of economic growth, the orientation of East Asian developing economies to mobilisation of capital inputs, rather than concentrating on the more limited role of TFP increases, is therefore entirely rational.

- As improvements in technology and entrepreneurship would show statistically within TFP, and as these are themselves products of division of labour, given TFP increases are proportionately less important for growth that increases in factor inputs, there is no reason why strategies based on mobilisation of capital and labour cannot achieve levels of GDP per capita which equal or exceed those of already developed economies. This is confirmed particularly strikingly by the most developed of the East Asian economies, Singapore – for a detailed analysis see (Vu K. M., 2010). This, naturally, is not an argument against promoting technology and entrepreneurial activity, but that these are a product of the more important inputs of division of labour, capital and labour, and strategies based on increasing participation in division of labour and mobilising capital and labour inputs will be most effective.

- Flowing from the above, the ‘Asian growth model’, far from being erroneous, corresponds to the classical theory of economic growth as outlined by Adam Smith. Its success was therefore logical, and for the same reasons, such a strategy will continue to be successful. This is confirmed by the superior growth performance of those East Asian economies which have achieved developed status compared to the countries of North America and Europe.

In contrast to the success of the Asian growth model, corresponding to the classical theory of economic growth, the critique, and alternative model, put forward by Paul Krugman and others, suffers from error, and has been shown to be invalid by factual developments, for the following reasons.

- The theory that TFP plays the quantitatively key role in economic growth is incorrect. In descending order of their quantitative weight in economic growth, division of labour, as shown in the growth of intermediate inputs, mobilisation of capital and mobilisation of labour play the main role in economic growth. All play a greater quantitative role than TFP.

- There is no tendency for the role of TFP in economic growth to increase with economic development. Instead the role of capital inputs increases with economic development.

- Regarding inputs, the character of economic development is not a transition from growth based on inputs of capital and labour to growth based on TFP, but a transition from growth based predominant on inputs of labour to one based on inputs of capital.

- As Krugman’s theory is erroneous regarding the sources of growth in general it is also incorrect specifically regarding the sources of growth in both the developed and East Asian economies.

- In light of the above, it is logical that Paul Krugman’s prediction that the East Asian economies would be unable to achieve ‘developed’ status has been shown factually to be erroneous.

In summary, Adam Smith’s ‘classical’ theory of economic growth has been confirmed by the development of the East Asian economies, while Paul Krugman’s analysis, published in 1994, of the ‘Asian growth model’ has been shown to be in error regarding factual developments. As Adam Smith’s is a correct theory of economic growth, of which Asian development is a further confirmation, and as Paul Krugman’s is unfortunately not a correct theory, the relative track record of the last 17 years of the two in foreseeing events was predictable. Given Adam Smith’s ‘classical’ theory has been demonstrated to be correct on the key issues under dispute, if this approach is maintained, the success of the East Asian economies will continue.

It is not a piety to recall that the ability of Adam Smith’s theoretical analysis to continue to correctly predict the key parameters of economic development 235 years after it was put forward once again confirms it as one of the great achievements in human intellectual history.

Notes

1. The same comparison appears in The Wealth of Nations as follows: ‘without the assistance and co-operation of many thousands, the very meanest person in a civilized country could not be provided, even according to what we very falsely imagine, the easy and simple manner in which he is commonly accommodated. Compared, indeed, with the more extravagant luxury of the great, his accommodation must no doubt appear extremely simple and easy; and yet it may be true, perhaps, that the accommodation of an European prince does not always so much exceed that of an industrious and frugal peasant, as the accommodation of the latter exceeds that of many an African king, the absolute master of the lives and liberties of ten thousand naked savages.’ (Smith, 1776, p. 23)

Smith therefore concluded an individual: ‘In civilized society he stands at all times in need of the co-operation and assistance of great multitudes… man has almost constant occasion for the help of his brethren.’ (Smith, 1776, p. 26)

2. For example Adam Ferguson in 1767 wrote: ‘It is evident, that, however urged by a sense of necessity, and a desire of convenience, or favoured by any advantages of situation and policy, a people can make no great progress in cultivating the arts of life, until they have separated, and committed to different persons, the reveal tasks which require a peculiar skill and attention. The savage, or the barbarian, who must build and plant, and fabricate for himself, prefers, in the interval of great alarms and fatigues, the enjoyments of sloth to the improvement of his fortune: he is, perhaps, by the diversity of his wants, discouraged from industry or, by his divided attention, prevented from acquiring skill in the management of any particular subject.

‘The enjoyment of peace, however, and the prospect of being able to exchange one commodity for another, turns, by degrees, the hunter and the warrior into a tradesman and a merchant. The accidents which distribute the means of subsistence unequally, inclination, and favourable opportunities, assign the different occupations of men; and a sense of utility leads them, without end, to subdivide their professions.’ (Ferguson, 1767, pp. 269-70)

3. This was related by Smith to the increasing interconnectedness of society: ‘‘The woollen coat, for example, which covers the daylabourer, as coarse and rough as it may appear, is the produce of the joint labour of a great multitude of workmen. The shepherd, the sorter of the wool, the woolcomber or carder, the dyer, the scribbler, the spinner, the weaver, the fuller, the dresser, with many others, must all join their different arts in order to complete even this homely production. How many merchants and carriers, besides, must have been employed in transporting the materials from some of those workmen to others who often live in a very distant part of the country! how much commerce and navigation in particular, how many ship-builders, sailors, sailmakers, rope-makers, must have been employed in order to bring together the different drugs made use of by the dyer, which often come from the remotest corners of the world! What a variety of labour too is necessary in order to produce the tools of the meanest of those workmen! To say nothing of such complicated machines as the ship of the sailor, the mill of the fuller, or even the loom of the weaver, let us consider only what a variety of labour is requisite in order to form that very simple machine, the shears with which the shepherd clips the wool. The miner, the builder of the furnace for smelting the ore, the feller of the timber, the burner of the charcoal to be made use of in the smeltinghouse, the brick-maker, the brick-layer, the workmen who attend the furnace, the mill-wright, the forger, the smith, must all of them join their different arts in order to produce them. Were we to examine, in the same manner, all the different parts of his dress and household furniture, the coarse linen shirt which he wears next his skin, the shoes which cover his feet, the bed which he lies on, and all the different parts which compose it, the kitchen-grate at which he prepares his victuals, the coals which he makes use of for that purpose, dug from the bowels of the earth, and brought to him perhaps by a long sea and a long land carriage, all the other utensils of his kitchen, all the furniture of his table, the knives and forks, the earthen or pewter plates upon which he serves up and divides his victuals, the different hands employed in preparing his bread and his beer, the glass window which lets in the heat and the light, and keeps out the wind and the rain, with all the knowledge and art requisite for preparing that beautiful and happy invention, without which these northern parts of the world could scarce have afforded a very comfortable habitation, together with the tools of all the different workmen employed in producing those different conveniences; if we examine, I say, all these things, and consider what a variety of labour is employed about each of them, we shall be sensible that without the assistance and co-operation of many thousands, the very meanest person in a civilized country could not be provided, even according to, what we very falsely imagine, the easy and simple manner in which he is commonly accommodated. Compared, indeed, with the more extravagant luxury of the great, his accommodation must no doubt appear extremely simple and easy; and yet it may be true, perhaps, that the accommodation of an European prince does not always so much exceed that of an industrious and frugal peasant, as the accommodation of the latter exceeds that of many an African king, the absolute master of the lives and liberties of ten thousand naked savages.’ (Smith, 1776, p. 22)

4. For example regarding sectors, Smith noted of agriculture: ‘The nature of agriculture, indeed, does not admit of so many subdivisions of labour, nor of so complete a separation of one business from another, as manufactures. It is impossible to separate so entirely, the business of the grazier from that of the corn-farmer, as the trade of the carpenter is commonly separated from that of the smith. The spinner is almost always a distinct person from the weaver; but the ploughman, the harrower, the sower of the seed, and the reaper of the corn, are often the same. The occasions for those different sorts of labour returning with the different seasons of the year, it is impossible that one man should be constantly employed in any one of them. This impossibility of making so complete and entire a separation of all the different branches of labour employed in agriculture, is perhaps the reason why the improvement of the productive powers of labour in this art, does not always keep pace with their improvement in manufactures. The most opulent nations, indeed, generally excel all their neighbours in agriculture as well as in manufactures; but they are commonly more distinguished by their superiority in the latter than in the former. Their lands are in general better cultivated, and having more labour and expence bestowed upon them, produce more in proportion to the extent and natural fertility of the ground. But this superiority of produce is seldom much more than in proportion to the superiority of labour and expence. In agriculture, the labour of the rich country is not always much more productive than that of the poor; or, at least, it is never so much more productive, as it commonly is in manufactures. The corn of the rich country, therefore, will not always, in the same degree of goodness, come cheaper to market than that of the poor. The corn of Poland, in the same degree of goodness, is as cheap as that of France, notwithstanding the superior opulence and improvement of the latter country. The corn of France

is, in the corn provinces, fully as good, and in most years nearly about the same price with the corn of England, though, in opulence and improvement, France is perhaps inferior to England. The corn-lands of England, however, are better cultivated than those of France, and the corn-lands of France are said to be much better cultivated than those of Poland. But though the poor country, notwithstanding the inferiority of its cultivation, can, in some measure, rival the rich in the cheapness and goodness of its corn, it can pretend to no such competition in its manufactures; at least if those manufactures suit the soil, climate, and situation of the rich country. The silks of France are better and cheaper than those of England, because the silk manufacture, at least under the present high duties upon the importation of raw silk, does not so well suit the climate of England as that of France. But the hard-ware and the coarse woollens of England are beyond all comparison superior to those of France, and much cheaper too in the same degree of goodness. In Poland there are said to be scarce any manufactures of any kind, a few of those coarser household manufactures excepted, without which no country can well subsist.’ (Smith, 1776, p. 16)

The issue here, or course, is not whether Adam Smith was right or wrong in his assessment of the possibilities of division of labour in agriculture, but simply that it illustrates his view that division of labour was the key to how far the economy could be developed.

Regarding development of countries see Smith’s remarks on China noted above.

5. This is of course well understood by many modern supporters of globalisation. For example Martin Wolf notes: ‘since division of labour is limited by the size of the market, it [a country] will also benefit from trade, not just in goods and services, but in ideas, capital and people.’ (Wolf, 2005, p. 34)

6. When Adam Smith wrote in 1776 no comprehensive and systematic internationally or national economic statistics existed. He was therefore necessarily forced to present his arguments with examples, illustrations, of the processes he described but, precisely because these are selective, these strictly speaking did not prove his arguments. It may therefore be said that much later comprehensive statistics more rigorously prove Smith’s arguments than the evidence available to Smith himself – which is, of course, a tribute to his genius. Later Keynes faced a similar problem. Keynes had at his disposal when writing The General Tory of Employment, Interest and Money some data on investment trends. Modern systematic national accounts, however, became available only after World War II.

7. Sachs and Warner’s conclusion was that: ‘Within the group of developing economies, the open economies grew at 4.49 percent per year, and the closed economies grew at 0.69 percent per year. Within the group of developed economies, the open economies grew at 2.29 percent per year, and the closed economies grew at 0.74 per cent per year… Within the closed group, average growth is about the same for the poorer developing countries (0.69 percent) as the richer developed countries (0.74 percent). However, within the group of open economies, the developing countries grew faster (4.49 percent) than the developed countries (2.29 percent).’ (Sachs & Warner, 1995, p. 36)

8. The figure for England for 1688 is that in (Maddison, 2006). UK figures after 1688 and up to 1947 are calculated from (Lister, 1989). Figures from 1948 are calculated from International Monetary Fund, International Financial Statistics(August 2008) Minor adjustments have been made to chain the earlier statistics to be consistent with the IMF data – in no case does this make any significant difference to the pattern shown. The data for fixed investment for the earlier period used by (Lister, 1989)The Economist One Hundred Years of Economic Statistics are based on calculations in (Feinstein & Pollard, 1988). Other commentators have suggested that Feinstein and Pollard’s figures are somewhat too high – see for example. (Crafts, 1986, p. 73). None of these revisions and differences however is of sufficient magnitude to alter the fundamental pattern shown here.

US figures prior to 1948 are calculated from (Lister, 1989). Figures from 1948 are calculated from International Monetary Fund, International Financial Statistics(August 2008) Data for the earlier period give only private fixed capital formation whereas that after 1948 is for total fixed capital formation – i.e. including government fixed capital formation. There are no reliable estimates of government fixed capital formation in the earlier period and therefore data for the earlier period have been adjusted upward by the difference between the two in 1948 – which is slightly over two per cent of GDP. This has the effect of revising upwards slightly the percentage of GDP allocated to fixed investment in the earlier period but the difference is too small to affect the overall pattern.

Figures for Germany prior to 1960 are calculated from (Lister, 1989). Figures from 1960 are calculated from International Monetary Fund, International Financial Statistics (August 2008). There is however no significant statistical difference between the two.

Figures for Japan, South Korea, China, India and Vietnam calculated from International Monetary Fund, International Financial Statistics.

9. (Deane & Cole, 1967, p. 2) being closer to the lower figure while further studies have tended to revise the figure upwards slightly. The higher estimates for the earlier period have been taken here so as to avoid any suggestion of exaggerating the degree to which the proportion of GDP devoted to Gross Domestic Fixed Capital Formation has risen. The precise figure used here is that calculated by Maddison in (Maddison, 2006, p. 395) The higher figure, as can be seen, makes no difference to the overall trend.

10. The only group which is an exception to this is the special case of the countries of Eastern Europe undergoing the transition from Communism to capitalism. Exclusion of this group, which follow a path which cannot be repeated by the overwhelming majority of other countries, would increase the weight of factor inputs of capital and labour still further. For a more detailed analysis of this see (Ross, 2010).

Works Cited

Acs, Z. J. (2002). Innovation and the Growth of Cities. Cheltenham UK, Northampton MA USA: Edward Elgar.

Audretsch, D. B., Keilbach, M. C., & Lehmann, E. E. (2006). Entrepreneurship and Economic Growth. New York: Oxford University Press.

Barro, R. J., & Sala-i-Martin, X. (2004). Economic Growth. Cambridge, Massachusetts, US: MIT Press.

Cao, J., Ho, M. S., Jorgenson, D. W., Ren, R., Sun, L., & Yue, S. (2009, July). ‘Industrial and aggregate measures of productivity growth in China, 1982-2000’. The Review of Income and Wealth, 485-513.

Erumban, A. A., Gouma, R., Los, B., Stehrer, R., Temurshoev, U., Timmer, M., et al. (2010). World Input-Output Database (WIOD): Construction, Challenges and Applications. Paper prepared for Thirty-first General IARIW Conference Sankt Gallen,

2010.

Feldman, M., & Florida, R. (1994). The geographic sources of innovation: technological infrastructure and product innovation in the United States. Annals of the Association of American Geographers, 84, 210-229.

Ferguson, A. (1767). An Essay on the History of Civil Society. Retrieved March 1, 2011, from http://books.google.co.uk/books/download/An_essay_on_the_history_of_civil_society.pdf?id=CvoIAAAAQAAJ&hl=en&capid=AFLRE72y7PQNqGCaf34N5NvaA6SFY6kqjCTclVf5Th6dVq2fZDYtwizl51bbtTTw93pFHDBenOZh-OHY7S_Kxs7RaS6bL_a_Lw&continue=http://books.google.co.uk/books/d

Ferreira, P. C., & Trejos, A. (2008). Trade in Intermediate Goods and Total Factor Productivity. Graduate School of Economics, Getulio Vargas Foundation (Brazil), Economics Working Papers (Ensaios Economicos da EPGE).

Friedman, M. (1957). A Theory of the Consumption Function. Princeton: Princeton University Press.

Jaffe, A. B. (1989). Real effects of academic research. American Economic Review, 79(5), 957-98.

Jorgenson, D. W. (2009). ‘Introduction’. In D. W. Jorgenson (Ed.), The Economics of Productivity (pp. ix-xxviii). Cheltenham, UK: Edward Elgar.

Jorgenson, D. W., & Vu, K. M. (2007). ‘Information Technology and the World Growth Resurgence’. German Economic Review, 8(5).

Jorgenson, D. W., & Vu, K. M. (2010). Potential growth of the world economy. Journal of Policy Modeling(doi:10.1016/j.polmod.2010.07.011).

Jorgenson, D. W., Gollop, F. M., & Fraumeni, B. M. (1987). Productivity and US Economic Growth. New York: toExcel.

Jorgenson, D. W., Mun, S. H., & Stiroh, K. J. (2005). Productivity Vol 3 – Information Technology and the American Growth Resurgence. Cambridge, Massachusetts: MIT Press.

Krugman, P. (1994). The Myth of Asia’s Miracle. Foreign Affairs, 62-78.

Lardy, N. R. (1993). Foreign Trade and Economic Reform in China 1978-1990.Cambridge, UK: Cambridge University Press.

Maddison, A. (1992). A long run perspective on saving. Scandanavian Journal of Economics, 94(2), 181-196.

Ren, R., & Sun, L. L. (2007). ‘Total factor productivity growth in Chinese industries, 1981-2000’. In D. W. Jorgenson, M. Kuroda, & K. Motohashi (Eds.), Productivity in Asia, Economic Growth and Competitiveness (pp. 76-112). Northampton: Edward Elgar.

Ross, J. (2009, September 8). ‘The Asian and Chinese Economic Growth Models – Implications of Modern Findings on Economic Growth’. Retrieved from Key Trends in Globalisation: http://ablog.typepad.com/keytrendsinglobalisation/2009/09/the-issue-of-whether-chinas-economic-stimulus-package-and-the-asian–growth–model-in-general-is-correct-and-therefore-its.html

Ross, J. (2010, September 10). The greater capital intensity of economic growth in developed than developing economies – confirmation in new data from Jorgenson and Vu. Retrieved June 20, 2011, from Key Trends in Globalisation: http://ablog.typepad.com/keytrendsinglobalisation/2010/09/the-greater-capital-intensity-of-economic-growth-in-developed-than-developing-economies-confirmation-in-new-data-from-jor.html

Sachs, J. D., & Warner, A. (1995). Economic Reform and the Process of Global Integration. Brookings Institute. Brookings Papers on Economic Activity.

Smith, A. (1776). An Inquiry into the Nature and Causes of the Wealth of Nations(1981 ed.). Liberty Edition – 2 Volumes.

Smith, A. (n.d.). Lectures on Jurisprudence.

Solow, R. M. (1957, August). ‘Technical change and the Aggregate Production Function’. Review of Economics and Statistics(3), 312-320.

Spengler, J. (1959). Adam Smith’s Theory of Economic Growth – Part I. Southern Economic Journal, XXV(April).

Timmer, M. P., O’Mahony, M., & van Ark, B. (2007). ‘EU KLEMS Growth and Productivity Accounts: an Overview’. Retrieved from http://www.euklems.net/data/overview_07I.pdf

Vu, K. M. (2007). ‘Determinants of economic growth over the period 1995-2005’. Retrieved from http://docs.google.com/viewer?a=v&q=cache:s7odRXb7owsJ:www.spp.nus.edu.sg/Handler.ashx%3Fpath%3DData/Site/SiteDocuments/wp/wp0907.pdf+%22Determinants+of+Economic+Growth+Over+the+Period+1995-2005%22+Vu&hl=en&gl=uk&pid=bl&srcid=ADGEESj9omj1MsLK6PX0-ns9x4Gvz

Wolf, M. (2005). Why Globalization Works. New Haven and London: Yale University Press.

Young, A. (1995, August). The Tyranny of Numbers: Confronting the Statistical Realities of the East Asian Growth Experience. Quarterly Journal of Economics, 110, 641-80.

Young, A. (2000). Gold into Base Metals: Productivity Growth in the People’ Republic of China during the Reform Period. Cambridge, MA: NBER Working Paper 7856.