- There should be a short-term acceleration of growth during the early period of the Trump presidency, for the simple statistical reason that in 2016 the US economy was growing significantly below its long-term average. A move of the US economy up towards its long-term average growth rate will therefore create the illusion that the US economy is improving during the early period of Trump’s administration – when it is in reality a predictable statistical effect.

- Trump, however, cannot accelerate the long-term US growth rate without fundamental changes in the US economy which are very unlikely for reasons analysed below. Therefore, over the long-term Trump will not accelerate US economic growth.

Analysing these most fundamental trends in the US economy also identifies which key US data must be watched carefully to assess the success or failure of Trump’s economic policy in both the short and long term.

The long-term slowing of the US economy

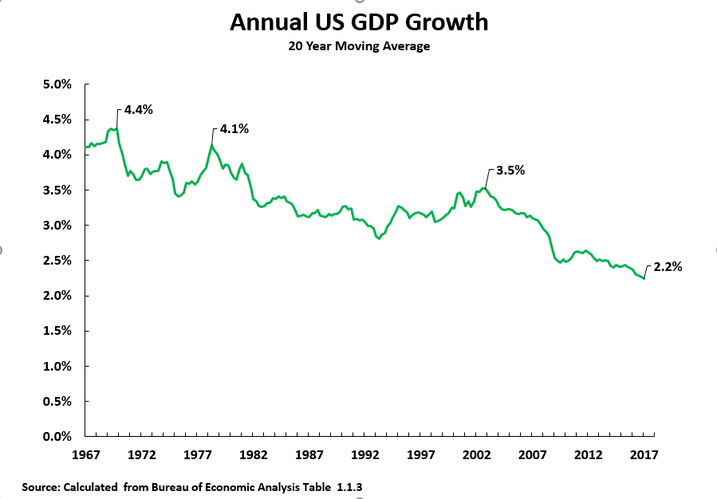

To start with the most fundamental trend of US long term growth, Figure 1 shows US annual average GDP growth using a 20-year moving average to remove all purely short term fluctuations due to business cycles. This data shows clearly the most profound trend in US growth is a half century long economic slowing – the peaks of US growth progressively falling from 4.9% in 1969, to 4.1% in 1978, to 3.5% in 2003, to 2.2% by the latest data for the 1st quarter of 2017.

The cyclical situation of the US economy

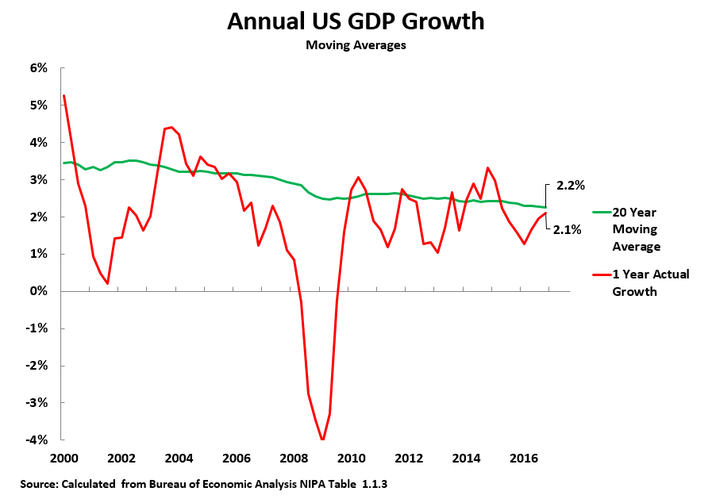

Turning to short term developments, the trend of US growth shown in Figure 1 is a long-term average. This necessarily means that short term economic growth is sometimes above and sometimes below this average. Figure 2 therefore shows the short-term trend in US growth, the economy’s year by year growth rate, compared to the long-term average.

It may be seen from Figure 2 that the US economic growth in the year to the 3rd quarter of 2016 was 1.7% and in the 1st quarter of 2017 it was still only 2.1%. That is, the US economy in the period leading up to Trump’s election was growing at significantly below its long-term trend. For this reason, purely for statistical reasons, it is probable that the US economy may accelerate in the short term.

As this would coincide with the initial period of Trump’s presidency this would lead to the claim ‘Trump is improving the US economy’. But this is false, such acceleration would be expected purely for statistical reasons.

The determinants of US growth

Finally, if the reasons for the US long term economic slowdown are analysed these are simple. The most fundamental of all features of the US economy is that it is a capitalist economy. This means when there is a high rate of capital accumulation the US economy grows rapidly, when there is a low rate of capital accumulation the US grows slowly.

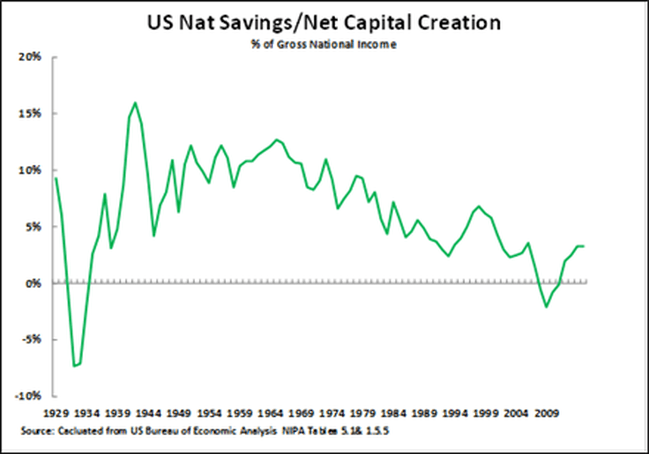

In terms of economic statistics net capital accumulation is equal to net savings. Figure 3 therefore shows the long-term trend in the US savings rate/capital accumulation rate since 1929. The curve of long term development of the US economy can be seen to be clear:

- During the crisis creating the beginning of the Great Depression in 1929-33 US capital accumulation was negative – that is the US economy was creating no capital. This necessarily produced a deep crisis of the US economy. After this the rate of US savings/capital creation rose, with a powerful acceleration during World War II, to reach a long-term peak as a percentage of the economy in 1965.

- After 1965 US net savings/capital creation steadily fell as a percentage of GDP until it once again became negative during the ‘Great Recession’ in 2008-2009. This declining trend of US capital creation of course explains the long-term growth slowdown that was shown in Figure 1.

This trend therefore shows the fundamental issue confronting Trump which he would have to overcome to accelerate the long-term growth of the US economy. Unless he can engage in large scale foreign borrowing, which is difficult for reasons analysed in ‘The Economic Logic Behind Trump’s Foreign Policy – Why the Key Countries are Germany and China’, Trump would have to increase the percentage of capital creation in the US economy. Without this, while a short-term speed up in the US economy is to be expected for the statistical reasons given earlier, no long term acceleration of US economic growth will take place. Without such a sharp increase in the level of capital accumulation claims by Trump that he will accelerate the US rate of growth are purely ‘hot air’.

It is clear that the first effect of Trump’s policies will not be to increase but to reduce US savings/capital accumulation. This is due to the fact that an economy’s savings are not only household savings but company savings plus household savings plus and government savings – government savings in most economies being negative because the government runs a budget deficit. Trump has announced policies that will clearly increase the US budget deficit – tax cuts focussed on the rich and increased military spending. This increased budget deficit will necessarily reduce the US savings level.

In the purely short term Trump could lessen the effect of low US savings/capital creation by borrowing from abroad. But historical experience shows that over the medium/long term in major economies it is domestic capital creation which is decisive. Therefore, Trump has so far announced no policies which will increase the long-term US growth rate. Therefore, in summary:

- A short-term speed up of the US economy is likely for the statistical reasons already given – but does not indicate any increase in long term economic growth.

- Trump has no put forward policies that will accelerate US long term economic growth.

Finally, these trends show which data must be closely watched to see success or failure in Trumps economic policies. The short term shifts in the growth rate must not be seen in themselves but compared to the long term trend of US growth: the key variable for judging long term US growth is whether the level of capital formation in the US economy is rising or falling.