Introduction

It is well known that China will continue economic stimulus measures in 2023 – the only serious discussion is of what type. To be successful these measures must simultaneously achieve two goals. First, they must adequately respond to China’s short-term situation – that is they must substantially reverse 2022’s economic slowdown. Second, they must aid in achieving the strategic goals China has set for 2035.

It is equally well known that the international economic situation which will confront China in 2023 is unfavourable. In this regard, it is important to understand that this negative international context is itself due to the failure of the stimulus programmes the US launched in order to deal with the consequences of the Covid pandemic. The fact that China and the US have both now released their economic data for 2022 as a whole allows this situation to be judged clearly. In 2022 the US suffered its worst stagflationary crisis for almost half a century – the EU’s similar situation merely followed a few months behind the US. In detail, the US experienced the highest inflationary wave for forty years while simultaneously its economic growth rate has dropped by half compared to that earlier period. These two factors, in turn, combine to produce a US/EU economic policy paralysis in adequately responding to their short-term slowdown in 2023 – high inflation means their policy makers have to adopt economically contractionary policies, in particular raising interest rates, which fail to offset, indeed intensify, economic slowing.

In summary the result, as will be shown in detail, is not only short-term US/EU economic deceleration in 2023 but a medium/long term slowdown which prevents these economies achieving their strategic objectives. That is, the US stimulus programmes was a strategic failure – in addition to the short-term inflation, prospects for long-term economic growth were worse after these packages than before them.

In summary, the present world economic situation, and therefore the one facing China, is largely determined by the interrelation of two stimulus programmes. The first is the damaging consequences of the US stimulus packages, creating the worst global stagflationary situation for forty years, the second is the stimulus programmes being launched by China which have the potential both to launch its own economic growth and to play a key role in global economic recovery. Given these facts it is, therefore, clarificatory for achieving China’s goals to examine in detail the present international economic situation and understand the reasons for the failure of the US packages, and the lessons of these for China’s own stimulus programmes.

Two interrelated but distinct issues are involved with this – both of which directly relate to China’s own economic situation and policies as it enters 2023.

- The failure of the US/EU stimulus programmes was completely predictable – as they followed from fundamental errors in economic analysis and theory. These errors unfortunately sometimes also appear in discussion in China. It is therefore important that these analytical/theoretical issues are clarified.

- These analytical issues directly interrelate with the precise international and domestic economic situation confronting China at the beginning of 2023. To simultaneously meet both the immediate goals for 2023 and the strategic goals for 2035 it is necessary to accurately analyse the key elements of the short, medium and longer term economic situation.

Both these aspects will be dealt with below. In analysing these lessons, and their interrelation to the Western economies, as always, the correct method is to seek truth from facts. Therefore, first the facts that must be explained in the failure of the Western stimulus packages will be set out and then the reasons for these negative effects and the conclusions for China will be analysed.

China’s strategic goals to 2035

Turning to the specific interrelation of these international economic issues with China’s strategic goals the latter, in terms of economic growth, were set out in November 2020 by Xi Jinping in 关于《中共中央关于制定国民经济和社会发展第十四个五年规划和二〇三五年远景目标的建议》的说明. This stated that discussion around the 14th Five Year Plan discussion had noted that: “the goal of doubling the economic aggregate or per capita income by 2035 should be clearly stated.” It concluded that: “It is entirely possible to double the total or per capita income.”

China doubling per capita GDP from 2020 to 2035 would mean, leaving inflation out of account, achieving a per capita GDP level of $21,050. At the 20th Party Congress the fundamental goal was set as reaching the level of a “medium-developed country by 2035”. Per capita GDP of slightly above $21,000 would be significantly above the level of Hungary or Poland today, that is of major East European states, and slightly above the level of Greece – precisely a medium developed advanced economy.

China’s annual population growth in the recent period has been zero, and in 2022 was slightly below zero, consequently achieving the target of doubling total GDP is extremely close to that for doubling per capita GDP – and ensures that that the latter target will also be met. Therefore, the growth assumptions in what follows are for China doubling GDP by 2035 – any realistic estimate of population changes by 2035 will not affect the fundamental economic situation.

To achieve doubling of GDP/per capita GDP during 2020-2035, after growth of 3.0% in 2022, requires annual average growth of at least 4.6% in 2023-2035. Any adequate stimulus programme must therefore achieve the tactical goal of accelerating economic growth in 2023 but doing so in a way that simultaneously ensures achievement of the strategic goal for 2035. These requirements will be assumed in what follows.

Part 1 – The Strategic Failure of the US/EU Stimulus Programmes

The inflationary wave in the US and EU

Starting with the current international situation, it is already known that 2023 will be an extremely difficult year for the global economy and therefore for the international situation surrounding China. The US/EU governments are fully aware their economies are decelerating, the only discussion is of by how much – that is the only debate is as to whether there will be an actual recession, that is negative growth, or merely very slow growth. This clear understanding dominates projections by international economic organisations and discussion in the media. But, as already noted, Western government are paralysed from taking any adequate stimulus measures to avoid this slowdown because during the last two years the US economy has been passing through its worst stagflationary situation for almost half a century. This inflationary wave, accompanying the very slow growth, is therefore the first specific feature of the present international situation, differentiating it from other recent periods of low growth. Consequently, to understand the global economic processes, it is necessary first to accurately analyse the reasons for the inflationary wave and the reasons China escaped it.

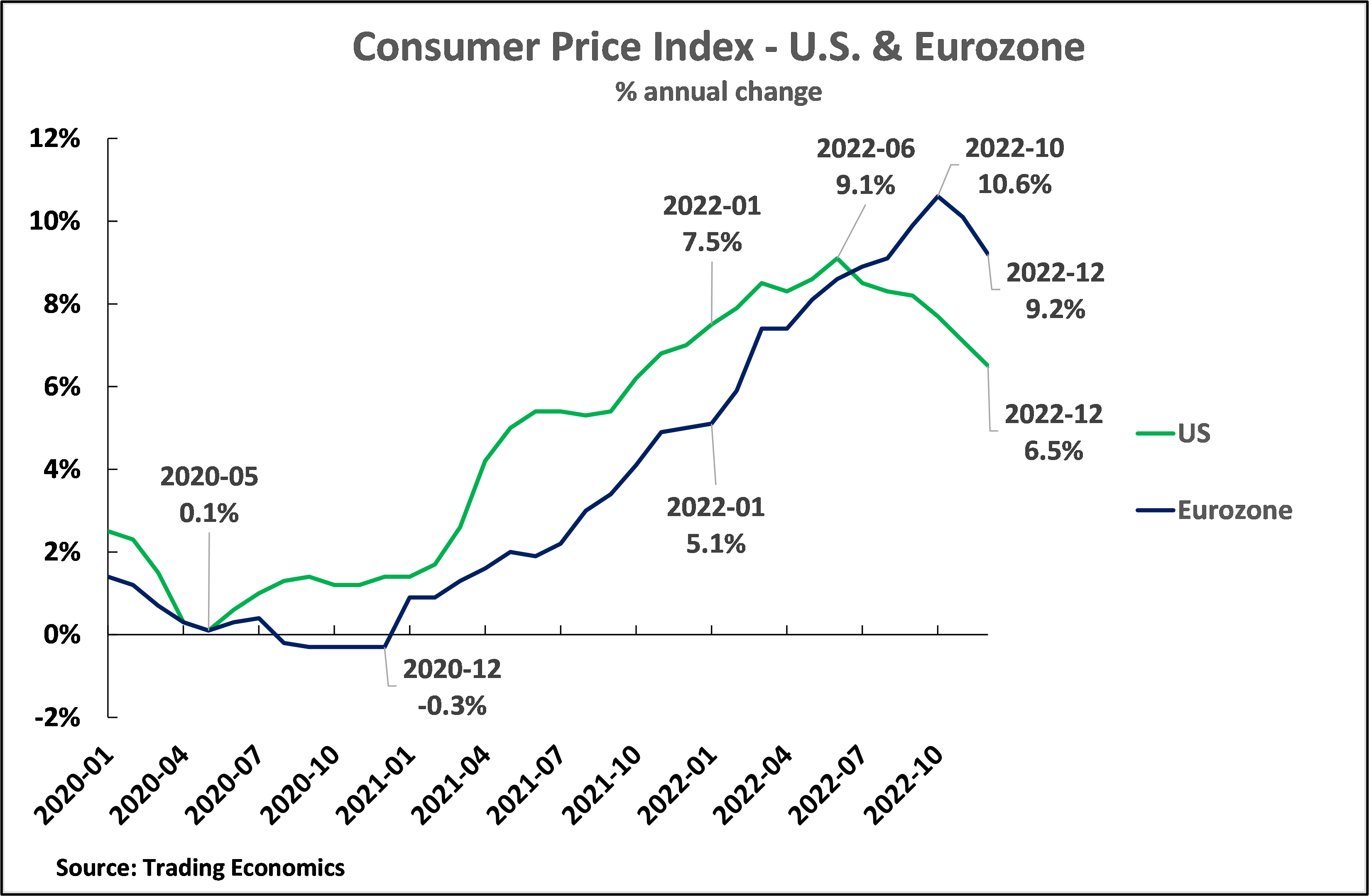

First it is extremely important and very easy to show that the claim by the US government that its inflationary wave is due to the Ukraine war is entirely false – as is clearly demonstrated by the chronology of the inflationary tsunami. Figure 1 shows that more than 80% of US inflation took place before the Ukraine war started. The Ukraine conflict broke out on 24 February 2022. But by January 2022, that is before the war commenced, US inflation had already risen from 0.1% in May 2020 to 7.5% – that is it had increased by 7.4% to the highest inflation level for over 40 years. US recent peak inflation was in 9.1% in June 2022, therefore 82% of peak US inflation occurred before the Ukraine war. By December 2022, US inflation was 6.5% – which was actually lower than before the war. Regarding Eurozone inflation, Figure 1 shows that this was merely lagging two to three months behind the US.

In summary the US/EU inflationary wave was created long before the Ukraine war broke out and therefore this war cannot be responsible for the inflation. The claim that the US/EU inflationary wave was due to the Ukraine war therefore will not stand factual examination and is US propaganda, aimed to divert attention from the real causes of the inflationary wave. The real causes of the inflationary wave lay in the errors of the US stimulus packages to respond to Covid, which are examined below.

Figure 1

Slowdown in US growth

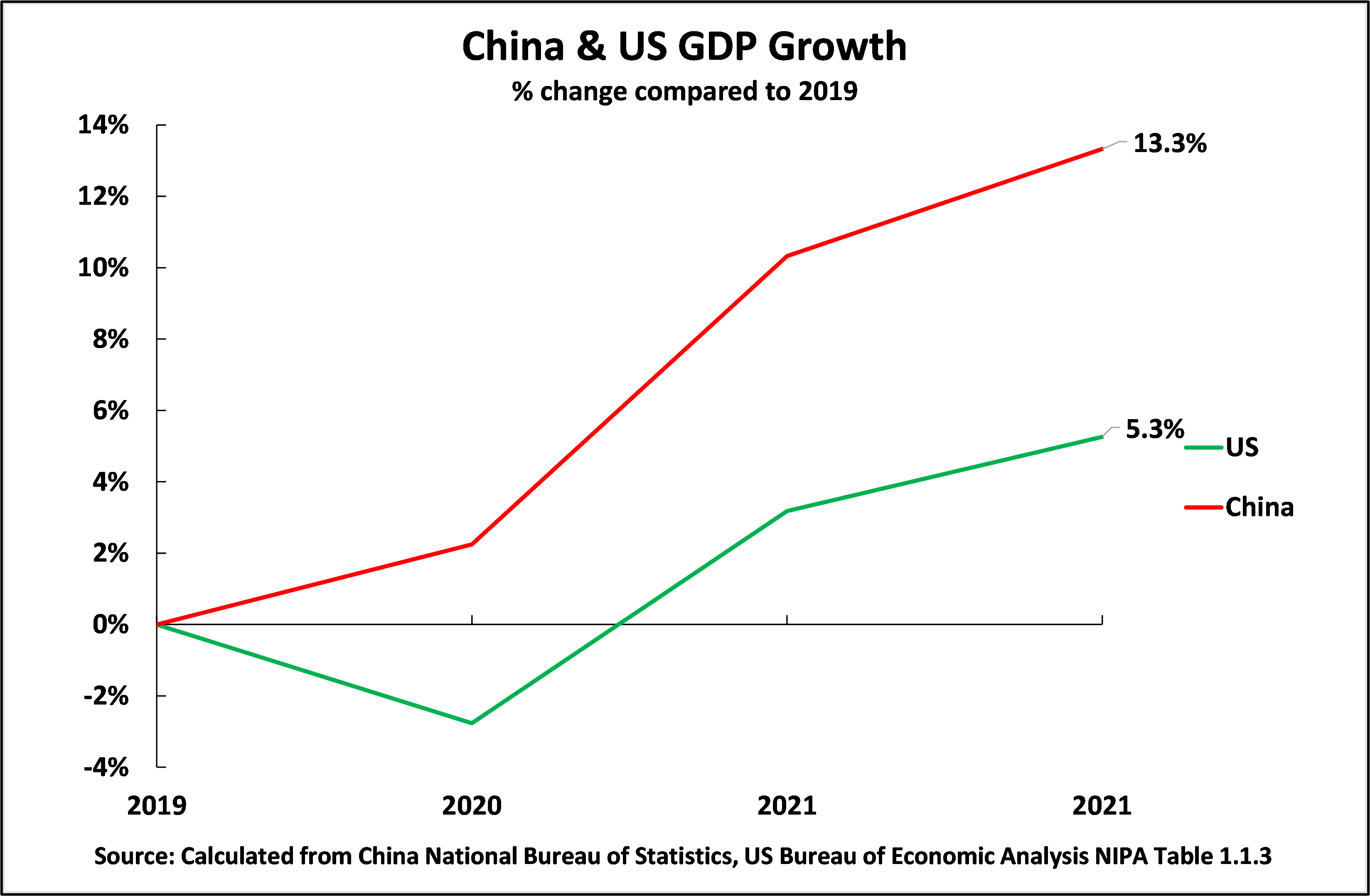

But if US inflation soared during the period of its pandemic era stimulus packages US economic growth was very slow. Recent publication of US economic data for the whole of 2022, which means that three years of pandemic, 2020-2022, are covered shows that US GDP grew by a total of only 5.3% during this period – an annual average 1.7%. This compares to China’s total growth in the same period of 13.3%, or China’s annual average 4.3%. During the pandemic China’s economy therefore grew two and a half time as fast as the US. This data is shown in Figure 2. The US stimulus packages were therefore accompanied both by extremely high inflation and low growth i.e., stagflation.

Figure 2

US short term contractionary policies

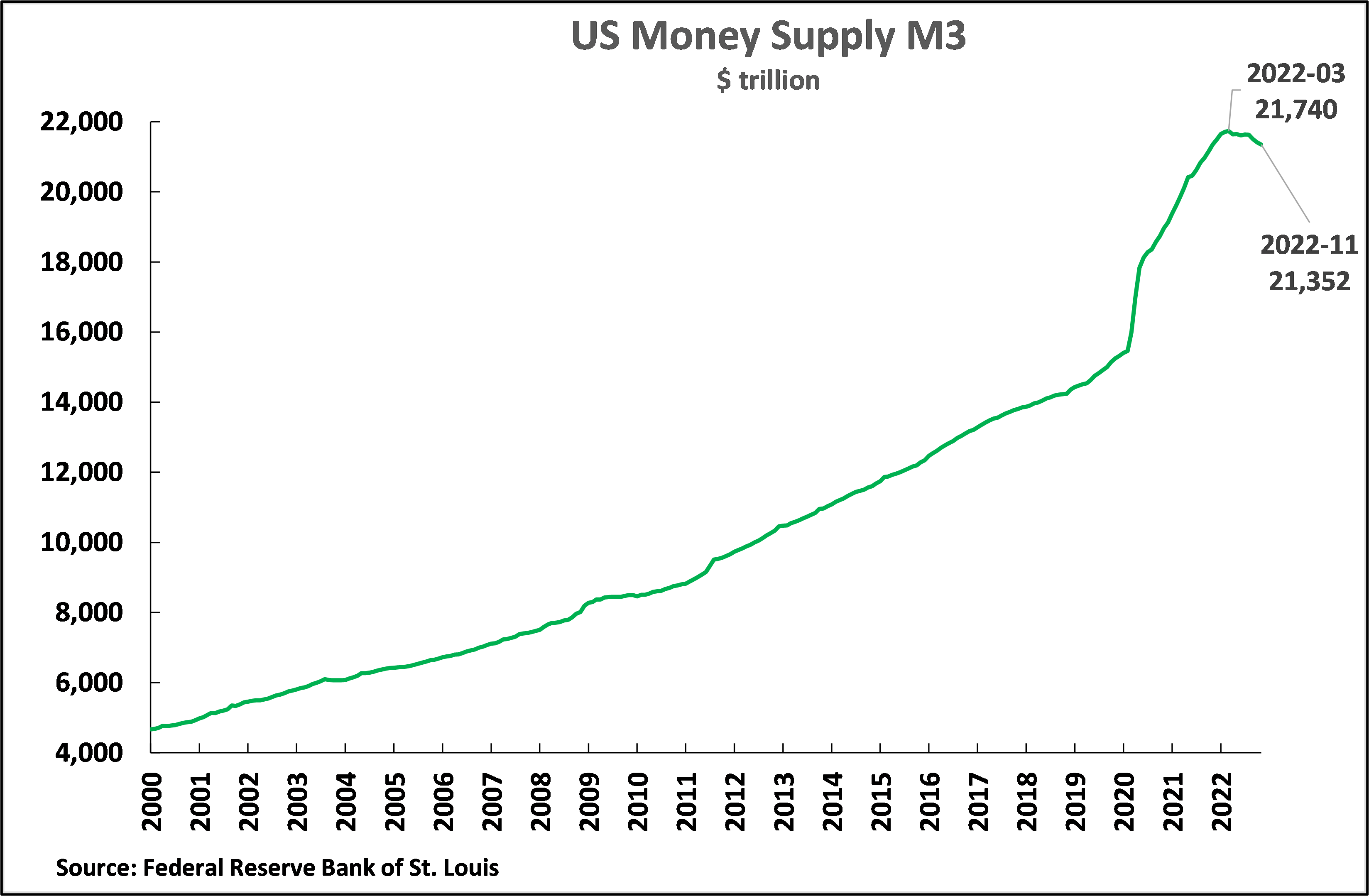

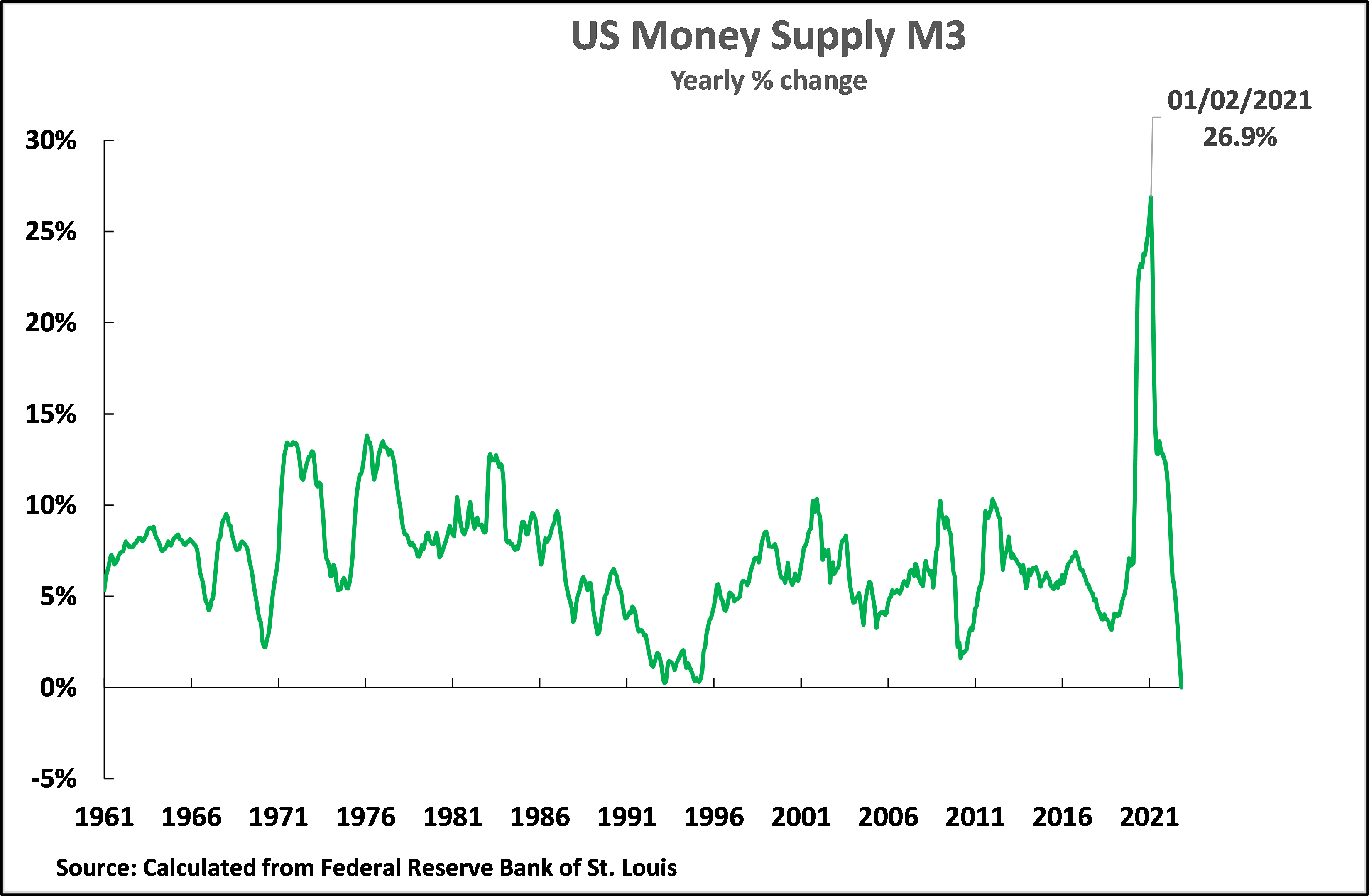

As is well known, to attempt to combat the inflationary wave, the US Federal Reserve, and other Western central banks, have had to, and will continue for some time, to increase interest rates and tighten monetary policies with inevitable contractionary economic effects. Indeed, as Figure 3 shows, US money supply has actually been falling since its peak in March 2022 – a highly unusual and contractionary monetary situation. This is the exact opposite of what would be required to lessen economic slowdown. This helps ensure that the US economy will remain locked in slow growth in 2023.

Figure 3

Medium/long term slowdown of the US economy

An immediate consequence of these sharply contractionary policies being carried out by the US economic authorities in 2022-23 is that the medium-term term effects of the US/EU stimulus packages must be judged a complete strategic failure. Any short-term benefits during the pandemic were cancelled out, or more than cancelled out, by the contractionary policies and resulting low short-term growth required to get inflation back under control – an inflation which, as will be seen, was itself created by US economic policy. This helps produce the stagnationary aspects of the situation.

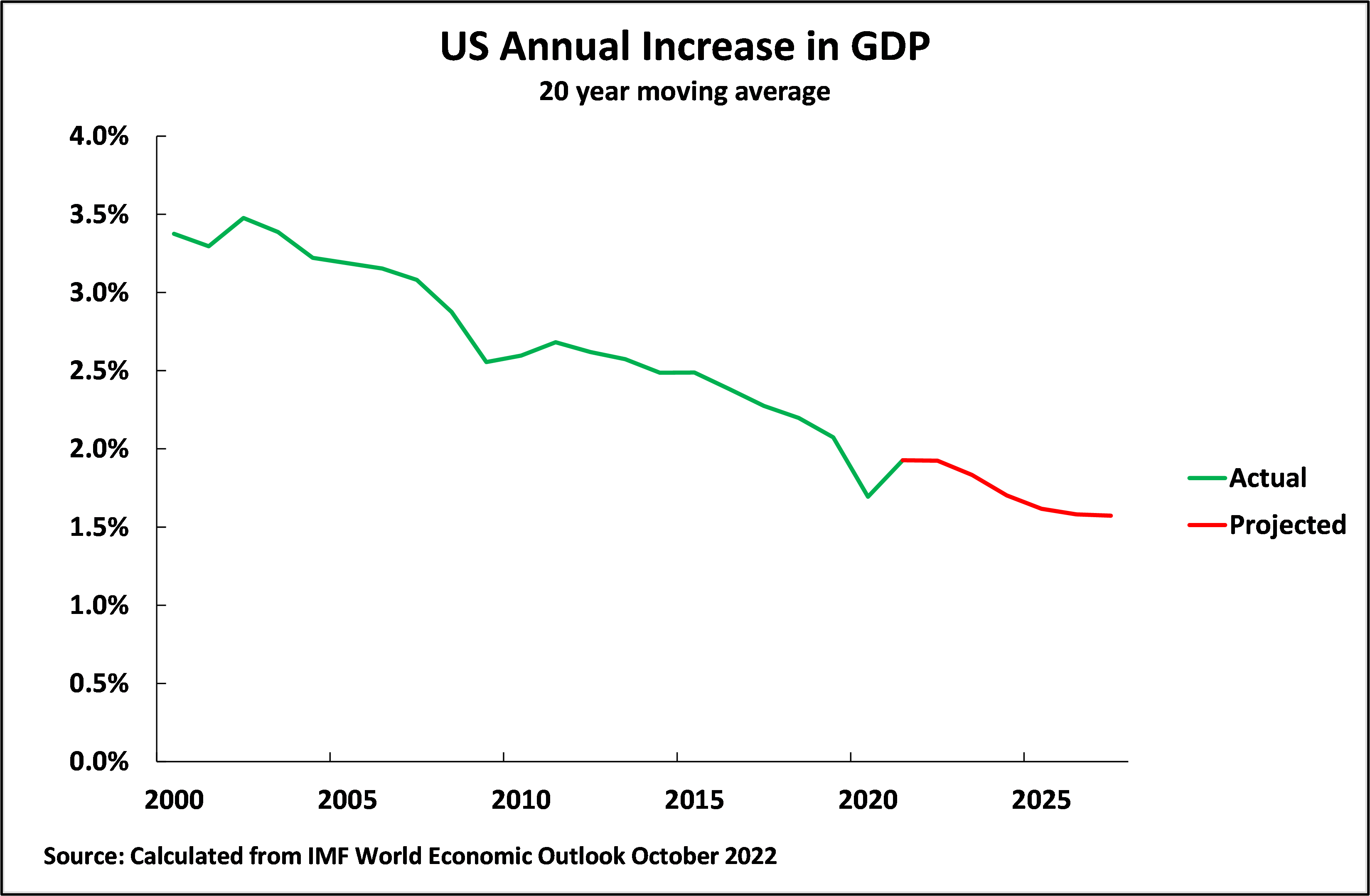

For this reason, not only will the US/EU’s 2023 growth decelerate but Western economies medium/ long-term growth, in particular that of the US, will slow – as the IMF, whose predictions are normally somewhat biased in favour of the US, admits. Figure 4 shows that the IMF projects that annual average US GDP growth, taking a long-term average to remove the effect of business cycle fluctuations, will fall from an already low 1.9% in 2021 to 1.6% in 2027. Over the same period the IMF projects EU annual growth will fall from 1.4% to 1.2%.

This complete strategic failure of the US/E.U. stimulus packages launched against the Covid economic downturn makes clear why it is important that China studies and draws the lessons from this extremely negative experience – as these lessons are linked to fundamental issues of economic policy and therefore also affect China.

Figure 4

What happened during the US stimulus packages?

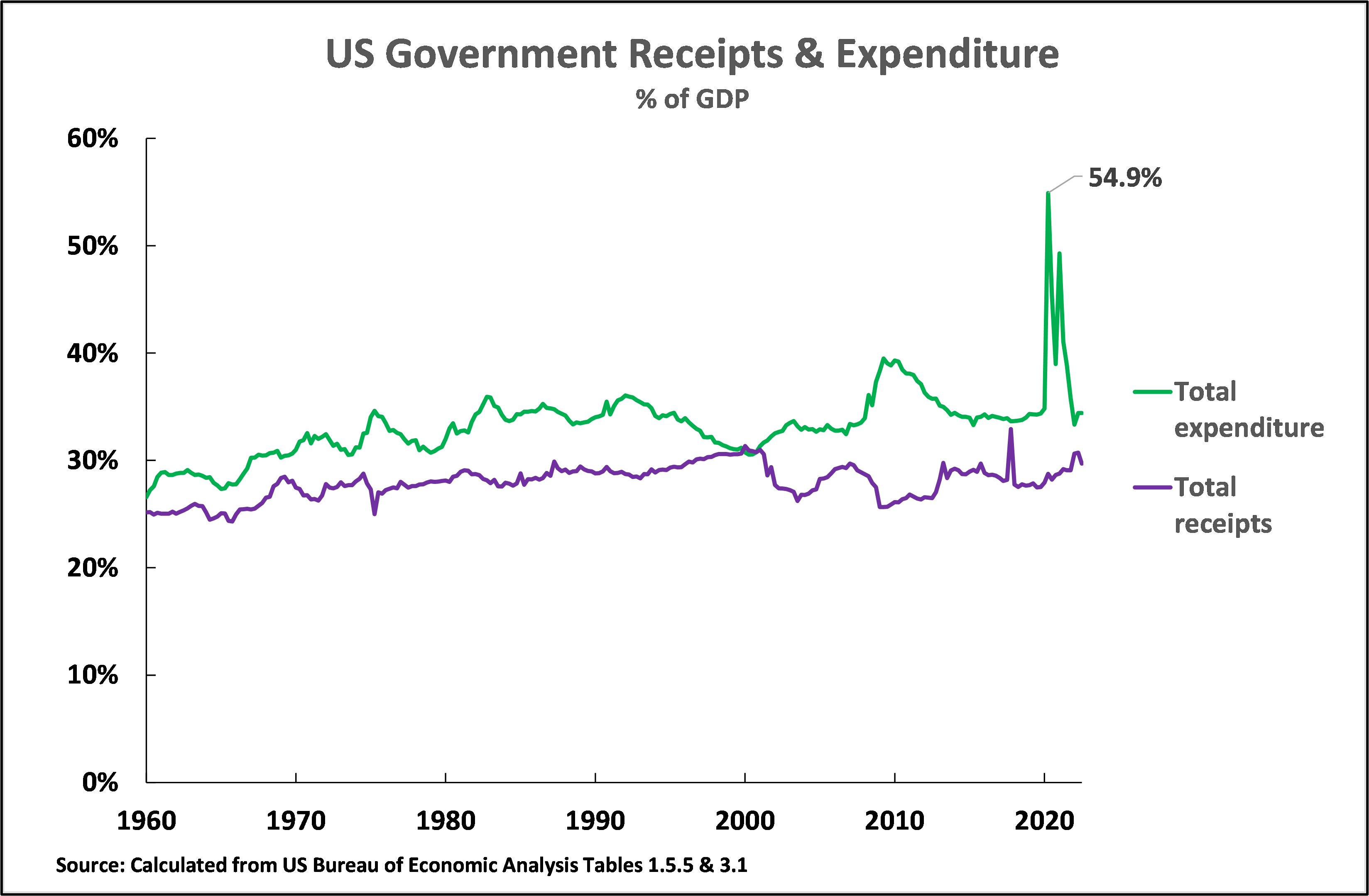

Turning from the results of the US stimulus packages to the processes which occurred during them, and produced these negative results, by far the largest change was in US government behaviour. Figure 5 shows US government receipts and expenditure. As may be seen during the pandemic there was no very dramatic change in US government receipts – they were 27.5% of GDP in the 4th quarter of 2019 on the eve of the pandemic, never fell below that level during it, and rose moderately to peak at 30.7% of GDP in the 2nd quarter of 2022, a rise of 3.2% of GDP. The extraordinarily dramatic change was the enormous surge in government expenditure during the pandemic. Between the 4th quarter of 2019 and the 2nd quarter of 2020 US government expenditure rose from 34.4% to 54.9% of GDP – an extraordinary increase of more than 20% of GDP during six months. This 54.9% of GDP of government spending was unparalleled in US peacetime history.

Figure 5

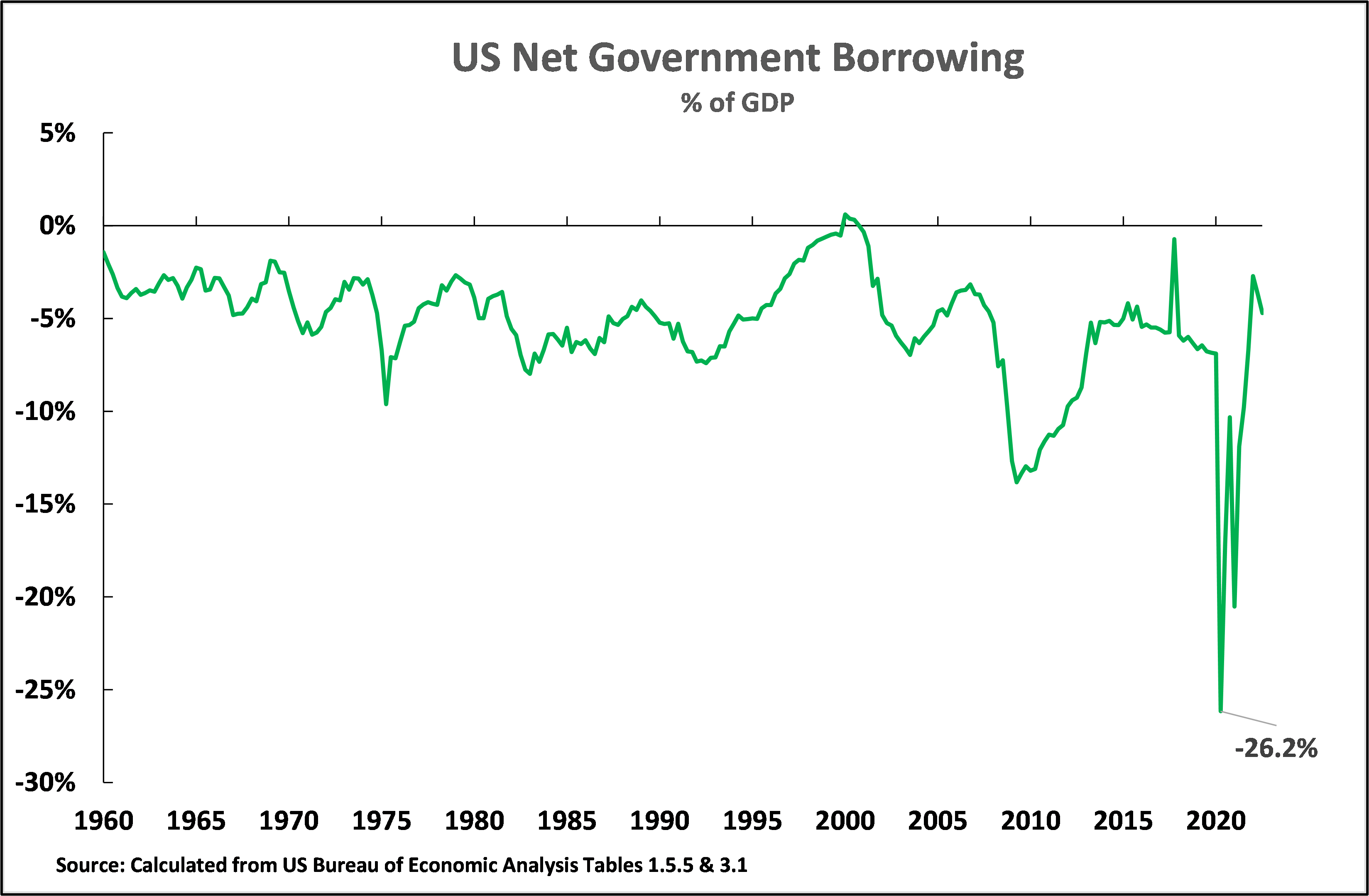

The vast surge in US government expenditure, with merely a moderate rise in receipts, of course produced a huge excess of expenditure over income and consequently a vast increase in the budget deficit and state borrowing. As Figure 6 shows US government quarterly borrowing soared to an unprecedented peacetime level of 26.2% of GDP in the 2nd quarter of 2020.

Figure 6

A huge increase in US transfer payments and subsidies

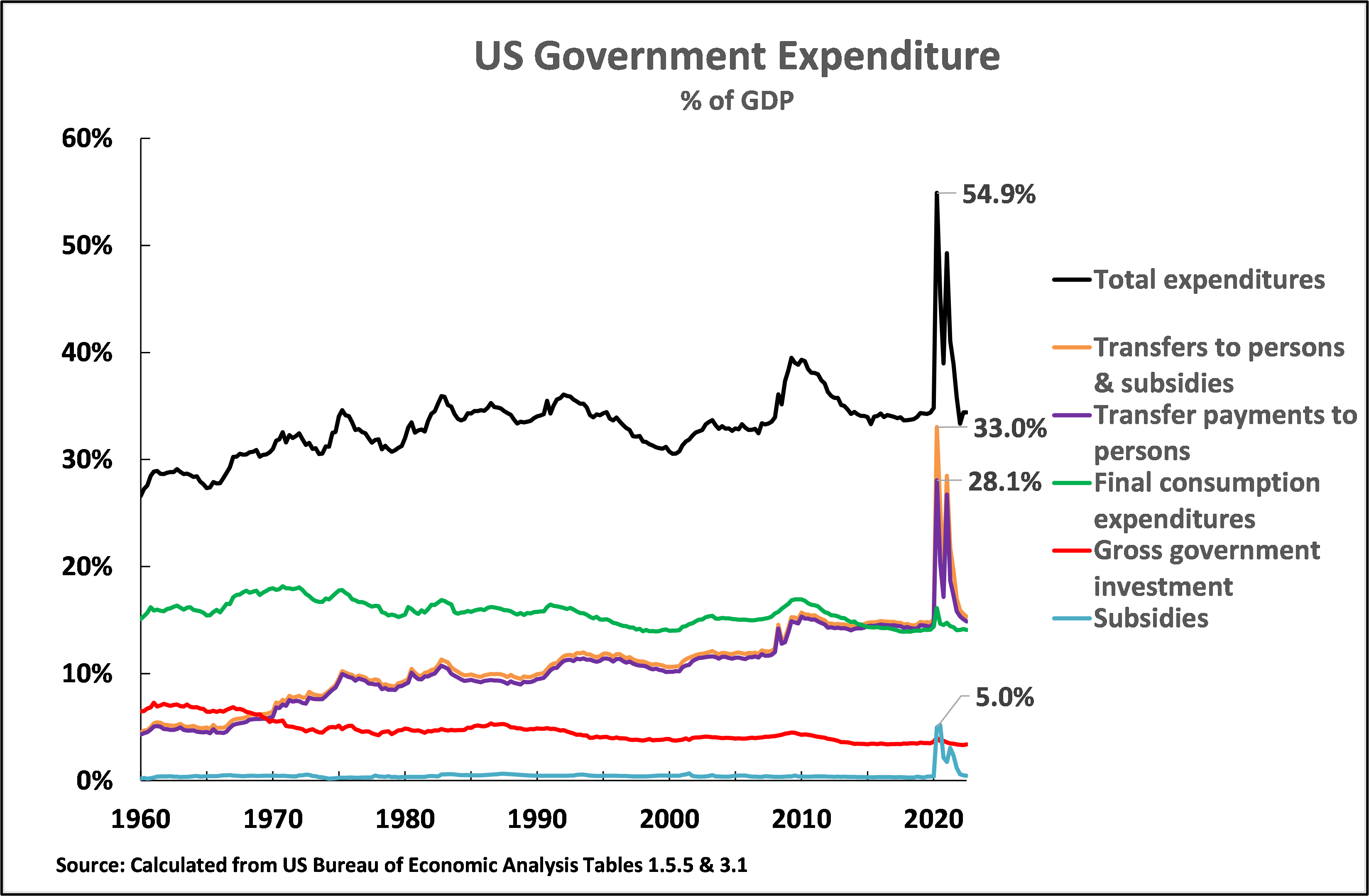

Turning to examine the uses this huge increase in US government expenditure was put to, Figure 7 shows the structure and purposes of this. Making a comparison of the 2nd quarter of 2020, the peak of US government spending, to the 4th quarter of 2019, the last before the pandemic struck, shows:

- There was no increase in government investment – it was 3.5% of GDP at the beginning of the period and 3.5% at the end.

- Government final consumption rose only modestly from 14.1% to 16.1% of GDP – an increase of 2.0% of GDP.

- Government subsidies, above all to transportation and related uses, rose from 0.4% to 5.0% of GDP in the 2nd quarter of 2020 – an increase of 4.6% of GDP.

- Transfer payments to persons enormously increased from 14.4% to 28.1% of GDP – an increase of 13.7% of GDP. Payments to individuals accounted for the vast majority of the increase in government spending and were overwhelmingly used for consumption.

In terms of the structure of the economy and the stimulus packages which were launched, this increase in US government spending was therefore overwhelmingly consumer oriented – 10% of the increase in government expenditure went into final government spending, 23% into subsidies, and 67% into transfer payments to individuals. There was no increase in government investment. This is therefore the type of exclusively or overwhelmingly consumer-oriented stimulus programme some supporters of the US model advocate for China.

Figure 7

US money supply

The huge increase in consumer-focused government transfer payments was in turn accompanied by extremely rapid expansion of the US money supply. Figure 8 shows that in the year to February 2021 the US broad money supply rose by 26.9% – by far the most rapid increase in US peacetime history. Even more extraordinarily, between February and September 2020 US broad money supply rose by 20.2% in only a seven-month period – an annualised rate of 37%. These rates of monetary emission vastly exceeded, for example, the increase in US money supply accompanying the Quantitative Easing to attempt to deal with the international financial crisis after 2007 – the peak annual expansion of the US money supply in that period was under 10%. In summary, the US stimulus packages saw an unprecedented increase in the US budget deficit and in US money supply.

Figure 8

What occurred in the US economy during its stimulus packages?

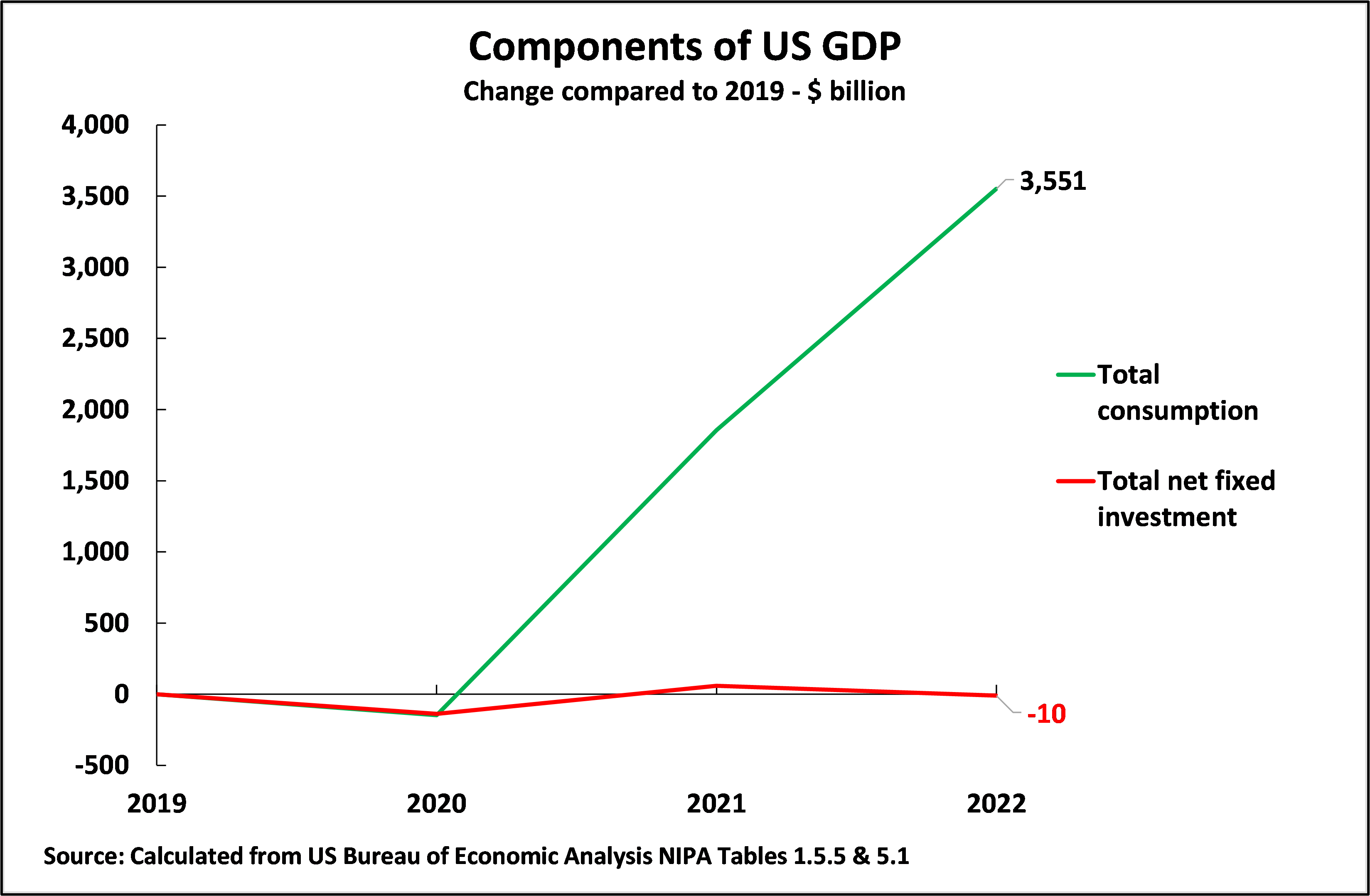

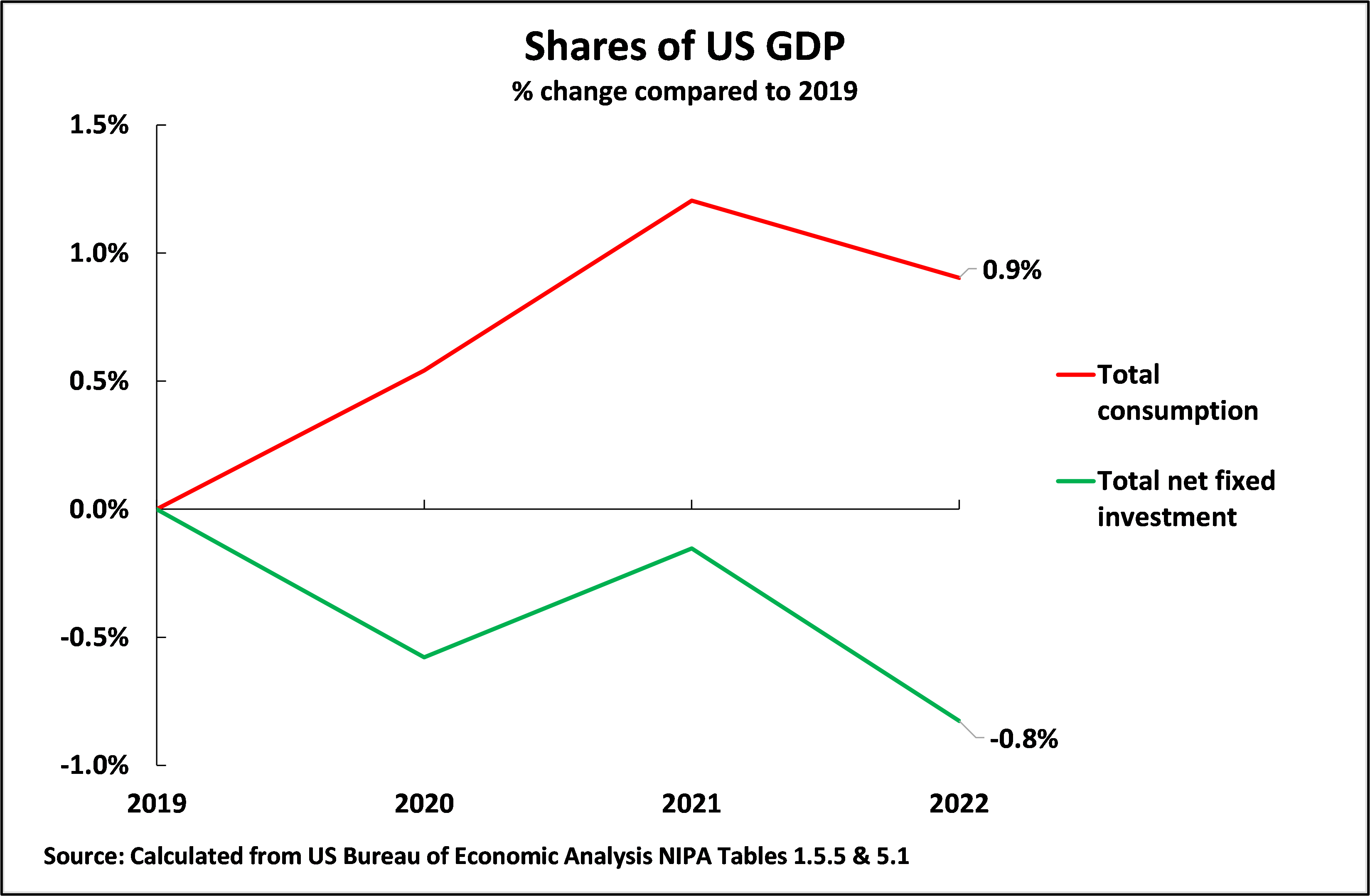

Turning to the impact of these consumer focussed stimulus programmes on the US economy, Figure 9 shows the key changes in structure of US GDP during the pandemic – that is, the changes from 2019, prior to the pandemic, to 2022. US consumption rose relatively strongly by $3,551 billion. US gross fixed investment also rose, by a much smaller $838 billion, but this was insufficient to even offset the capital depreciation of $848 billion in the same period. Therefore, US net fixed investment, taking into account depreciation, fell by $10 billion at the same time as a surge in consumption was taking place. The US capital stock at the end of this period was therefore marginally smaller than at the beginning – as the change was very small, it may be said fundamentally that during this period while US consumption rose significantly there was no increase in US net capital investment/US capital stock.

Figure 9

Analysing this in terms of the changes of the structure of US GDP during the stimulus packages, the share of total consumption in US GDP rose by 0.9% while the share of net fixed investment fell by 0.8% – as shown in Figure 10. This data confirms again that the nature of the US stimulus programmes was almost exclusively oriented to consumption and produced a further shift of the US economy into consumption, while the share of net fixed investment was reduced – it was therefore almost a pure consumer stimulus.

Figure 10

The final outcome of the US stimulus packages

To summarise, the combination of the changes in US government spending with macroeconomic changes the changes in the US economy during the pandemic were clear and the following:

- A large stimulus package was launched by this US government.

- This stimulus was overwhelmingly/almost exclusively concentrated on consumption.

- The structure of the US economy was shifted further into consumption.

- The result was the greatest inflationary wave for 40 years.

- Strategically the stimulus programme was a complete failure – in the short term the inflationary wave forced the introduction of contractionary measures sharply slowing the US economy in 2023, while in the medium/long term annual average the US economic growth actually declined.

At the end of these stimulus packages the US economy was therefore in a worse strategic situation, with lower growth and higher inflation, than at the beginning. Given such a policy failure, with such negative results, what was the explanation of this? Was it possible to foresee it in advance? And what were the lessons?

Part 2 – Confusion of Supply and Demand – Why the US Stimulus Packages Failed

The reason for this complete strategic failure of the US stimulus packages was twofold. Ultimately, of course, this failure was determined by the power of different social forces within the US, but in more immediate terms it was due to:

- Confusions in US economic thinking.

- The point in the business cycle at which this consumer based stimulus was launched.

Both have direct lessons for China as it considers its own stimulus packages for 2023.

Confusions in US economic thinking

Considering first the confusions in US economic thinking these were dealt with in detail in 引发世界经济危机的罪魁祸首是美国,而非乌克兰战争. Therefore, here only an update to the new US data and a summary is given.

The most important confusion in popular, more precisely “vulgar”, writing in Western economics is a fundamental and damaging confusion between the economy’s demand side and its supply side. This was used to create a false rationale for the US stimulus packages, with their damaging consequences, and it unfortunately also sometimes appears in sections of China’s media. It is therefore important to clarify this.

This confusion between the economy’s demand and supply sides necessarily fails to understand the different roles played by consumption and investment in the economy, and therefore to an erroneous view that consumption can substitute for investment in terms of economic growth. To be precise:

- Considering first investment, this constitutes part of both the economy’s demand and supply sides. Investment goods and services appear in the economy’s demand side by being purchased (buying of machines, factories etc) but they are also an input into production together with other factors such as labour – i.e. investment is part not only of the economy’s demand side but also part of its supply side. An increase in expenditure on investment is therefore not only an increase in demand but also an increase in supply – for example, if there is a purchase of a billion yuan of investment goods (machines etc) there is also automatically a billion yuan increase in overall supply in the economy.

- In contrast to investment, consumption is only a category on the economy’s demand side, it does not appear in the economy’s supply side. This is necessarily the case because, by definition, consumption is not an input into production – if anything is an input into production it is not consumption. Therefore, for example, if there is a billion yuan increase in consumption there is a billion yuan increase in the demand side of the economy, but not any automatic increase in the economy’s supply side. An increase in consumption increases the demand side of the economy but, unlike with investment, it does not automatically increase supply.

Confusion over this fundamental theoretical issue, as will be seen, significantly explains the strategic failure of the US stimulus packages.

A technical note

To put this issue technically then, for example, in the most common form of “Western economics”, the growth accounting deriving from Solow, inputs into production are capital, labour, and total factor productivity (TFP). Other forms of Western growth accounting make a more detailed breakdown of these factors – an example is the KLEMS (capital, labour, energy, materials, services) framework developed by Jorgenson and applied by the European Commission. In Marxist economics supply side categories are living labour, capital, and socially necessary (or non-socially necessary) labour time.

It is unnecessary here to discuss the differences between these concepts in “Western” and Marxist economic as both agree that investment (capital) is an input into production and therefore part of the economy’s supply side, but neither includes consumption as an input into production – and therefore in both consumption is only part of the economy’s demand side but not of its supply side. Put in technical language, consumption is not an input into the production function – but for non-economists it is sufficient to understand that consumption is not part of the economy’s supply side.

As a result of investment being part of both the economy’s demand side and its supply side, but consumption being only part of the economy’s demand side, if there is an increase in investment demand, that is there is an increase in real expenditure on investment, there is also a direct increase in the economy’s supply side. However, if consumption is increased there is an increase in demand but not any direct increase in supply.

Under certain circumstances, analysed below, an increase in demand caused by increasing consumption expenditure, may indirectly lead to an increase in production – but this is not at all automatic and also under other circumstances, because consumption is not an input into production, an increase in consumption demand may not lead even indirectly lead to an increase in production. In some circumstances an increase in consumption expenditure may simply create inflation, suck in imports, or both without an increase in production. But in all cases, any increase in output can only occur if there is an increase in the economy’s supply side (that is in labour, capital etc). Consumption itself provides no input into production and no increase in productive capacity.

The confusions in vulgar Western economic thinking

Both Marxist and serious Western economics understand this difference between the economy’s supply side and its demand side. But unfortunately, in popular, or “vulgar” Western economics, the two are confused by statements such as: “With consumption accounting for 67 percent of GDP growth”. This implies, because the economy is divided into consumption and investment, that consumption contributed 67% of GDP growth and, by implication, investment contributed 33%. But this statement is false. The correct statement is that “67% of economic growth was consumed and 33% was invested.” But because consumption is not an input into supply, consumption always contributes precisely zero percent to any increase into production. Consumption, consequently, always produces precisely zero percent of GDP – it may be the case that 67% of GDP is consumed, but consumption creates zero percent of that GDP production. As John Papola rightly put it: “The systematic failure… to distinguish between consuming and producing value is the single most damaging fallacy in [Western] popular economic thinking.”

This confusion over demand and supply sides of the economy, and therefore over the role of consumption and investment, then follows directly from statements such as “With consumption accounting for 67% of GDP growth”. If both consumption and investment are an input into production this suggests then one can replace the other. For example, if consumption and investment are both inputs into production, and therefore both are parts of the economy’s supply side, perhaps consumption could be increased to 80% of GDP, and investment reduced to 20%, and production growth would continue as before? But this is entirely false.

If consumption were increased from 67% of GDP to 80%, and total GDP remained the same, then certainly total demand would remain the same – because both consumption and investment are sources of demand. Total demand would remain the same, and simply its division between consumption and investment would change. But if investment were reduced from 33% of GDP to 20%, because consumption had been raised from 67% of the economy to 80%, then the inputs into production would have been radically reduced. And because inputs into production had been radically reduced then, other things remaining equal, the increase in GDP would be radically slowed. That is, consumption cannot substitute for investment in production, because consumption is not an input into production.

This is why, for clarity of thinking and policy making, it is necessary to entirely eliminate such statements as “consumption contributed 67% of GDP growth” – consumption always contributes zero percent of GDP increase. This confusion between the economy’s demand side and its supply side provided the economic rationale for the damaging consumer, that is demand side only, US stimulus programmes.

The aim is consumption but the means is investment

This same confusion of the supply and demand sides of the economy appears in other forms. For example, I read one recent article in the Chinese media which started by arguing, correctly, that the eventual benefit to humanity of all production is only in consumption. This is correct because, to take an example, the aim in constructing a railway is not at all to have steel lines or locomotives (means of production/investment), it is to transport food or other goods to consumers, to allow people to travel to work, to let them go on vacation etc – that is, to enable consumption. But the article then went on to argue that because the ultimate goal was consumption therefore the intermediate stage of investment (e.g. building a railway) should be cut out and money should simply be put directly into consumption – for example coupons to purchase food, carrying out tourism etc.

But that argument is false. If a billion yuan is used to give consumer tokens for purchasing food, or a billion yuan is used to subsidise free or cheap travel for tourism, that is all used at once in consumption, but it does not increase the capacity of the economy to produce in the future. The food which is purchased, or the trips which are made for tourism, are not an input into production, and therefore do not produce anything – that is why they are consumption, not investment. But if a billion yuan is used to build a railway, or purchase machinery for manufacturing cars, then the productive capacity of the economy is increased – it will produce new goods and services in the future. This fact, that the contribution of consumption to an increase in production, will always be precisely zero, because consumption by definition is not an input into production, is crucial for economic clarity.

Confusions over these elementary but crucial issues of economic theory as will be seen, determined the strategic failure of the US stimulus packages. They rationalised the huge boost in consumption but no increase in supply and therefore are also crucial lessons for future stimulus packages for China in 2023.

Under what conditions can consumption increase supply?

Turning from these issues of economic theory to their practical effects in the US stimulus packages this interrelates with the point in the business cycle at which these programmes were launched. It was noted above that consumption, as it is by definition not an input in production, cannot directly contribute to the supply side. But consumption can under certain conditions, by increasing demand, indirectly create increases in supply. But this is not automatic or necessary as it is subject to both physical and profitability constraints. Understanding both these distinctions, and the possible role of consumer stimulus, is therefore important.

First, if in any economic system there is spare capacity it is possible that increased demand resulting from increased consumption can result in extra supply to attempt fulfil this demand. But if there is no spare capacity then, until extra capacity is created by investment, there can be no increase in supply no matter what the increase in demand is. That is, there may be a physical constraint on increasing production. If there is an increase in consumer demand, but no ability in the short term to increase supply, what will be produced by the increase in demand is inflation, not an increase in production and GDP.

Second, for capitalist producers, if there is an increase in demand, it is not sufficient that there is unused capacity and therefore no physical constraint on increasing production. In a capitalist enterprise there will only be a meaningful increase in production if there is also an increase in profit – that is, there may be a profitability constraint on production if there is an increase in demand led by consumption even if spare capacity exists.

Why the US stimulus package was a strategic failure

Taking into account these fundamental conditions immediately makes clear why the US stimulus programmes to deal with the Covid pandemic were a complete failure in both the short term and strategically. At the end of 2019, immediately before the pandemic, the US economy was growing above its trend rate of growth. Year on year growth in the 4th quarter of 2019, the last before the pandemic, was 2.6%, significantly above the US long term average at that time of 2.1%. As the US economy was already growing above its trend rate of growth when the pandemic hit it was unlikely that at this position in the business cycle there was meaningful spare capacity in the US economy.

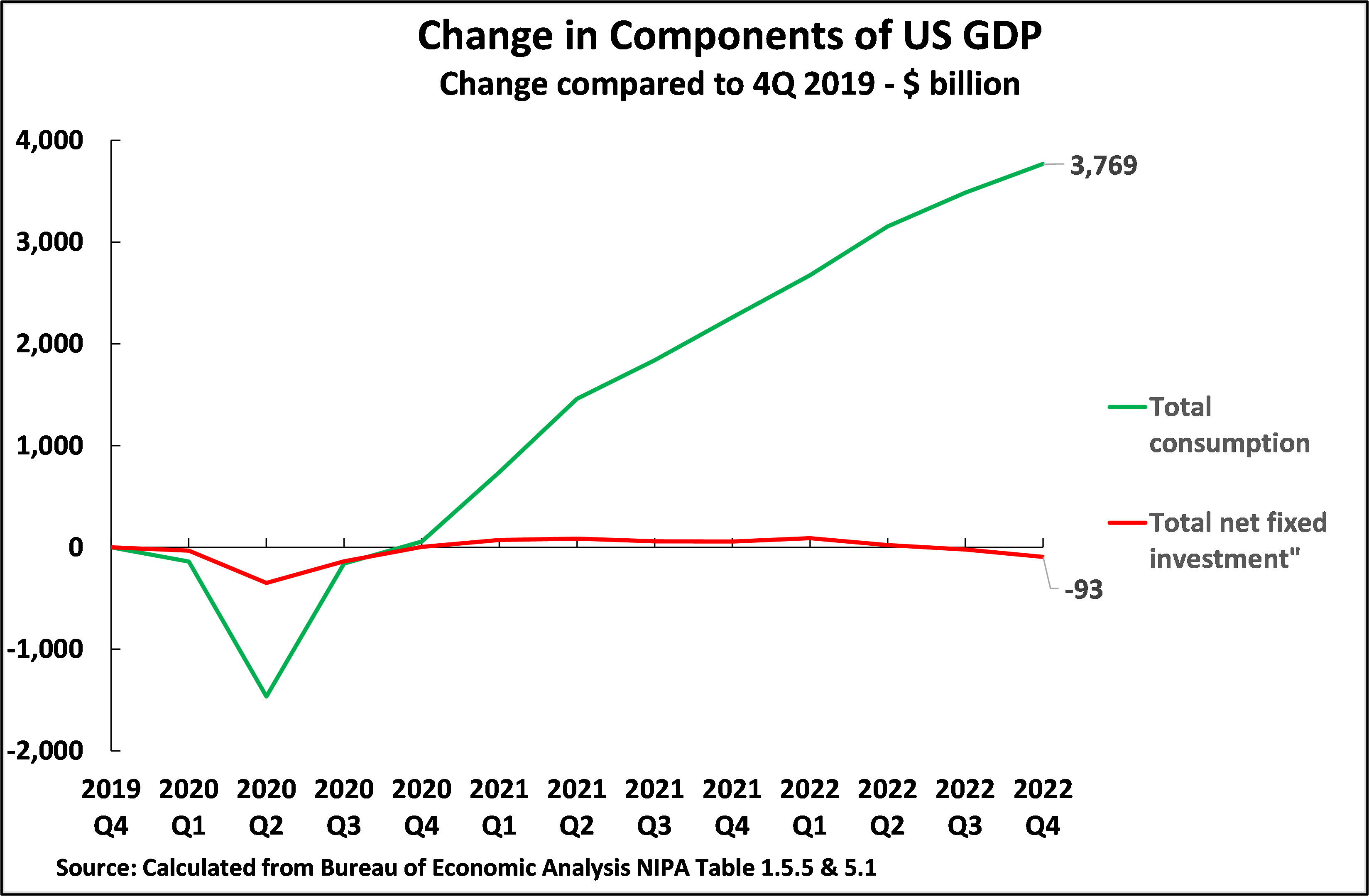

In the purely short term, obviously when the pandemic struck there was immediately a sharp fall in US production – in the 2nd quarter of 2020 US GDP was 9.6% below its level in the 4th quarter of 2019 prior to the pandemic. But US recovery was rapid, in part because of the stimulus packages – by the 1st quarter of 2021 US GDP had already regained its pre-pandemic level. But, as already analysed, the US stimulus packages were designed to be, and were, almost exclusively consumer focussed. As a result, US consumption, but not investment, continued to rise strongly even after the pre-pandemic level of GDP had been regained. By the 1st quarter of 2021 US consumption was already $741 billion above its 4th quarter of 2019 level, and then it rose by a further $3,028 billion by the 4th quarter of 2022. In contrast US net fixed investment rose by only $73 billion between the 4th quarter of 2019 and the 1st quarter of 2021. Then it actually fell by $166 billion by the 4th quarter of 2022 – to finish $93 billion below its pre-pandemic levels.

This experience during the US stimulus packages clearly illustrates the theoretical issue that increasing consumer demand does not automatically lead to an increase in productive capacity, in investment – substantially rising US consumer demand did not lead to an increase in investment but was accompanied by investment failing even to increase by sufficient to replace capital depreciation.

Figure 11

Therefore, because an essentially totally consumer focused US stimulus was launched, creating a strong demand side boost, when the US economy had already been growing above trend, and therefore spare capacity was small, and there was no increase in net investment, i.e. in capital stock and supply, the result was the huge US inflationary wave already noted. As the Wall Street Journal editorial board, normally a firm supporter of the US, admitted, even if it didn’t accurately admit the reasons why: “This isn’t Putin’s inflation, this inflation was made in Washington”.

Strategic consequences for the US economy

Turning from the short term to the strategic consequences for the US economy these theoretical issues have clear medium- and long-term implications.

The short-term destabilisation of the global economy caused by the US stimulus packages, is extremely striking. But it is only an extreme illustration of the damage done by confusion over the role of consumption in the economy – this confusion also affects long term growth. Clarifying this theoretical conclusion leads to immediate factual, and therefore testable, conclusions which further clarify the reasons for the damaging strategic effects of the almost entirely consumer-based US stimulus packages.

The prediction from economic theory is that because consumption is not an input into production, and investment is, then other things being equal the greater the share of consumption in the economy, and therefore the lower the share of investment, then over anything other than the short term the slower will be economic growth. Equally because, by definition, investment is an input into production, then, other things being equal, the higher the percentage of investment in the economy the more rapid will be economic development. As will be seen analysis of the US economy fully factually confirms these theoretical predictions. This allows the long term strategic, as well as short term, failure of the US stimulus packages to be clearly understood.

The slowing of the US economy

Turning to medium/long term consequences, the changes in the structure of the US economy which have been produced by the COVID stimulus packages have already been analysed – that is they produced a further shift into consumption. But in addition to their negative short-term consequences how did these changes correspond, or fail to correspond, to the changes required to speed up US economic growth over the medium and longer term – that is how do they strategically affect the US economy? This was analysed in detail in 引发世界经济危机的罪魁祸首是美国,而非乌克兰战争 so here only the main points are summarised – for other factual data please see that article.

Over the short term no single structural factor of US GDP has a decisive influence on US economic growth – as analysed below this means, for example, that a consumer stimulus can have a short-term effect. However, if longer time periods are considered then the situation is entirely different. Taking a 10-year period, as would be predicted by economic theory, there is a positive correlation, to be precise 0.66, between the share of net fixed investment in the US economy and GDP growth – a very high correlation. That is, the higher the percentage share of net fixed investment in US GDP the faster the rate of US GDP growth.

For present purposes it is unnecessary to determine why there is this close positive long-term correlation between net fixed investment and US GDP growth – although the obvious explanation, in line with economic theory, would be the positive cumulative effect of high levels of fixed investment, an input into the economy’s supply side, in increasing US capital stock. Nor is it even necessary, for present purposes, to determine the direction of causation between high levels of net fixed investment and high levels of GDP growth, or even to ascertain whether some third process determines both. It is simply sufficient to note that, due to this high correlation, the US economy cannot achieve high levels of GDP growth without there also being high levels of net fixed investment in GDP. In other words, if over the longer term the US economy is to grow more rapidly the percentage of net fixed investment in the US economy must increase.

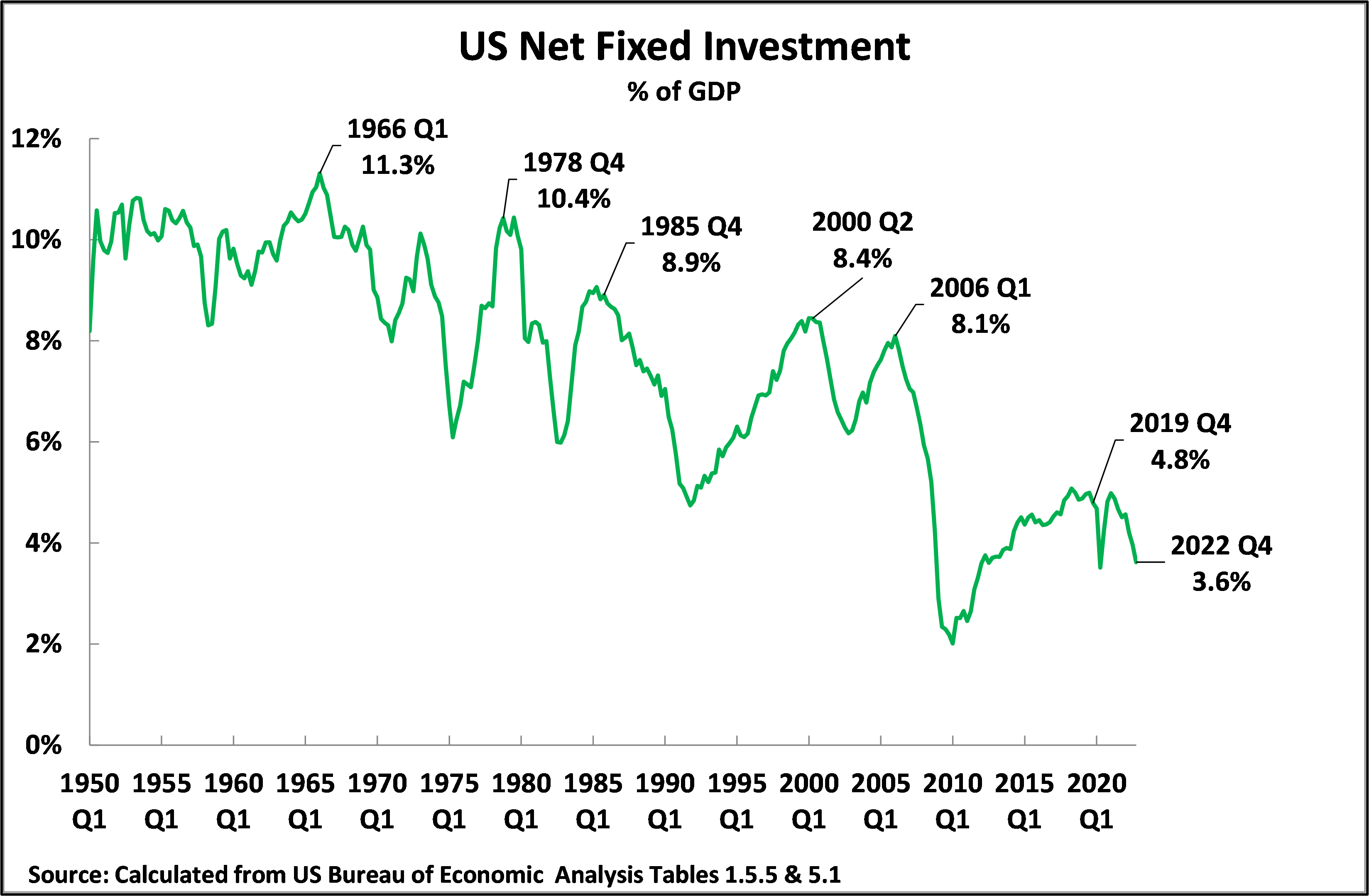

This, therefore, provides the fundamental criteria for evaluating the strategic effect of the US stimulus packages to deal with the consequences of Covid on longer term US economic growth. As already noted, these failed to raise US net fixed investment – on the contrary US net fixed investment fell as a share of US GDP during these stimulus programmes. Figure 12 shows the declining levels of US net fixed investment during successive post-World War II business cycles, which explains the long-term slowdown in the US economy. As the latest stage in this decline, US net fixed investment was 4.8% of GDP in the 4th quarter of 2019, on the eve of the pandemic. This had fallen to 3.6% of GDP by the 4th quarter of 2022. Given that the closest correlation for US GDP growth is with net fixed investment the US stimulus packages will therefore fail to raise the rate of US long term economic growth – in line with IMF projections of a continuing slowdown of the US economy. That is, the stimulus packages were accompanied by a further fall in US net fixed investment – which in turn will undermine US long term growth due to the close correlation of US GDP growth and US net fixed investment. That is these consumer-based packages not only produced extremely damaging short term inflation but were a strategic failure for the US economy.

Figure 12

Negative effects on US growth

To clarify these trends further, it is possible to analyse the factors which are negative for US growth. Again, there are no short-term correlations. But over the long term there are strong correlations. Strongest of all is the negative -0.63 correlation, over a 10-year period, between the percentage of GDP US devoted to total consumption and US economic growth – i.e., the higher the percentage of consumption in US GDP the slower is long term US economic growth. This entirely confirms factually the theoretical issues noted above – that because consumption is by definition not an input into production an increase in the percentage of consumption in GDP will lead to slower economic growth.

As already seen the US stimulus packages raised the percentage of total consumption in US GDP. As the closest negative correlation in US GDP growth is between the percentage of total consumption in the US economy and its economic growth these packages will therefore have a negative effect on long term US economic growth. This explains the projections of slowing US medium- long term growth already noted.

It is therefore clear that the US stimulus packages, because they were concentrated on consumption, produced no fundamental increase in the share of net fixed investment in US GDP. Given that net fixed investment has the strongest correlation with US GDP growth these US stimulus packages therefore produced no increase in long term US GDP growth. That is, they were a strategic failure.

The distinction between the percentage of consumption in GDP and the growth rate in consumption

Clarifying the relation of consumption and economic growth, and eliminating the confused idea that consumption is an input into production and therefore contributes to GDP growth, has a further immediate consequence. It makes clear why it is necessary to avoid confusion between the two different issues of the rate of growth of consumption and the percentage of consumption in GDP – a confusion which sometimes appears in sections of China’s media. This distinction is obscured by an unclear phraseology of “increasing consumption”, without specifying if what is meant is increasing the percentage of consumption in GDP or increasing the rate of growth of consumption. This distinction is crucial because, as will be seen, the two move in opposite directions over the medium/long term – other things being equal, the higher the percentage of consumption in GDP then, except in the very short term, the lower with be the growth rate of consumption.

As already noted, the long-term growth rate of consumption in the US economy is highly positively correlated with overall economic growth in the US economy. But as already show, the higher the percentage of consumption in US GDP the slower is the rate of US economic growth. Other things being equal, therefore, a higher share percentage share of consumption in GDP, by slowing economic growth, will lead to a slower growth rate of consumption. This prediction from basic economic theory, is confirmed by the fact that the negative correlation of the share of total consumption in US GDP and the rate of growth of consumption is an extremely high -0.79. That is, the higher the share of consumption in US GDP the more slowly consumption, and therefore US living standards, grows. The same processes will be seen to operate in China’s economy.

But it is the level and rate of growth of consumption, not the percentage share of consumption in GDP, which affects people’s real lives. This is indeed obvious. For example, a country such as the Central African Republic has an extremely high percentage of consumption in GDP, 99%, but is one of the poorest countries in the world, with a per capita GDP of $492 and its per capita consumption has fallen by 15% in the last 10 years. It would be absurd to tell the inhabitants of the Central African Republic that they had a high level of consumption because it is 99% of GDP! What matters to them is their extremely low level of consumption, due to the very low level of per capita GDP, and the extraordinarily low rate of growth of consumption.

The correlation of GDP growth and consumption growth

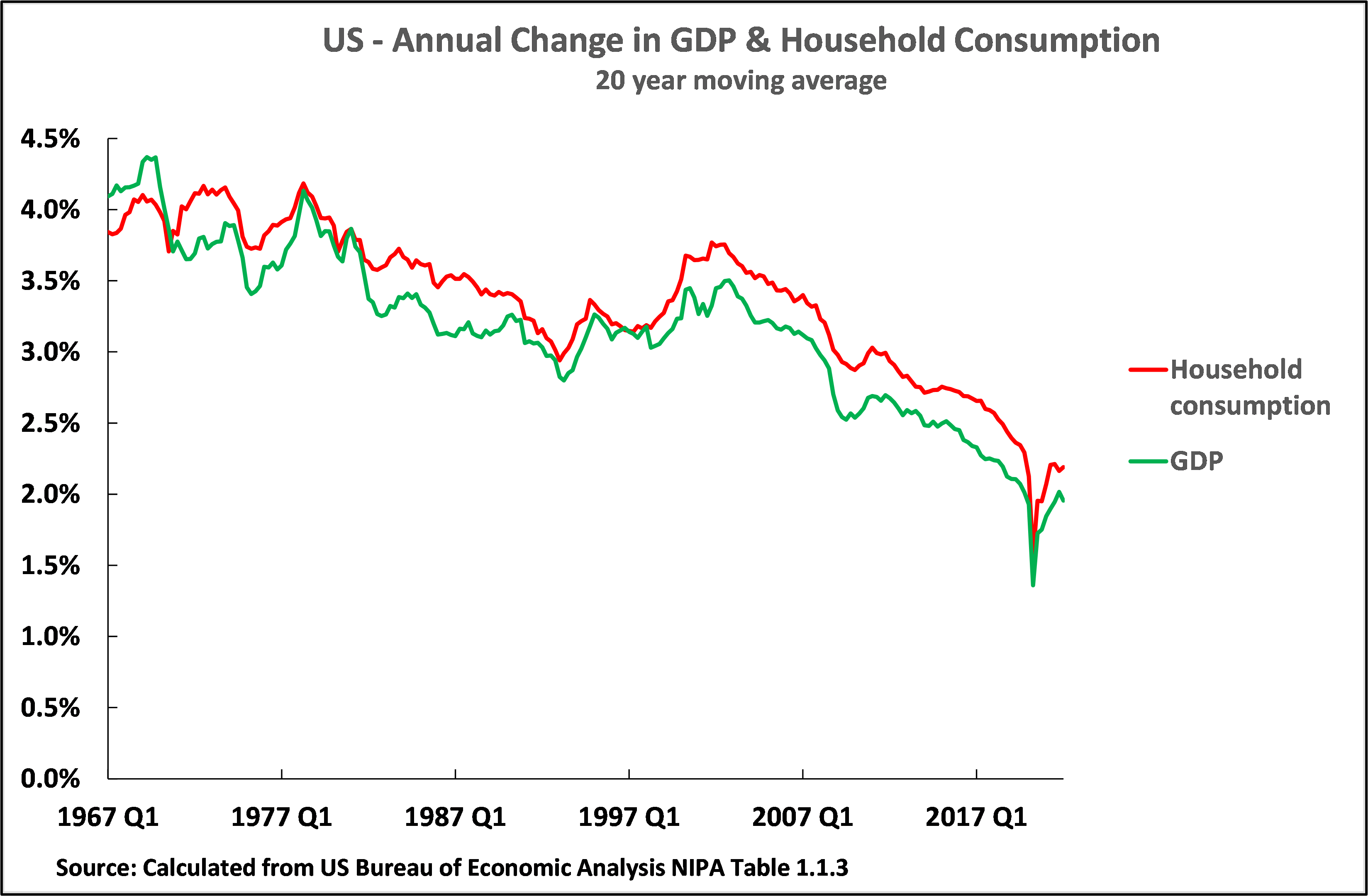

In contrast, there is almost a perfect long-term correlation between US GDP growth and growth of household consumption as shown in Figure 13. Taking a 20-year moving average, to remove short-term effects of business cycles, the correlation between US GDP growth and US household consumption is 0.97 – an extraordinarily high figure, leaving no doubt as to the extremely high interrelation between US GDP growth and the growth rate of US consumption.

In summary, an increase in the share of consumption in US GDP will lead to a slower rate of increase of consumption, and a higher rate of growth of GDP will be associated with a higher rate of consumption growth. This basic prediction of economic theory is fully factually confirmed for the US and, as will be seen below, equally applies to China.

Figure 13

Part 3 – The Implications for China

These theoretical issues, confirmed factually by the US stimulus packages, can be applied to China and help clarify the discussion on its own stimulus programmes.

First, regarding the position in the business cycle, the situation of China’s economy at the beginning of 2023 is significantly different to that of the US when it launched its stimulus packages. In the 4th quarter of 2019, immediately before the pandemic struck, China’s annual growth rate was 6.0%. However, in the previous three years China’s annual average growth rate was 6.4%, and in the preceding five years it had been 6.6%. In short, when the pandemic struck China’s economy was growing significantly below trend – whereas when the pandemic struck the US was growing significantly above trend. Furthermore, during the three years since the beginning of the pandemic China’s economy significantly slowed further – its annual average growth rate in 2020-2022 was only 4.3%. In summary China’s growth during the last period, before it launches any stimulus measures in 2023, has been significantly below trend.

Furthermore, during the pandemic the pattern of change in China’s economy was also completely different to the US. Over the whole period 2020-2022, calculated from the annual summary data published by the National Bureau of Statistics, China’s fixed asset investment rose by 13.4% while retail sales rose by 7.9%. Although China’s retail sales are a narrower category than the US data for overall consumption, they are a sufficiently large part of consumption to make clear that during the pandemic China’s fixed investment grew more rapidly than consumption – the exact opposite of the US pattern in the same period.

In addition the fact that whereas the US experienced very high inflation China’s producer price index has actually been falling since October 2022, combined with China’s low rate of consumer price inflation, is entirely in line with China’s lower than trend rate of growth – indicating both an absence of substantial inflationary pressures and the existence of spare capacity.

Therefore, China’s economy as it enters 2023 is in almost the exact opposite situation in terms of position in the business cycle to the US when it launched its Covid stimulus packages.

- The US economy was growing above trend when it entered the pandemic and then launched a stimulus package overwhelmingly focused on the demand side – on consumption. As already noted, the result was predictable. With a large increase in demand, and no increase in net fixed investment, that is no increase in the supply of capital, the US suffered extremely high inflation and low growth.

- China entered the pandemic growing below trend and its fixed investment, that is the supply of fixed capital, grew more rapidly than retail sales during the pandemic itself. China experienced more rapid growth than the US and entirely escaped the inflationary wave in the US. China’s consumer price inflation in December was 1.8% and its peak inflation in that year was 2.8%, whereas US consumer price inflation in December was 6.5% and its peak inflation during 2022 was 9.1%.

These changes in the US and China were therefore both in line with economic theory. They also determine the different situations regarding economic stimulus programmes. It is clear that in the short-term China has the economic space to launch a programme containing a significant consumer, that is demand side only, stimulus without the likelihood of this creating major inflation. Indeed, a stimulus for consumption is necessary for both economic and political reasons. Politically, the relatively low rate of increase in consumption during the pandemic period, compared to its previous growth rates, means that a rapid short-term increase in consumption will aid the population in recovery from the sacrifices of the three years – which saved millions of lives but involved sacrifices in living standards. Economically, consumer industries have been growing more slowly than their historic rate creating negative pressure on them. A stimulus to consumption would therefore greatly aid output in the consumer industries.

A boost to consumption is also particularly appropriate for a stimulus programme aimed to have relatively rapid results – as, in general, short term increases in production in consumer facing industries can be more rapid than in capital goods industries as consumer facing industries, in general, are less capital intensive than investment ones. Therefore, output can be increased in a shorter period without the very high capital expenditures frequently required in investment industries.

The forms of consumer stimulus

Regarding the form of consumer stimulus economic theory and analysis indicates, as already widely discussed in China, that this should aim to minimise the chances of an increase in resources for households being saved rather than spent and should aim to bring forward in time consumption that would occur in any case but at a later date. This includes measures such as price reductions, financed by subsidies that are limited in time, consumer tokens that must be used by a certain date etc. A number of such programmes have been launched by Chinese regions. It is not possible by these means to 100% prevent “leakage” of such financial flows into saving but nevertheless theoretical issues are in line with the author’s personal experience that the bulk of such measures stimulate consumption and do not leak into saving.

Certainly, the present author does not have personal experiences of economic stimulus in an economy the size of China, but nevertheless his experiences in a very large city economy, London, are relevant. The author was in charge of London’s economic policy from 2000-2008 and London’s economy is larger than that of the majority of European countries – due to its extremely high level of productivity, with it being the only city in Europe that equals US levels of per capita GDP. The author’s experience was entirely in line with the experience of Chinese regions that have launched steps to stimulate short term consumption via marketing, price reductions, coupons and other steps. The most powerful specific experience of such consumer stimulus programmes in London was in 2003 when the city suffered an extremely severe external economic shock due to the consequences of the US invasion of Iraq. This invasion, as with Covid, was an extraneous blow, that is not due to normal economic processes in the business cycle.

London is one of the world’s largest internationally oriented city economies – in particular one of the world’s most important financial centres and largest travel destinations for both business and tourism, and these form a large part of its economy. Fear of terrorism or military attacks during the Iraq war led to an extremely severe collapse of international, and to a lesser extent domestic, visitors. An indicator of the scale of this was that under this impact of the war the daily price of hotel rooms in London fell by 70-80% and those locations which, for branding reasons, refused to reduce their prices suffered 70-80% falls in visitors. Visits by domestic visitors also declined due to fear of terrorist attacks. This created serious downward pressure on London’s economy.

To meet this crisis no stimulus package was launched during the war itself, as no price or marketing incentive would lead to people travelling or going to visitor attractions if they believed they might be killed. But a stimulus package was prepared in advance for when the war ended. As soon as that occurred a consumer facing stimulus package was launched by London’s city government essentially similar to that launched by some Chinese regions and cities at the beginning of this year. This consisted of two elements. First, a major marketing campaign, financed by the city government, was launched promoting visitor attractions, restaurants, exhibitions etc in the city. Second, in an interrelated move, subsidies were launched to allow temporary price reductions to visitor attractions, restaurants, exhibitions etc. In the case of London, the private sector companies involved in this were encouraged to offer temporary price reductions and the city government also gave a subsidy to such companies to make the price reductions still greater.

The results of this consumer facing programme were extremely successful. Both international and domestic visitor numbers recovered extremely rapidly boosting economic recovery in the city. It is entirely possible some of this stimulus may have leaked into saving, but overall it is clear that the majority was used for consumption and the overall short term programme was successful. Therefore, for both theoretical reasons and those of practical experience the present author is a strong supporter of launching consumer-oriented stimulus packages in the appropriate economic circumstances.

But as already analysed any such consumer stimulus, that is one purely on the demand side, does not automatically increase supply. Therefore, except in conditions of deep economic depression, with enormous amounts of unused capacity, which does not exist in China at present, a purely consumer, that is demand side, stimulus will, outside of the short term, lead to putting back to use large amounts of spare capacity but only an increase in the supply side, which involves increased fixed investment, can sustain over the medium/long term an increase in production/GDP. Therefore, to judge the strategic effect of any stimulus programme it is necessary to constantly measure not only the short-term effects on demand and consumption but also to see if it is producing an increase in investment.

Longer term growth

Although such short-term consumer stimulus programmes can be successful at appropriate points in the business cycle, such as exist in China at present, nevertheless, in order to integrate these with economic strategy, it is simultaneously necessary to bear in mind the fundamental medium/long term economic issues.

First, other things being equal, what is being achieved by such consumer-oriented programmes is to change in time when expenditure occurs – for example, this is achieved by a price and/or advertising incentive given for consumers to spend now and not to delay in time expenditure. But while experience shows this can have a significant short-term impact nevertheless over the medium/long term, if nothing else changes, expenditure will remain limited by income. The consumer stimulus may change in time the point at which expenditure takes place, which in some circumstances is extremely economically useful, but by its direct effect it cannot by itself alter the overall expenditure that takes place over time. Long term expenditure is determined by income. If everything else stays the same higher expenditure than normal in the short term will be accompanied by lower expenditure than normal later. Only an increase in income can create, other things being equal, an overall long-term increase in consumption. And such long term increases in income are determined by economic growth and production.

Second, in anything other than the short term, that is while unused capacity is being put back to work, only an increase in investment, that is in supply, can increase output. If this does not occur then, as with the US stimulus packages, the increase in demand from increased consumption will primarily, or even exclusively, over the medium/longer term produce inflation, not an increase in output.

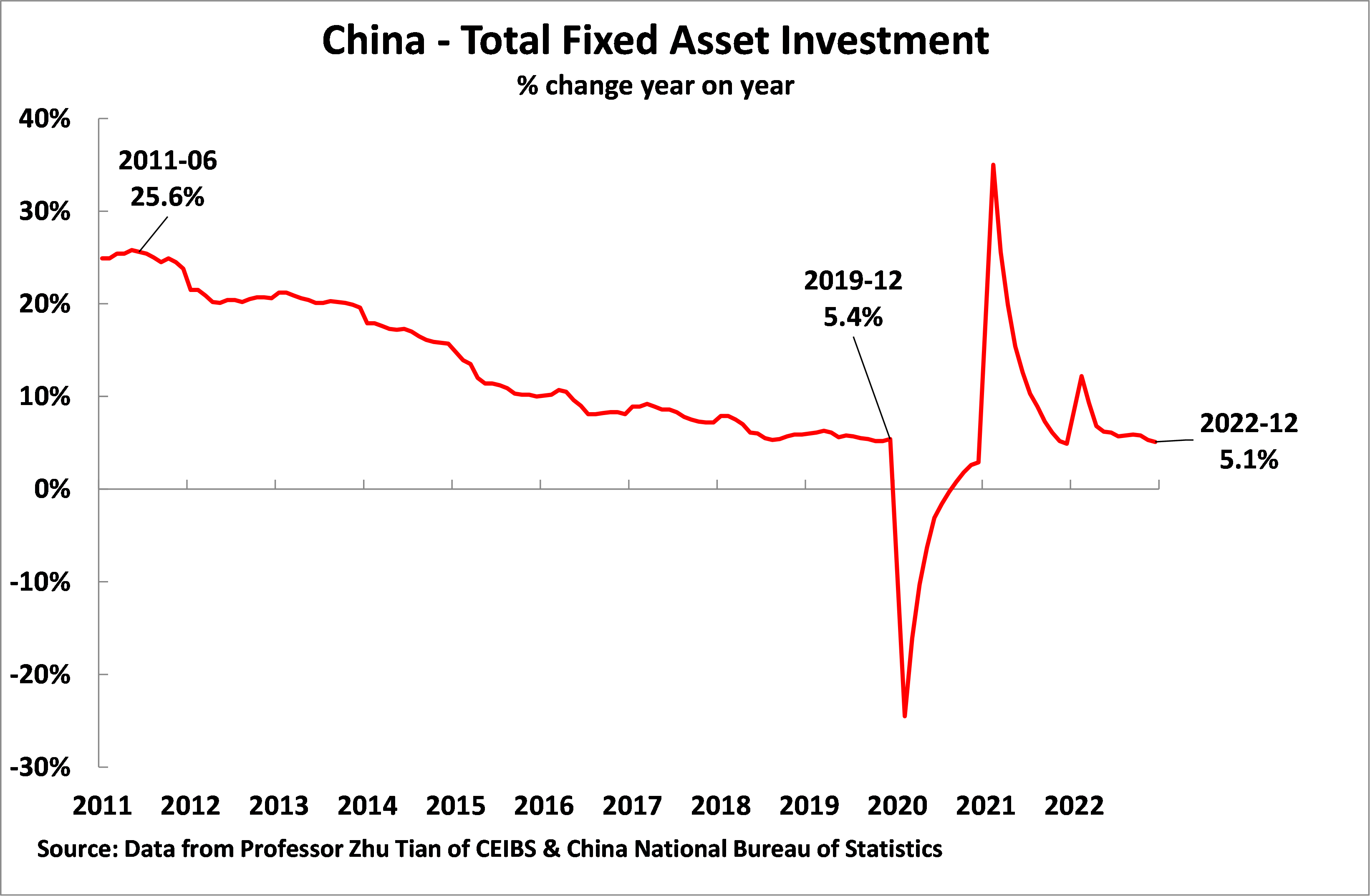

It is on this point that there is a clear medium/long term issue in China’s economy, and therefore for its strategy, which differs significantly from the short term. While China’s fixed investment has grown more rapidly than consumption during the pandemic this is exclusively due to the extremely sharp fall in consumption’s growth rate – it is not at all due to an increase in the growth rate of fixed asset investment. Figure 14 shows that the annual rate of increase of China’s fixed asset investment in December 2022, at 5.1%, was actually slightly slower than the 5.4% in December 2019 on the eve of the pandemic.

Figure 14

The fall in the proportion of net fixed investment in China’s GDP

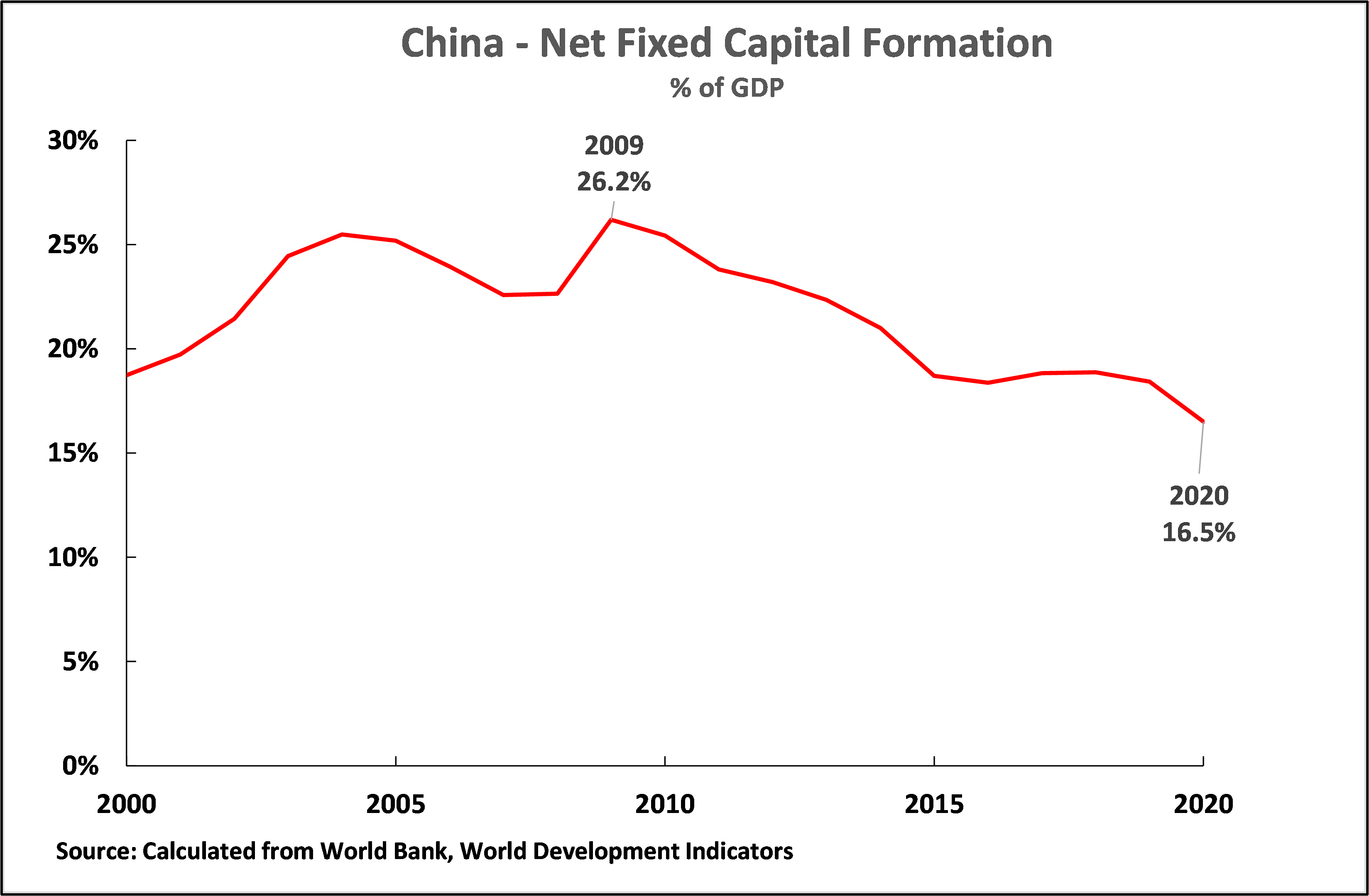

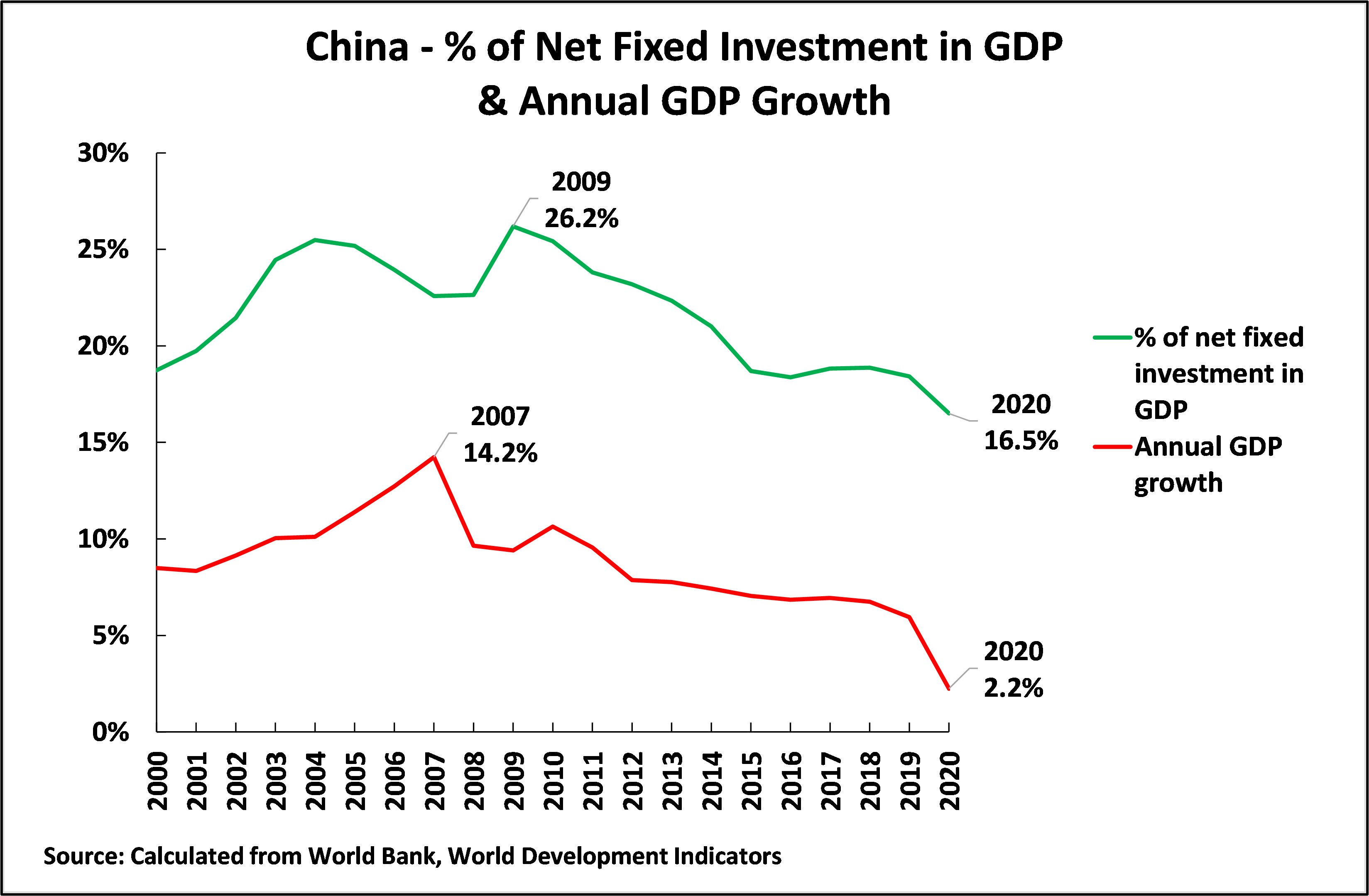

It is also crucial to note that over the longer term the percentage of fixed investment in China’s GDP, in particular net fixed investment, has fallen very considerably. Figure 15 show that between 2009 and 2020, the latest available internationally comparable data, the share of net fixed investment in China’s economy fell from 26.2% of GDP to 16.5% of GDP – a huge fall of almost 10% of GDP.

Figure 15

It as this point that any theoretical confusion between the economy’s demand and supply sides becomes crucial. If consumption were an input into production, that is into the economy’s supply side, then consumption could compensate for this fall in investment in terms of producing economic growth. But, as already seen, consumption by definition is not an input into production and therefore contributes zero percent of production of GDP. The fall in net fixed investment therefore necessarily leads to fall in the rate of growth of GDP – as shown in Figure 16.

The percentage of net fixed investment in China’s GDP peaked in 2009 at 26.2% and fell by 2020, the latest available internationally comparable data, to 16.5% of GDP. Annual GDP growth peaked slightly earlier at 14.2% of GDP in 2007 and by 2020 had fallen to 2.2% – this last figure was certainly lowered by the Covid pandemic but the downward trend before this was clear. This shift is exactly as would be predicted by economic theory and as factually confirmed by the US experience – other things being equal the lower the percentage of net fixed investment in GDP the lower will be the rate of GDP growth. The correlation between the two is a high 0.74. This is in line with the point that as consumption is not an input into production, into the economy’s supply side, it cannot substitute for, that is, be an alternative source of GDP growth, for investment. The long term, that is strategic, growth of China’s economy depends on investment.

Figure 16

Confusion over the percentage of consumption in GDP and the rate of growth of consumption

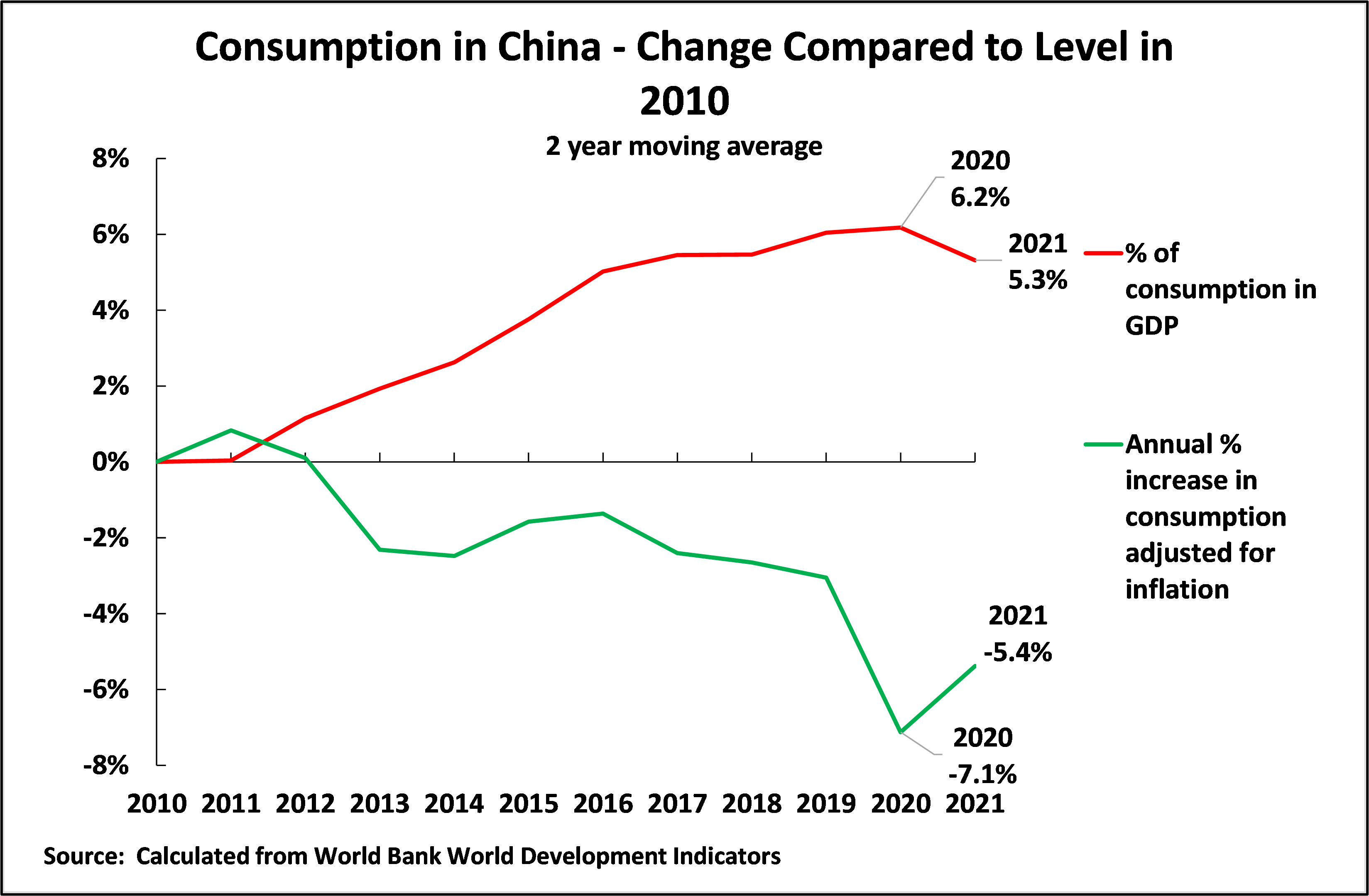

It is at this point that another theoretical confusion referred to previously comes in, again with exactly the same consequences as in the US. This is that loose talk of “increasing consumption” obscures the difference between the two different things of the percentage of consumption in GDP and the rate of growth of consumption. As already seen in the US these move in exactly the opposite direction – the higher the percentage of consumption in GDP the lower is the growth rate of consumption. This factual finding in the US is in line with economic theory. Figure 17 shows that exactly the same applies in China – as would be expected. Figure 17 shows that, taking a two-year moving average to even out purely short-term fluctuations caused by the pandemic between 2020 and 2021, the latest available data, the percentage of consumption in China’s GDP grew sharply by 5.3% of GDP, from 49.5% of GDP to 54.8%. But accompanying this the growth rate of consumption fell sharply by 5.4% of GDP – from 10.1% a year to 4.8% a year. There was a strong, -0.76, negative correlation between the percentage of consumption in GDP and the rate of growth of consumption. That is, raising the percentage of consumption in China’s GDP led to a slower growth rate of consumption and therefore to a slower rate of growth of Chinese living standards – precisely as with the US.

Because the percentage of consumption in GDP and the rate of growth of consumption move in opposite directions it is necessary to clearly strictly distinguish the two. This real relation is confused by unclear formulas of “raising consumption” as this obscures that an increase in the percentage of consumption in GDP will lead to a lower rate of growth of living standards. Therefore, to take the phrase in one recent article, talk of China having historically been “tightening its belt” because of its low percentage of consumption in GDP is highly misleading. It is the high level of investment in China’s economy which has led to a rapid rate of economic growth and therefore a rapid rate of growth of consumption and therefore of China’s living standards. “Loosening the belt”, if by that is meant a higher percentage of consumption in China’s GDP, other things being equal, will lead to a lower rate of growth of consumption and therefore a lower rate of growth in living standards – and therefore, over time, to lower living standards than are possible with a lower percentage of consumption, and higher level of investment, in GDP.

Figure 17

Relation of GDP growth a consumption

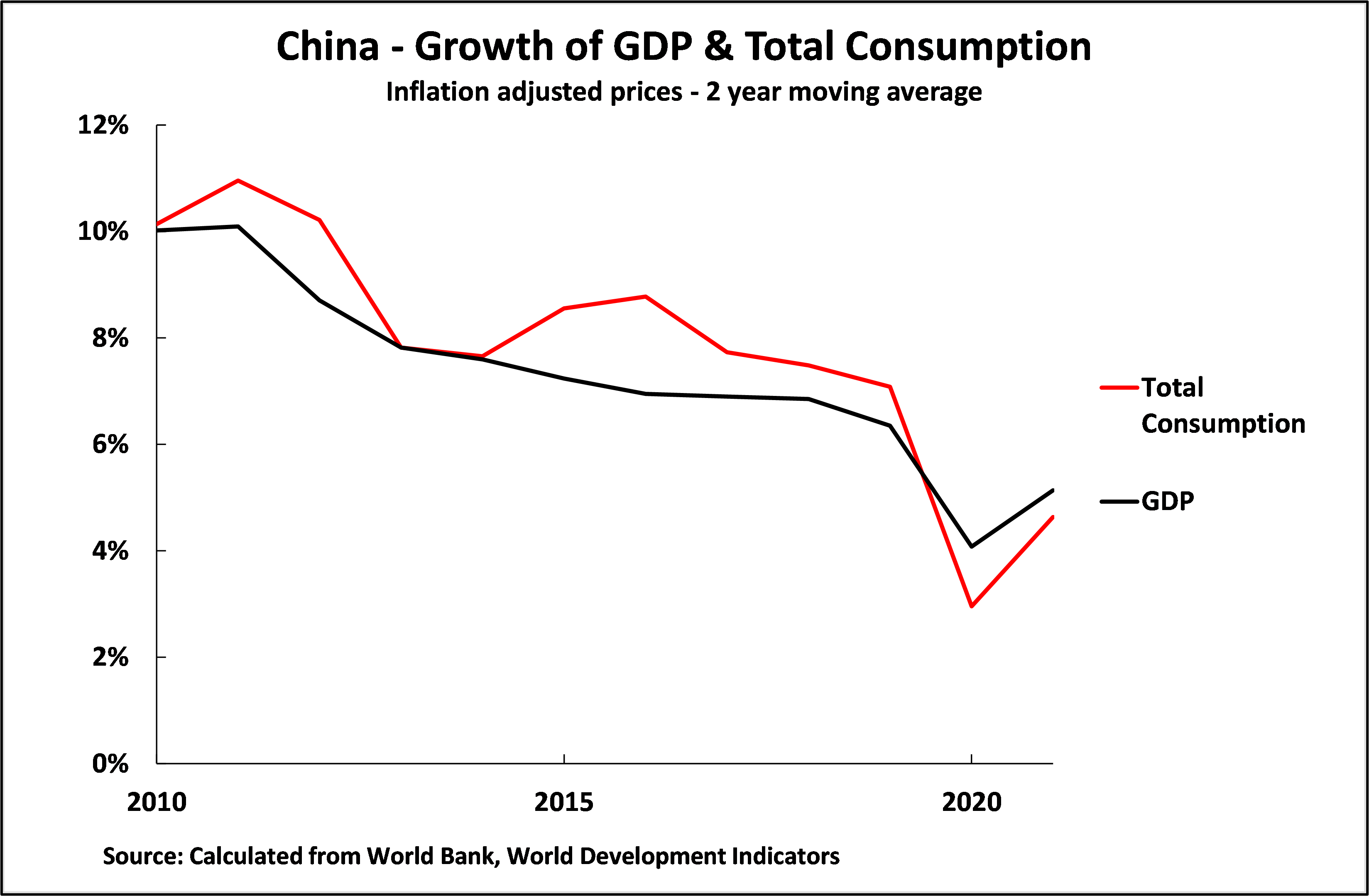

The reason why increasing the percentage of consumption in GDP will lead in China to a slower rate of growth of consumption, and therefore of living standards, precisely as in the US, is because of the close correlation of GDP growth with the growth of consumption – as shown in Figure 18. The correlation is 0.76. That is if GDP grows slowly so also will consumption. As investment is an input into production, increasing the percentage of consumption in GDP, and therefore lowering the percentage of investment, will lead to slower GDP growth – and therefore lower the rate of increase of consumption and living standards. This fundamental prediction of economic theory is confirmed factually just as much by China as by the US.

Figure 18

The interrelation between short term stimulus programmes and strategic goals

Clarity on these issues then allows the interrelation between short term stimulus programmes, to deal with the situation in 2023, and longer-term strategic goals to be clearly understood.

A short-term consumer, therefore purely demand side, stimulus is highly desirable in order to put existing unused capacity back to work. But because consumption is not an input into production, and not part of the economy’s supply side, such a stimulus programme will not by itself add to the economy’s productive capacity. Therefore, only if this increase in consumer demand leads to an increase in supply, which necessarily includes investment, will it lead to long term growth and therefore achievement of the strategic goals to 2035. The only way to know if this is occurring is to carefully factually monitor the factual situation regarding investment.

In regard to this, certainly various predictions, theoretical or factual, may be made but, as always, in the end “the proof of the pudding is in the eating”. If there is not an increase in investment created by the demand created by the consumer stimulus programme, which is precisely what occurred in the US, then all that a prolonged consumer stimulus will create, once unused capacity is put back to work, is inflation – again this is what factually occurred in the US and was entirely in line with economic theory. To achieve the strategic goals for 2035, doubling GDP/per capita GDP compared to 2020, which requires a doubling of the economy’s productive capacity, then a very large increase in investment is required. An increase in consumption, because it is not an input into production, will itself create no increase in the economy’s productive capacity – despite the fact consumption is the ultimate goal of goal of economic activity. Incorrect statements, such as that consumption accounted for 67, or any other, per cent of GDP growth, as sometimes appear in sections of the Chinese media, obscure this reality and helped provide a rationale for damaging programmes and results such as were seen in the US in the last period. Investment will account for a large part of the increase in productive capacity which is required to achieve the 2035 strategic goals, consumption necessarily will be zero percent of the increase in productive capacity necessary to chieve the 2035 goals.

Finally. for clarity, these issues, naturally do not mean that even in the short term any initial demand side stimulus should consist wholly of consumption – demand for investment increases overall demand just as much as does consumption demand. But this difference of the demand and supply sides of the economy becomes particularly clear over the medium/long term.. Therefore, increase in consumption demand, if unaccompanied by increased investment, can only produce relatively short term increases in output. An increased in investment, in contrast, because it increases not only demand but supply can lead to a medium/long increase in output and, therefore achievement of strategic goals.

The strategic goals in the economy, in particular, therefore require an examination of the conditions which will create a sustained increase in investment. That large issue however, has to be the subject of another article simply for reasons of word length.

Conclusion

To summarise, the present world economic situation, is largely determined by the interrelation between two sets of stimulus measures. The first is the simultaneous inflationary wave and slowdown of production in the main Western economies which is inseparably bound up with the predictable failure of the US stimulus programmes launched to deal with the consequences of the Covid pandemic. Clarification of the reasons for this failure, in turn, has crucial lessons both for the short-term stimulus measures China’s economy requires in 2023 and their interrelation with the achievement of the strategic goals for 2035. In particular:

- As shown, confusion between the economy’s demand side and its supply side is extremely damaging. The facts regarding the results of the US stimulus programmes, and the issues involved for China, are entirely in line with both Marxist and serious Western economics. But they also show the dangerous errors of “vulgar” Western economics – errors which unfortunately sometimes appear in parts of China’s media.

- The negative aspects of the Western economies’ situation, the most severe stagflationary problems for forty years, was not caused by the Ukraine war – as this inflationary wave was already taking place long before that war started. It was directly caused by the major errors in the stimulus programmes launched by the US. Frequently rationalised by the wrong idea that consumption can produce something, that is that it is an input into production, the US launched a massive essentially exclusively consumer based, i.e. demand side only, stimulus. If such a stimulus had been launched when the US had been growing below trend, and had spare capacity, then despite its theoretical confusions this stimulus package might have been effective – the impact of economic measures is determined by their practical content not by their theoretical economic rationale. But instead, this massive demand side only stimulus was launched when the US economy was already growing above trend. The result was entirely predictable – with a huge increase in demand, and no increase in supply, the inevitable consequence was a huge inflationary wave, that is a short-term crisis. This inflation in turn led to sharply contractionary policies, notably steep interest rate rises, to attempt to bring it under control. These contractionary polices in turn slowed the economy – meaning that the stimulus packages were not only a short term but a complete strategic failure.

- China faces a sharply different practical situation. Its economy has been growing significantly below trend. A demand side stimulus will therefore find a situation where there is significant unused capacity. Under those circumstances a consumer stimulus, that is one solely on the demand side, is likely to be effective and necessary. Therefore, based both on considerations of economic theory and of personal practical experience, the present author strongly supports the idea of consumer stimulus as part of any overall stimulus programme in China at present.

- A potential danger in China’s situation is of a different type. It is the confusion that appears in some sections of China’s media of repetition of the same confusions as in vulgar Western economic theory – the false idea that consumption is an input in production and therefore that consumption can produce something.

- The damaging practical consequences of this error are clear. A consumer-based stimulus launched in the current conditions of China’s economy, as already analysed, should lead to a rapid and significant increase in production. But what will happen over the medium/long term will be determined by whether this demand side stimulus is accompanied by an increase in the economy’s supply side – which requires investment. The initial increase in output created by the consumer stimulus should not lead to damagingly high inflation in the short term for the reasons given, but after a certain period of time, exactly how long depends on how much spare capacity there is, unless there is an increase in investment, that is an increase in the supply side, there will either be slow growth, or inflation, or both – as in the US.

- The long-term implications for consumption of raising the percentage of consumption in GDP must be clearly understood. Other things being equal, over the medium/long term, the higher the percentage of consumption in GDP, because this lowers the percentage of investment, the lower will be the growth rate of the economy and of consumption. Over a longer period, such as the twelve years to 2035, increasing the percentage of consumption in GDP will lead to a lower level of consumption, and a lower standard of living, than with a higher percentage of investment, and therefore a lower percentage of consumption, in GDP. Those arguing for a higher percentage of consumption in GDP are in fact arguing in favour of a lower living standard by 2035 than would otherwise be the case. This is an inevitable consequence of the fact, demonstrated by economic theory, and confirmed factually by both the US and China, that over anything other than the short term the percentage of consumption in GDP and the growth rate of consumption move in opposite directions – that is, the higher the percentage of consumption in GDP the lower will be the rate of growth of consumption.

- A consumption, that is purely demand side, stimulus is valuable in creating a rapid revival in 2023 by putting unused capacity back to work. But consumption, because it is not an input into production, can constitute nothing, that is precisely zero percent, of the doubling of productive capacity which is required to achieve the strategic goals to 2035. That doubling of productive capacity, however, requires a huge increase in investment. A necessary condition of the achievement of these strategic goals of 2035 is therefore creation of such investment – the conditions for achieving this, solely for reasons of space, requires another substantial article.

As the present global economic situation is largely defined by the by the extremely negative consequences of the US stimulus programmes, which was fully in line with economic theory, clarity on these issues is crucial both for achievement of China’s immediate economic targets in 2023 and the achievement of its strategic goals to 2035.

* * *

This article was originally published in Chinese at Guancha.cn.

22 February 2023