The reality of a ‘Great Stagnation’ in the West has not merely major economic consequences but also major geopolitical effects which are summarised in this introduction and then will be analysed in greater detail in the conclusion of this article. This ‘Great Stagnation’ explains, for example, the political instability in the US around the Trump administration, in the UK around the vote for Brexit, and in France Macron’s recent crushing defeat of the traditional political parties.

This overall reality is crucial to bear in mind because in 2016 economic growth in the G7 economies was so slow, per capita GDP growth of only 0.9%, that for purely statistical reasons a partial recovery is likely in 2017. But, as will be analysed below, this upturn will be weak and will not restore the Western economies to relatively rapid growth. In terms of its perspectives for the international economy China must therefore be prepared for:

- A real but relatively small upturn in the business cycle in the major Western economies in 2017.

- This increase in 2017 however will not be large enough to alter the fundamental trend of very slow Western growth – China must prepare for at least a further five years of slow G7 growth.

A detailed analysis of the causal reasons for this very slow Western economic growth was given, focusing on the US, in ‘Why the US Remains Locked in Slow Growth’. A theoretical analysis is given in my book The Great Chess Game (一盘大棋? ——中国新命运解析). These analyses are therefore not repeated here. This article analyses the factual trends in the G7. It uses a source which cannot be accused of being biased against the West – the IMF. Indeed, analysis of the twice-yearly IMF predictions for the advanced economies shows that it has consistently overestimated the growth that will occur in the Western economies. All contemporary data in this article is from the latest IMF World Economic Outlook.

The rest of this article will analyse in detail the points made in this introductory summary.

Long term trends

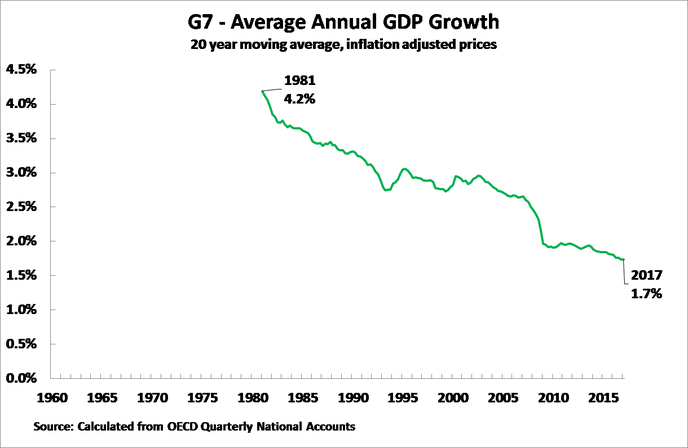

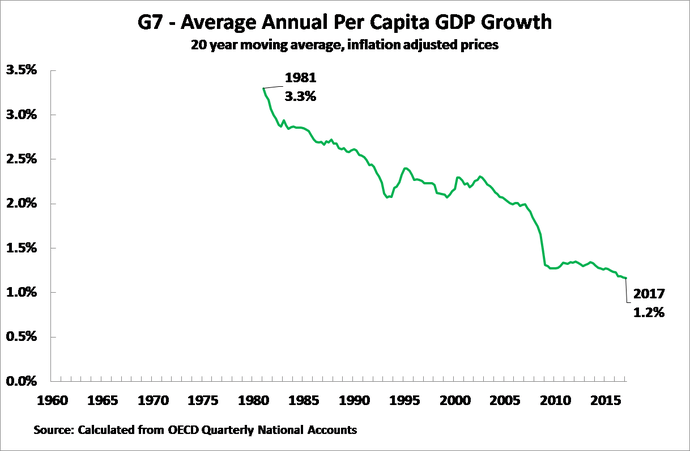

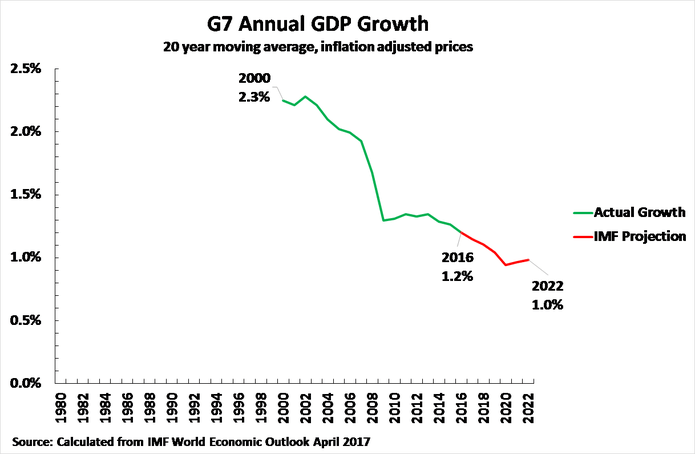

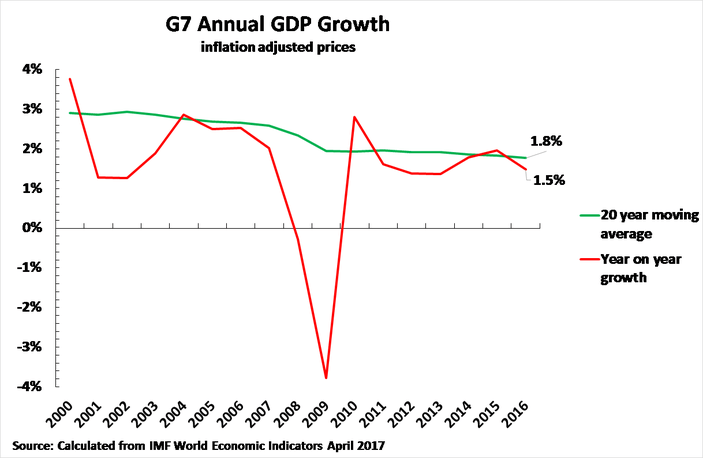

Starting with the most fundamental long-term trends, Figure 1 shows annual average GDP growth in the G7 economies up to the 1st quarter of 2017, while Figure 2 shows per capita GDP growth – both calculated using a 20-year moving average. The reason for analysing such a long fundamental trend is that market economies inherently show business cycles, therefore short-term trends are distorted by periods of economic expansion (which exaggerates average growth) or economic recession (which underestimates average growth). Using a long term moving average removes these cyclical shifts and allows the fundamental trend to be seen. Shorter term periods will be analysed towards the conclusion of this article.

The fundamental feature of G7 growth is clearly its profound slowdown. Annual average GDP growth has fallen from 4.1% in 1981 to 2.1% in the 1st quarter of 2017. Per capita GDP growth fell from 3.3% to 1.2% in the same period. Per capita GDP growth in the G7 in the last 20 years is therefore only slightly over 1%. The cumulative social and economic effects of such a prolonged period of very slow growth, of course, underlies the growing political instability and political fluctuations in the advanced economies mentioned at the beginning of this article and analysed in greater detail in the conclusion.

Comparison to the Great Depression of the 1930s

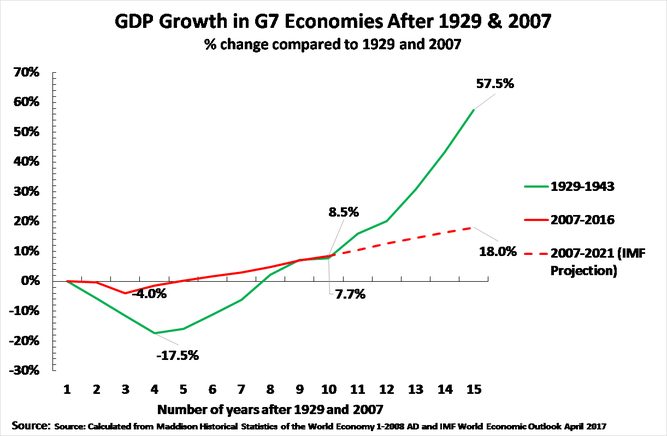

In order to appreciate the full historical scale of the current ‘Great Stagnation’ in the West it is useful to make a comparison to the ‘Great Depression’ after 1929 – the worst crisis in capitalism’s history. Figure 3 therefore shows the economic performance of the combined G7 economies after 1929, in comparison to their performance after 2007. This shows the following trend:

- Clearly the recession immediately after 1929 was more violent than that after 2007 – the maximum fall in G7 GDP after 1929 was 17.5% compared to 4.0% after 2007. The severity of this GDP contraction after 1929 gives rise to the name ‘Great Depression’.

- However, overall after the initial post-1929 economic collapse recovery during the 1930s was rapid and post-crisis growth strong – the US being the most important exception. In the G7 economies as a whole the Great Depression was actually a ‘V’ shaped – but with the rising stroke of the V greater than the descending one. This can be clearly seen in Figure 3 and by examining the situation in 1938, the last year before World War II. By a convenient statistical coincidence, 1938 was nine years after 1929, and 2016, the most recent year for current factual data, was nine years after the last pre-international financial crisis year of 2007. Therefore, in comparing 1929-38 with 2007-16 the same length of time is being analysed. By 1938, nine years after the beginning of the Great Depression, G7 output was 8.5% above its 1929 level and in 2016, nine years after 2007, G7 growth was 7.7% above its pre-financial crisis level. By 2016 growth of the Western economies after the international financial crisis was therefore almost as slow as in the Great Depression. But strikingly growth during the recovery period in the Great Depression was much faster than after the international financial crisis, so already by the end of this year overall growth after 2007 will be slower than after 1929 – G7 growth in the 10 years after 1929 was 15.9% and by 2017, 10 years after 2007, it will be 10.6% on IMF projections. The fact that Western growth after 2007 will actually be slower than after 1929 clarifies why the present period is most clearly characterised as a ‘Great Western Stagnation’.

- This present underperformance of the G7 economies compared to the post-1929 period will get progressively worse. By five years after 2016, that is in 2021, 14 years the IMF projection is that total G7 growth since 2007 will be 18.0% while in the 14 years after 1929 growth in the G7 economies was 57.5%. Average growth in the 14 years after 1929 was therefore more than three times as fast as in the 14 years after 2007 on IMF projections.

It is correct to point out that the final phase of recovery from the crash of 1929 was not achieved by ‘normal’ peaceful means. The period after 1938 was characterised by massive state intervention in the economy to prepare for and then wage war. But this fact does not alter economic reality. Economic expansion produced by massive state intervention, or oriented to war, is still economic growth. Furthermore, such growth, with the most important exception of the US, itself built on the rapid recovery already taking place after the post-1929 collapse. The fact is therefore clear that the period after 2007 will see far slower average growth than following 1929.

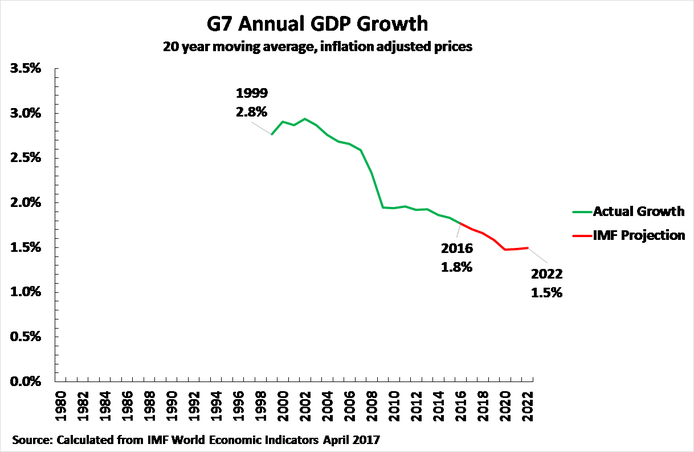

No recovery in the next periodFinally, it is important to note that the IMF predicts no acceleration of growth that will counteract the long-term slowdown in the Western economies. Indeed, the cumulative consequence of the prolonged period of slow growth will be intensified in the coming period. This is shown in Figure 4 – which illustrates the consequences of the IMF’s annual growth projections up to 2022. This shows that taking the year 2016 as a whole, annual average GDP growth in the G7 was 1.8% using a 20-year moving average. By 2022 this will have slowed to 1.5%. Per capita GDP growth will fall from 1.2% to 1.0% in the same period. In short, in terms of cumulative long-term growth the slowing of the Western economies will get worse in the next five years. In terms of per capita GDP, with only only average 1.0% growth the major Western economies over a 20-year period will not be far from literal stagnation.

Situation of the G7 business cycleFinally, in order to accurately analyse the global economic situation that will face China, it is necessary to assess not only the medium/long term situation of the Western economies but also their position in the business cycle. As market economies inherently show business cycles average growth is created by continuous oscillations above and below the long-term average growth rate created by structural economic factors. This means that a period of above average growth will be followed by a period of below average growth and vice versa.

Figure 6 therefore shows both a 20-year moving average for an annual average G7 growth and the year by year rate. It may be noted that in 2016 G7 growth was very low, at 1.5%, which was below the long-term average of 1.8%. Purely for statistical reasons, therefore, it would be likely that in 2017 G7 growth would accelerate somewhat. The IMF’s prediction for G7 growth in 2017 is 1.9%, slightly above the long-term average. This precisely illustrates the way in which exceptionally slow growth in one year is compensated for by faster growth in following years and vice versa.

But, as was shown in Figure 4 above, this slight upturn in the business cycle in 2017 will not be sufficient to prevent the slowdown of medium/long term average G7 growth. Therefore, as outlined at the beginning of this article, China must be prepared for the following global economic context:

- A real but relatively small upturn in the business cycle in the major Western economies in 2017.

- This increase not being large enough to alter the fundamental trend of very slow Western growth – China must prepare for at least a further five years of slow G7 growth.

Conclusions

The economic conclusions regarding trends in the Western economies that will confront China are therefore clear. To recapitulate and expand the consequences of the trends already noted:

- The limited upturn in the Western economies in 2017 will have beneficial results for China’s exports to these economies – this process is already underway.

- The medium/long-term growth of the Western economies will continue to be slow – meaning China cannot rely on the Western economies as the main locomotive of the global economy, and the chief locomotive of growth outside China will continue to be the developing economies and the One Belt One Road region.

For China’s overall international situation the implications are also clear:

- During the periods of earlier China leaders, from Mao Zedong to most of the period of Hu Jintao, China faced relatively rapid growth in the Western economies – whereas the period under Xi Jinping faces slow growth in the West. It is the combination domestically of China’s transition to first ‘moderate prosperity’, and then a ‘high income’ economy by World Bank standards, with very slow growth in the Western economies that constitutes a new feature of the ‘Xi Jinping period’. Dealing with this situation is reflected in the further development of China’s analysis in key concepts which have been introduced such as ‘community of common destiny’, ‘four comprehensives’ etc.

The geopolitical consequences of this very slow Western growth, and the domestic political consequences within in the Western countries, are also evident and can again be made still clearer by a comparison to the Great Depression.

- After 1929 the extreme rapidity and violence of the recession meant that acute political crisis appeared very early in the downturn – in 1931 Japan invaded China, also in 1931 the then existing international financial system collapsed with Britain leaving the gold standard, in 1932 Roosevelt was elected US President to launch the ‘New Deal’, in 1933 Hitler became German Chancellor etc.

- In contrast after 2007 the immediate economic recession was not so severe as after 1929, but the average economic stagnation is even longer than after 1929. This slow cumulative crisis means that acute political instability appears later in the economic process compared to after 1929 and starts in developing countries before penetrating into the advanced economies. Therefore cumulatively in 2010 there is the outbreak of the Arab Spring and generalised destabilisation of the Middle East; in 2012 the electoral breakthrough of Marine in Le Pen in France began the rise of ‘populist’ movements in advanced countries; in June 2016 the UK voted for Brexit; in November 2016 Trump was elected US President against the wishes of the establishment of both Republican and Democratic Parties; in January 2017 Trump was inaugurated US President leading to almost continual severe political clashes in US politics with numerous Congressional investigations and clear attempts by powerful sections of the mass media (CNN, New York Times etc) to remove the President; in May 2017 Macron was elected French President against the opposition of both right and left wing traditional political parties and then proceeded to crushing defeat the traditional French parties in the legislative elections; in June 2017 Theresa May loses her Parliamentary majority in UK general election.

Given the extremely slow growth that will continue in the G7/Western economies there will therefore not be a ‘return to normal’ but political instability in the advanced Western economies will continue.

In conclusion it should again be emphasised that the data presented in this article does not come from an ‘anti-Western’ source but from a pillar of ‘Western orthodoxy’ – the IMF. Indeed, the IMF has been repeatedly too optimistic in its projections of growth in the advanced economies. Furthermore, fundamental theoretical analysis leads to exactly the same conclusions as the IMF – as shown in ‘Why the US Remains Locked in Slow Growth’.

It may be asked why the Western economies do not adopt policies that would lift them out of this slow growth – because such measures are available? Here, for reasons of length and focus, merely the fundamental factual data has been shown. It should merely be emphasised that with the policies currently adopted by the Western economies they will remain locked in the very slow medium/long term growth analysed in this article. The reasons for this are analysed in The Great Chess Game and can form the subject of a different article.

To summarise, there will therefore be a limited upturn of the Western business cycle in 2017, but the medium/long term growth of the Western economies, their ‘Great Stagnation’ will be even slower than after 1929. This is the fundamental international economic and geopolitical situation facing China.