In the US President Biden is carrying out a revolution in economic policy which, without openly acknowledging it, in fact admits the failure of US the neo-liberal economic policies pursued during the last 40 years. Entirely abandoning the neo-liberal goal of “small government” Biden has unleashed the greatest increase in peacetime government spending in US history. This scale of increase in US government spending today entirely dwarfs previous peacetime US economic stimulus packages such as Roosevelt’s New Deal, the US response to the international financial crisis of 2008, or Reagan’s military build-up during the early 1980s. So large is this increase in government spending, with no proposal from Biden to reduce it, that he is proposing to permanently change the shape of the US economy. This therefore poses a whole series of questions for China.

- What exactly is the pattern of this fundamental change in the US economy and why has it taken place?

- What are the implications of the total collapse of US neo-liberal economics – a policy which not merely dominated US economic policy for four decades, but which even had an intellectual influence in some circles in China?

- Will this new US economic policy lead to significant growth, a real revival, of the US economy?

- How will China’s socialist economy fair in comparison to this new formula of US capitalist development?

These and related issues form the subject of this article. Its method is to “seek truth from facts” – that is, not to look at words but to systematically study the facts which an analysis of US economic policy must explain.

The scale of the US Covid stimulus

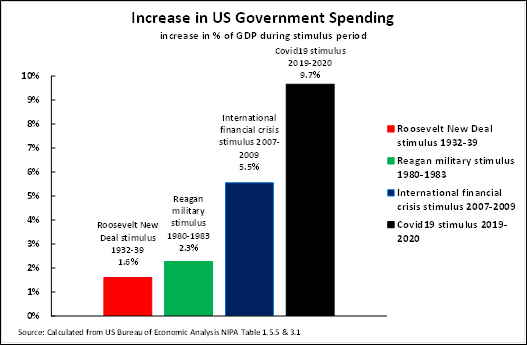

First it is necessary to accurately grasp the enormous scale of the state economic stimulus that the US has unleashed in order to try to deal with the effects of Covid. Indeed, Figure 1 shows that the increase in US government spending in 2020-2021 dwarfs anything in previous US peacetime history. Taking in each case the peak of the increase of US government spending as a percentage of GDP during stimulus packages.

- During Roosevelt’s New Deal in the 1930s US government spending increased by 1.6% of GDP – equivalent to $334 billion in 2020 prices.

- During Reagan’s military build-up of the early 1980s US government spending increased by 2.3% of GDP – equivalent to $476 billion in 2020 prices.

- During the US response to the international financial crisis after 2007 US government spending increased by 5.5% of GDP – equivalent to $1,162 billion in 2020 prices.

- In 2019-2020, confronted with the Covid19 crisis, US government spending increased by 9.7% of GDP – equivalent to $2,023 billion in 2020 prices.

That is, the increase in US government spending after Covid was almost twice as large as after the international financial crisis or more than six times as large as Roosevelt’s New Deal. Only the increase in US government expenditure during World War II, when this rose by 27% of GDP during 1941-44, exceeds the scale of the increase in US government spending since 2019.

Furthermore, there is no indication that Biden intends to substantially reduce this huge stimulus. Trump signed a $900bn Act for Covid relief in 2020. Under Biden Congress has already passed a $1.9 trillion economic stimulus plan and the Biden has proposed another $4 trillion of stimulus. Biden has proposed a $6 trillion US budget for next year.

Biden will undoubtedly face resistance in implementing these policies. Neo-liberalism was extremely profitable for sections of the US capital – in particular its policies of low taxes on the most well off aided the rich and its programme of privatisation, by taking sectors of the economy out of state ownership, opened up new areas for profitable exploitation by capital. Therefore, the Republicans will try to cut back some aspects of Biden’s stimulus packages, for example blocking increases in taxation on the rich which are intended to pay for parts of the programme and limiting state infrastructure spending. Nevertheless, the stimulus measures that have already passed mean that even with compromises on Biden’s proposals a very large stimulus programme and expansion of state spending will continue in the US.

Biden is therefore projecting enormous increases in US government spending not merely at present but extending into the future. The reasons for this change in US economic policy are analysed in detail below, but in summary they are the US’s competitive response to China’s economic success in general and in particular to dealing with the international financial crisis.

The changing shape of the US economy

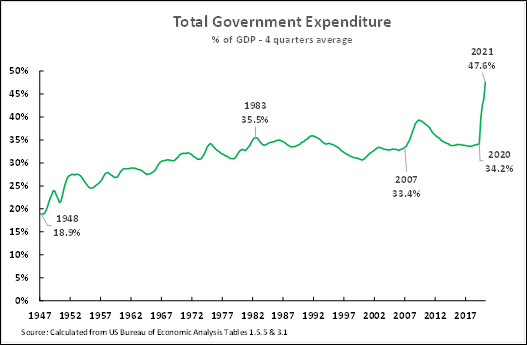

The impact of this enormous increase in US government spending can be seen clearly in Figure 2 – which shows the overall dynamics of US government expenditure since the end of World War II.

- During the period from World War II up to Reagan US government expenditure progressively rose – from 18.9% of GDP in 1947 to 35.5% in 1983. This steady increase means that this almost 40-year period from World War II up to the early 1980s may be characterized as the period of “big government” in the US.

- From Reagan onwards the share of government expenditure in US GDP essentially stopped rising – it was 35.5% of GDP in 1983 and 34.2% of GDP at the beginning of 2020. Despite Reagan’s verbal claims to stand for “small government” this cannot accurately be said to describe this 40-year period – as there was no substantial fall in the share of government spending in the US economy. But it was a period in which the remorseless rise in the share of government spending in US GDP, which had previously characterised the post-World War II US economy, was halted.

- Then, from the beginning of 2020 onwards, continuing into 2021, the share of government spending in US GDP soared upwards, reaching 47.6% of GDP – a level completely unprecedented in peacetime. Only the extraordinarily high level of state investment in the US economy during World War II, which at its peak the state accounted for 83% of total US investment, means that US state spending is not at its highest ever level not merely in peace but in wartime.

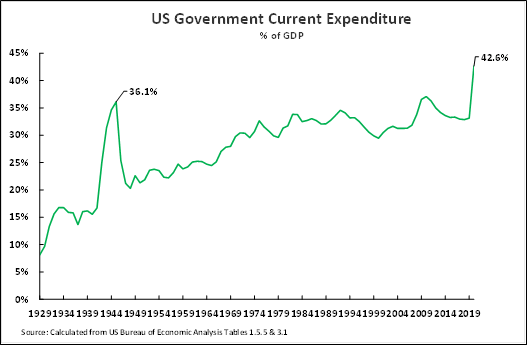

The highest level ever of US government current expenditure

Perhaps an even more striking trend is shown in Figure 3, which illustrates the share of US government current expenditure in GDP – that is excluding investment. This shows that the share of current US expenditure in US GDP is even higher than in wartime. The peak of US government current expenditure in World War II was 36.1% of GDP. However, the share of current US government expenditure in GDP was 42.6% in 2020 – therefore significantly above even its World War II level.

In summary, Biden is consolidating “big government” on a massive scale in the US. This therefore obviously poses several further questions. Why has Biden done this? Can Biden carry through his programme against Republican opposition? What will be its impact?

Why did the US launch such a huge recovery programme?

The first question is why did the US launch such a huge stimulus programme in response to Covid – by far the largest in its peacetime history and almost twice as large as after the international financial crisis? The answer lies not only in Covid itself but in the success of China’s response to the last international economic crisis, and the failure of the US, which has forced the abandonment of neo-liberalism in the US. Biden’s policies clearly show a calculation that unless US neo-liberalism is abandoned the US will have no chance of competing with socialist China.

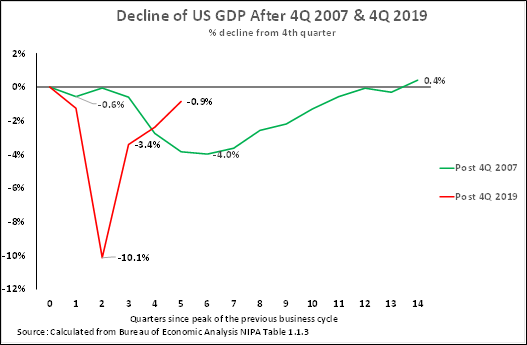

Analysing this shift in detail, the US stimulus programme in response to the 2008 financial crisis was proven in practice to be too weak to lead to rapid economic recovery. As Figure 4 showed it took US GDP three and a half years to recover to its pre-financial crisis level.

China’s advantage during the international financial crisis

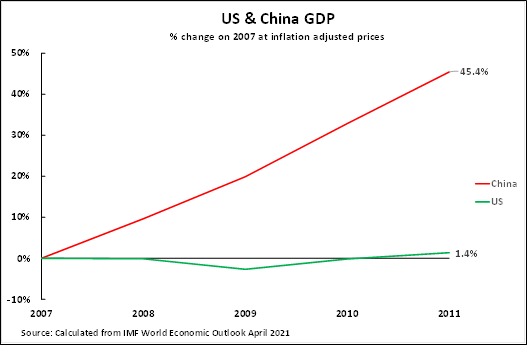

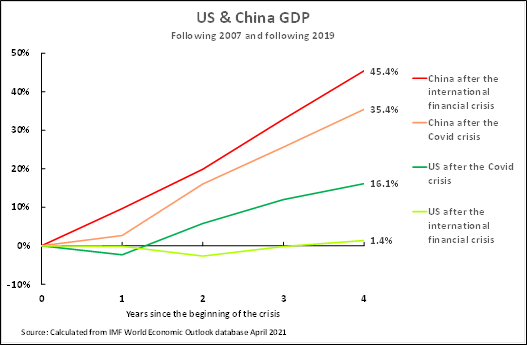

The result of the slow US recovery from the international financial crisis was that China, which had launched a major four trillion yuan ($586 billion) stimulus package to counter this crisis, achieved a huge comparative economic development advantage compared to the US. As shown in Figure 5 between 2007 and 2011 US GDP rose by only 1.4% but China’s GDP rose by 45.4% – producing a dramatic shift in the international relation of economic forces in China’s favour.

The US stimulus package in response to Covid, which is hugely bigger than China’s after the international financial crisis, therefore shows the real judgement that the US made regarding China’s earlier four trillion RMB stimulus. While in words the US criticised China’s earlier stimulus package, echoed by some in China, the facts of the US response to the Covid economic crisis shows that clearly the US concluded that such a stimulus package had been a huge success – any specific problems were secondary compared to the success of China’s stimulus package as a whole.

As the English saying goes “imitation is the sincerest form of flattery”. Therefore, faced with the Covid crisis, the US decided to launch its own huge stimulus package. Faced with the test of a real crisis US neo-liberalism, and “small government” collapsed.

The international dimension of the Biden stimulus package

In addition to its domestic impact there is already an early indication that the Biden stimulus package will reshape US relations with the world economy – although this is at present only an incipient trend and therefore its dynamics must continue to be followed in detail.

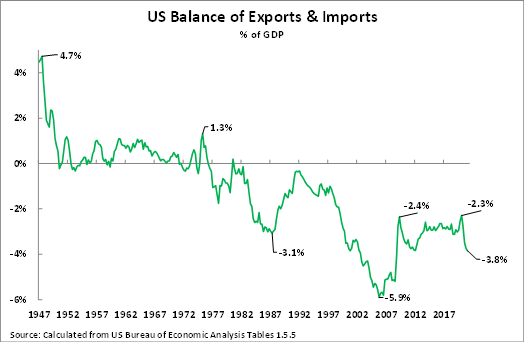

To understand this international process Figure 6 shows the US balance of a trade as a percentage of US GDP since the post-World War II period. This shows a sharply declining US international competivity during this more than 70-year period.

- Immediately after World War II the US, benefitting from its high productivity and the devastation of most other major economies by the war, ran a huge trade surplus of more than 4% of GDP.

- This huge trade surplus then declined. But nevertheless for three decades, until the 1970s, the US maintained a moderate average trade surplus of around or slightly under 1% of GDP.

- From the early 1980s, starting with the Reagan administration, US international competitivity began to drastically decline and the US developed a huge balance of trade deficit. This trade deficit reached 3.1% of GDP by the end of the Reagan presidency and then ballooned to 5.9% of GDP under George W Bush.

This enormous US trade deficit had deep economic and political consequences within the United States.

- Economically it meant that the US became increasingly dependent on inflows of foreign capital in order to finance its balance of trade deficit if the latter was not to cause a large decline in the dollar’s exchange rate (the outflow of dollars due to a large balance of trade and balance of payments deficit inevitably put downward pressure on the dollar’s exchange rate unless it was offset by a corresponding inflow of funds into the dollar). This huge inflow of global funds into the US helped finance US economic growth, but the balance of trade deficit meant that major sections of US internationally traded industries, above all manufacturing, were wiped out as they were no longer globally competitive. When such huge inflows of foreign capital were not available after 2007, due to the international financial crisis, the US balance of trade deficit was cut, to only 2.4% of GDP, but at the expense of the deep US economic recession already analysed in Figure 4 above.

- Politically the effect of these huge US trade deficits was to produce the notorious US “rust belts” – with entire working-class communities suffering drastic economic decline and mass unemployment, as their domestic production was replaced by imports.

Both these economic and political trends produced instability in the US – the economic process culminating in the international financial crisis, and the political one helping to lead to Trump’s election in 2016 as he claimed, falsely, that his tariffs policy would lead to a revival of US manufacturing jobs.

The slowing of the US economy

Figure 6 shows that under both Obama and during most of the Trump presidency the US balance of trade deficit ceased the dramatic widening that had been seen from Reagan to George W Bush – the US balance of trade deficit was 2.8% of GDP in the first quarter of 2009 when Obama came to office and it was the same more than 11 years later in the 2nd quarter of 2020 under Trump. This relative stabilisation of the US balance of trade meant that the US did not have to rely on increasing large inflow of foreign capital to stabilise the dollar’s exchange rate – but it also meant that there was not such a huge inflow of foreign funds to finance US economic growth.

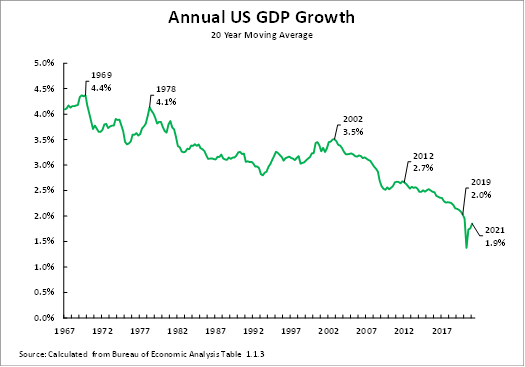

The domestic consequence of this was that under both Obama and Trump the US economy continued a slowdown which has been going on for 50 years. Figure 7 shows that, taking a long-term moving average, to remove the effect of short-term business cycle fluctuations, US annual average GDP growth fell from 4.4% in 1969, to 4.1% in 1978, to 3.5% in 2002, to 2.7% by 2012, to 2.0% in 2019 – that is immediately prior to Covid. While, naturally, the recession produced by Covid slowed the US economy still further, to 1.9% annual average GDP growth by the first quarter of 2021, this deceleration was not a “one-off” event but the continuation of a five-decade long slowing.

Figure 6 shows that the US trade deficit has significantly expanded again under the impact of Covid and/or the US stimulus packages – it grew from 2.3% of GDP prior to the onset of Covid and the stimulus packages to 3.8% of GDP in the first quarter of 2021. If this process continued it would mean that, in addition to domestic policies, the US was once again attempting to make use of increased inflows of capital from abroad to try to speed economic growth, rather than attempting to increase the weight of domestic industry – which had been Trump’s (unsuccessful) objective. If this trend develops it would supplement Biden’s domestic economic orientation by a new international one. But it is necessary to see if this trend is permanent or merely reflects the short-term impact of Covid.

Has Biden’s stimulus worked?

This long term slowing of the US economy obviously poses a key question. Will the Biden stimulus work? As can be seen from the data in Figure 4 above there is no doubt that the powerful US state spending stimulus launched in 2020-21 is associated with a more successful US recovery from the Covid recession than from the international financial crisis – how much this is due to its huge stimulus package and how much to the Covid crisis being different from the international financial crisis is not crucial for the present analysis as what matters is the result. It took US GDP three and a half years to recover to its pre-crisis level after the international financial crisis. But only one year and three months after the economic peak before the onset of Covid US GDP was only 0.9% below its previous peak level.

The large US stimulus package launched against Covid19 must therefore be counted as vey much more successful than the smaller one which followed the international financial crisis. But the problem, as already shown, is that this relatively greater success of the US economy in recovering from the Covid recession than from the international financial crisis comes against a fundamental background that the US economy has been slowing down for 50 years.

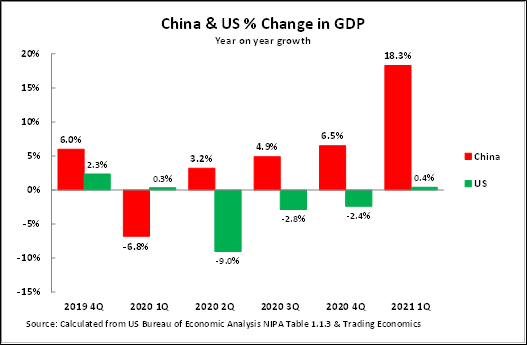

To make a thorough analysis of the prospects for the US economy under the Biden stimulus would require a lengthy analysis which will be the subject of a future article. However, for present purposes, the short-term practical consequences are already evident. While US economic recovery after Covid is much faster than after the international financial crisis, US recovery from the Covid recession has still not been as rapid as China’s. Figure 8 shows that, apart from the first quarter of 2020, when Covid had already hit China but not the US, China’s economic growth has far outperformed the US throughout the entire period of crisis created by the Covid pandemic.

Most directly in 2020 China’s economy expanded by 2.3% while the US economy shrank by 3.5%. That is, in a single year, China’s economy grew by almost 6% relative to the US. The exact pattern in 2021 will not be clear until at least the second quarter of the year, due to the 18.1% increase in China’s GDP in the first quarter of the year being exaggerated by comparison to the severe recession in China in the first quarter of 2020. But in the first quarter of 2021 China’s economy was 10.3% larger than in the first quarter of 2019, whereas the US economy was only 0.7% larger – that is, in the two years from the first quarter of 2019 to the first quarter of 2021 China’s economy grew by almost 10% relative to the US. While it is possible that the US will narrow that gap as it recovers in 2021 nevertheless this is a shift in the economic relation of forces against the US and in favour of China.

In summary, the enormous scale of the current US stimulus package can clearly be argued to have prevented the US suffering the prolonged economic slowdown after financial crisis, but it was not enough to catch up with the relative gain made by China.

How the US has gained from its stimulus package

The overall conclusion that follows from these economic facts is that the US concludes that it will do better after Covid than after the international financial crisis because of its huge stimulus – and China will do less well because of lack of a comparable large stimulus. This is shown clearly in the IMF projections for China’s and the US economies shown in Figure 9. As may be seen the IMF projects that the US economy will do significantly better following the Covid crisis, compared to following the international financial crisis, because of the large size of the US stimulus. In the four years following the onset of the international financial crisis the US economy grew by only 1.4%, whereas in the four years following Covid, due to its large stimulus the US economy is projected to grow by 16.1%. In contrast during the four years following the international financial crisis China’s economy grew by 45.4%, whereas in the four years following Covid it increased by only 35.4%.

To summarise, the US, by launching a large-scale stimulus package following Covid, when China has not launched an equivalently large stimulus, calculates it can reduce the type of huge gain that China made relative to the US during the international financial crisis. Placed in a geopolitical strategy the US goal is to limit the advantage economic advantage that China will gain during the Covid economic crisis relative to the US while the US simultaneously attempts to create a broad “anti-China united front” with its allies to more than offset any gain which China does make. The Biden domestic economic stimulus package and the attempt to recement relations with US allies are therefore two sides of the same geopolitical coin.

Conclusion

The conclusions that flow from the facts of the economic policy launched by Biden are clear.

First, Biden has completely abandoned the policies of “small government”, of neo-liberalism, that have been ideologically dominant, if less followed in practice, in the US for the last forty years. While the US continues to verbally criticise the large economic stimulus launched by China in response to the international financial crisis in reality the US has concluded that large scale stimulus packages are effective and has launched one.

Second, this huge stimulus launched by the US in response to Covid is leading to much more rapid US recovery and growth than after the international financial crisis. That is, using the power of the US state has produced a much more effective economic response than the much smaller US economic stimulus which followed the international financial crisis.

The result of this abandonment of neo-liberalism therefore means that the US has become a more formidable economic competitor for China. While China’s economy is continuing to outgrow the US nevertheless the large US stimulus package means that China’s lead in economic development over the US in response to Covid will be smaller than after the international financial crisis.

Meanwhile, of course, the US, will urge on China, in an attempt to damage it, exactly the opposite course to the one the US is itself now pursuing. If the US has abandoned neo-liberalism, because of its damaging effects, then the US will attempt encourage and boost all supporters of neo-liberalism in China – because this will damage China’s economy. If the US is using a large-scale stimulus to boost its own economy then it will oppose any stimulus at all, even accurately judged ones in scale, in China. While the neo-liberals have been abandoned in the US, because of the damaging effects of their policies, the US will attempt to boost the prestige of neo-liberals in China – precisely in order to damage China’s economy.

There are, of course, many more detailed issues to be examined within this overall framework. Most importantly the nature of the stimulus packages in the US are very different to the stimulus programmes in China – due to the different nature of the capitalist and socialist systems. Analysis of this will form the content of a future article.

But for the present, it is necessary to analyse the largest fact. Biden has abandoned 40 years of US neo-liberalism. He is attempting the greatest change in US economic policy since Reagan. This change in economic policy will make the US a more formidable economic competitor to China. These are very large facts with significant consequences for China.

John Ross has provided brilliant points:

[1] The US economy has been on a slow-down over 50 years. The implications are that it will be hard to change this trend without a revolutionary stroke of daring.

[2] US Trade Deficit had steadily grown, from post WWII +4% of GDP to -5.9% after Trump. The question is how should Biden apply his gigantic stimuli in order to sell more to the rest of the world, to jump past the habit of US citizen over-spending?

[3] During the Covid infected period of 5 quarters up to now, China vs US GDP has changed by 10% in favour of China. It is from this basis that future years will grow towards. IMF, World Bank and Biden have opined that the gigantic stimuli will lift US into supercharged growth; provided China does not unleash any gigantic stimuli of her own.

[4] John Ross analyzes that the 2008 NINJA crisis took 4 years for Obama to lift US from the big hole while China’s $670B stimulus showed success for China. The Biden group is trying to imitate China by launching a much bigger stimulus compared with their NINJA stimuli. Very insightful. Ross says jury is still out.

[5] Biden abandoning neo-liberalism in favour of big government, much bigger government share of economy. Reagan for all his talk of trickle-down less government, actually massively increased big government. John Ross again is very clear-headed in detecting the Biden dramatic slant. Again, I will await earnestly for John’s continue observation to see how well Biden will do. Again there has to be an assumption that China will not unleash a giant stimulus.

[6} John Ross has articulated the two pronged action of Biden, again very insightfully. One, Biden will use his historic gigantic stimuli to create a government boosted GDP growth to surpass China’s, or at least match China’s. Two, Biden will use hostile actions to try and increase the power of neo-liberalism within CPC factions because he believes neo-liberalism has failed, and so he want China to adopt it so as to fail. This Ross method of watching Biden/China is simple but so far unique among western analysts of high profile.

MY ADDITIONAL THOUGHTS

[1] Assumption of Plan125 is not in Biden nor any other western calculation. I say, the devil is in the details. During the NINJA/basket Financial Crisis, China was faster than the west but still had not gone through the Plan125 years. In fact from my personal knowledge, even the cadres, and planners of Plan125 did not expect the huge degree of success this plan engendered. The high-speed trains network was supposed to take 10 years before a citizen can go from Beijing to Guangzhou and return all in ond day. It took less than 5 years. China in this one sector, went from nothing to 66% of the world’s high-speed trains all in 5 years. That meant that all executives, operatives of China were able to travel 3 times faster at all times increasing the area of their coverage by 9 times. From 2016 onward, China therefore has been operating in a competitive dynamic of 9 times faster than before and than any other country. So if we add this calculation into watching the effects of geo-political shifts given Biden’s gigantic stimuli, we shall see the devil in the details.

[2] Application of A Budget. I first got to apply my MBA learned traits as one member of a team of 4 consultants sent into a corporation to turn it around. Two things, specific management policy changes, and application of the budget Rather than what others would go into cutting budgets to achieve profitability, I say the need to set some policies such as changing commission rates to give sales-force higher rate for exclusive high margin line. And instead of cutting cost across the board, took from wastes and added to areas and branches under-staffed. Again in another corporation where I administered all the budget for the CEO and saw good results from detailed studies, and then daring application of targeted spending. My CEO called me “the gnome of Zurich.”

I assume that the Biden has capable management talents in his team, e.g. Janet Yellen. But he is up against several reactionary forces. One is the Republicans who will opposed the size of his stimuli, and the taxes increases to reverse the pro-1% deeds of Bush and Trump. Secondly, the established pork-barrels of the MI-Complex will hold on to the defense spending which has built in habitual high costs blunting the effectiveness of competing with China. Thirdly, it bears repeating that US does not have the manufacturing infra-structure that China has. China in R&D has surpassed US and is graduating multiple times the number of STEM personnel. Throwing money at a problem or project requires the network that can apply it at efficiency and minimum costs.

As for China, I have to repeat my story from behind the curtain. In 2009, when Premier Wen Jiabao went to the G20 Summit in the midst of the NINJA financial crisis, the US and other colonial nations, infected by the NINJA loan disease, asked China for massive loans. Wen Jiabao instead announced that China would help kick back economic activities for the world by spending $670 Billions over 2 years on internal need, for the Sichuan earthquake reconstruction and for environmental clean-ups. On friend who was responsible for budgetary planning in a Chinese Provincial State Grid, got a phone call from his superior in Beijing State Grid Headquarters that same week-end to give him his portion of the stimulus which amounted to doubling his budgets for the next 2 years. Within 2 weeks he was to finalize and report back on which project proposals already submitted for future years to be brought forward. A month later, I participated in a teleconference as a member of an environmental trade delegation from Ontario to visit China. I asked a Chinese participant who was their provincial environment ministry high official about the Wen Jiabao stimulus. He told me the same thing that within days, he was contacted by his direct dotted superior in Beijing specifically bringing forward specific projects that were previously discussed. In another occasion, while in China a couple of months later, in Hunan, another friend high up in provincial environmental sector told me the same thing of how immediately his group worked overnight in detailing their portion of the stimulus, involved with the Fa Gai Wei.

I am saying that from my observation of how China effected their mega-policies from top down as well as from bottom up at the same time and quickly. I bet you Biden does not have a bureaucratic infra-structure that can pivot on a dime like the Chinese habitually do.

[3] PPP. All the calculations and analyses are mostly in nominal currency numbers. So a trillion dollar stimulus in US will buy a lot less than what it can buy in China. Given that in PPP, China’s GDP is already 18% higher than the USA. China now has the biggest manufacturing infra-structure of the world and China has major participation in all possible industries. Very little can be said about US in that regard. China has consistently shown her lower cost efficiency and higher speed of implementation. In fact before the Plan125, for over 10 years, engineers in giant western firms had complained that they would always lose to China engineering giants in African mega infra-structure projects. Let’s say Biden manages to cut Defense Budget massively and increase taxes to the rich, it will still require a lot of time to fund R&D massively to achieve the quality of fundamental education, research, manufacturing infra-structure to get up to speed to compete across the board with China.

China usually creates demand through non profitable investments.

USA is creating demand by stimulus to Wall St and some R&D programs.

We need to analyse what percentage of US stimulus will end up in asset trading only.

Another point is 2008 crisis was due to bad investment resulting from abundance of capital seeking profit making ventures.

So 2008 crisis was mostly a result of over accumulation or lack of demand crisis.

Covid crisis is mainly sudden halt of supply and hence supply shock crisis.

Demand creating stimulus is ideal for over accumulation crisis but can be inflationary for supply shock crisis.

More government led non profit investment

=> less profit from USA asset market

=> less foreign investment in USA asset market

=> less demand for USA asset in global market

=> less demand for US Dollar in global market

=> devaluation of US Dollar

=> less import of cheap products

=> more resources will go to substitute imports

=> less resources will be available for Pentagon and CIA or in short maintaining hegemony