Economics textbooks, particularly when discussing Keynes, frequently contain an elementary economic confusion – it should be made explicit this is a confusion in the textbooks and is not stated by Keynes. A typical example may be taken as Mankiw’s Principles of Economics, but numerous other examples could be cited as the confusion is widespread.1 This elementary economic confusion is expressed in the following formula

Y = C + I + G + NX

In this widely used formulation Y = GDP, C is private consumption, I is private investment, G is government spending, and NX is net exports. For a closed economy, which can be considered here as trade is not relevant to the issues analysed, this becomes.

Y = C + I + G

From this it is typically argued that if there is a shortfall in private consumption C, private investment I, or both, then this can, or should, be compensated for by an increase in government spending G. This allegedly constitutes a ‘Keynesian’ policy. The fundamental confusion is that there exists no category ‘government spending’ G which is neither consumption nor investment – government spending is necessarily used for either investment or consumption. In short the correct formula is expressed as

Y = Cp + Cg + Ip + Ig

Where Cp is private consumption, Cg is government consumption, Ip is private investment and Ig is government investment.

Keynes himself is clear on the distinction writing:

‘loan expenditure’ is a convenient expression for the net borrowing of public authorities on all accounts, whether on capital account or to meet a budgetary deficit. The one form of loan expenditure operates by increasing investment and the other by increasing the propensity to consume.2

This formula clearly distinguishes Cg and Ig as indicated above.

For Marxists it should be noted that this distinction is also made clear in Marx’s categorisation of the economy into Department I (investment goods and services) and Department II (consumption goods and services).

The attempt in economics textbooks to introduce a third category G which is neither used for consumption nor investment is a piece of economic nonsense which should be stopped.

A key reason the lack of clarity created by introducing the confused term G is practically economically significant is the consequence for the structure of the economy when is there is unspent private saving, including non-invested company saving – i.e. private saving is not being transformed into private investment, and the government steps in to maintain demand. There are then two possibilities.

If non-invested private saving is used by the government for investment, that is Ig increases, there is no change in the economy’s overall level of investment – private investment is simply replaced by government investment.

If, however, the non-invested private savings is instead used by the government to fund consumption, that is Cg increases, then the percentage of consumption in the economy rises and the percentage of investment falls.

The use of an economically confused term G therefore obscures the choice being made for the economy’s overall investment level by whether there is an increase in government investment Ig or an increase in government consumption Cg.

The practical significance of this confusion is that modern econometrics shows that capital investment is the quantitatively most important factor in economic growth. Therefore reducing the proportion of the economy used for investment, other things being equal, will reduce the economic growth rate.

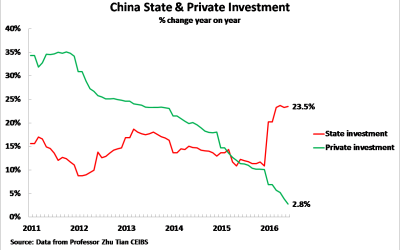

Both economic economic theory and practical results show that in a capitalist economy, not necessarily an economy such as China’s, there is greater resistance to government spending on investment than on consumption – as state investment involves an incursion into the means of production, which in a capitalist economy by definition must be predominantly privately owned. This theoretical point is confirmed by the fact that state expenditure on consumption has historically risen as a proportion of GDP in most capitalist economies since the economic period following World War II while state expenditure on investment has in general fallen in the same period.

The acceptance of government expansion of consumption, but opposition to government investment, therefore has the consequence that when so called ‘Keynesian’ methods of running government budget deficits are used, and G rises, what in practice happens is that Cg rises but Ig does not. As the government is transferring non-invested private savings into consumption such so called ‘Keynesian’ intervention therefore has the effect of reducing the economy’s investment level – and therefore reducing the economic growth rate. This process is concealed by using the confused term G instead of its proper components Cg and Ig .

However, as already noted, it should be made clear that this confusion is in textbooks and not in Keynes himself. But followers of Keynes should point out this elementary and damaging confusion contained in many economic textbooks.

Notes

1. Mankiw, Principles of Economics 6th edition p562.

2. Keynes, The General Theory of Employment Interest and Money, MacMillan edition 1983 p128

If, however, the non-invested private savings is instead used by the government to fund consumption, that is Cg increases, then the percentage of consumption in the economy rises and the percentage of investment falls.

The use of an economically confused term G therefore obscures the choice being made for the economy’s overall investment level by whether there is an increase in government investment Ig or an increase in government consumption Cg.

What would be examples of government spending on consumption? The only government spending I can think of are investments