In 1992-98 the greatest peacetime economic collapse in a major country since at least the Industrial Revolution took place in Russia under the impact of policies promoted by the IMF, World Bank and OECD.

- Russia’s economy contracted by almost 40%, male life expectancy dropped by six years to only 58 by 1998, and in 2013 Russia’s population was still 4.6 million less than in 1991. Russia’s GDP growth over the period from 1991, the last year of the USSR, to 2013 was 1.0% a year – compared to 10.2% in China.

- In Ukraine, the second largest state of the former USSR, the result was worse. In 2013, Ukraine’s GDP was still 23% below its level in 1991 – i.e. Ukraine experienced net negative growth over a 22-year period.

The IMF and Western media still hushes up this catastrophe because it is a total condemnation of their policies and theoretical framework of neo-liberalism in one of the greatest practical tests of economic theories in history.

It was perfectly possible to foresee this catastrophe in Russia from economic theory in advance as the author accurately predicted the catastrophic consequences of these policies – as shown in my 1991 article ‘An Economist’s Mein Kampf’ and the 1992 one ‘Why the Economic Reform Succeeded in China and Will Fail in Russia and Eastern Europe’. The contrast between the economic catastrophe in Russia and the extremely strong growth in China was clear.

As Justin Yifu Lin, China’s former Chief Economist and Senior Vice President of the World Bank, accurately summarised the results of this test of the contrasting approaches of China and majority Western economic advice:

‘China initiated its reform in late 1978, emphasizing gradualism and a dual-track approach. It fared much better than the former Soviet Union and Eastern European countries that went through the shock therapy proposed by mainstream theories. The prevailing view of many foreign scholars was that the market economy was best, the planned economy was bad, and the dual system combining the market and planned economy was worst. Mainstream [Western] theory urged socialist countries to make the leap from a planned to a market economy in a single bound.’[1]

But the test of facts, of practice, was decisive. Comparing the results of the policies pursued by China and majority Western advice, as Lin notes:

‘From day one the policies [of China] elicited widespread scepticism in international academic circles. But against a wave of criticism China’s economy notched up one amazing achievement after another, producing the ‘China miracle,’ with thirty consecutive years of rapid growth.’[2]

There are numerous lessons of the catastrophic failure of IMF/World Bank policies compared to the successful ones of China. But one is of particular relevance to present debates in China and some other countries – that of capital controls. The following article analyses the catastrophic results of IMF/World Bank policies in Russia and how they assisted oligarchs to loot that country. It places this against the overall wrong policies of the IMF/World Bank on liberalisation of capital controls.

A number of East Asian developing economies were persuaded by the IMF and World Bank to liberalise their international capital account. Elimination of these capital controls in turn permitted funds to flow out of the East Asian developing economies in 1997 – creating the devastating Asian financial crisis of that year. As Joseph Stiglitz, Nobel Prize winner and former chief economist of the World Bank, noted regarding this:

‘excessively rapid financial and capital market liberalization was probably the single most important cause of the crisis.’[3]

There are differing interpretations as to whether the US did or did not deliberately precipitate the 1997 crisis to slow the Asian Tiger economies.[4] What is clear, however, is that once the crisis began the US supported policies which made the results worse and opposed steps that would have alleviated it. In particular the US strongly opposed a proposal by Japan to set up an Asian Monetary Fund to provide funds to deal with the crisis.[5]

For present purposes it is unnecessary to judge US administrations subjective policy intentions in the Asian financial crisis – it is merely sufficient to note that liberalisation of the capital account had catastrophic economic consequences.

A similar process had unfolded earlier in Russia as IMF and World Bank policies allowed the looting of the country by the oligarchs.

The Russian catastrophe

The theoretical argument formulated by the IMF, World Bank and others to persuade Russia to adopt the policies which led to economic catastrophe in the 1990s was that as Russia’s companies were state owned they were subject to ‘soft budget constraints,’ that is they could receive state subsidies, and therefore they did not have incentives to increase efficiency.[6] Consequently companies should be privatised to subject them to ‘hard budget constraints’. On this basis their efficiency would increase and the economy would thrive. To further ensure ‘efficient allocation of capital’ international capital controls should be removed so that investment would flow internationally to where it would receive the best rate of return – this would allegedly further raise efficiency of capital allocation.

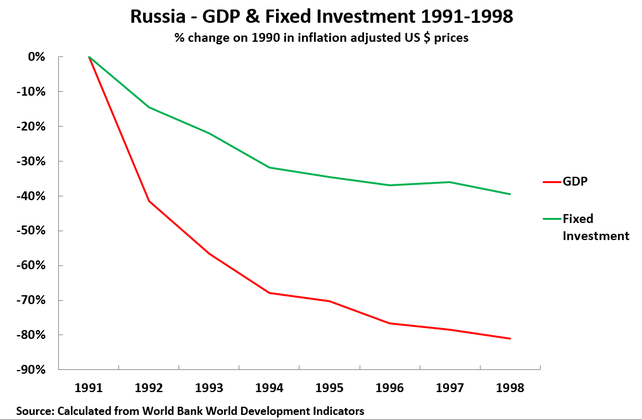

From a theoretical point of view this argument was false. First globally fixed investment, and second labour inputs, are more important sources of economic growth than Total Factor Productivity (TFP) – see ‘Why ‘Classical Economic Theory’ Correctly Explained Asia’s Growth’ and ‘A “Copernican Revolution” in Western Economics & China’s ‘Supply Side’ Reform’. Any increase in TFP would be overwhelmed by the collapse in Russia’s fixed investment which would unfold as companies were privatised and deprived of state support.

In line with this reality between 1991, the last year of the USSR, and 1998 Russia’s fixed investment fell by 81% – a fall even greater than in the US during the Great Depression. As an inevitable consequence Russia’s GDP fell by 41%, again an even greater collapse than during the US Great Depression – these trends are shown in Figure 1. What occurred in Russia became the greatest peacetime economic collapse in any economy since at least the Industrial Revolution – creating an economic as well as a national catastrophe.

‘The core section [of the World Bank/IMF A Study of the Soviet Economy] is the ‘Assessment of Medium Term Economic Prospects’. Its essential proposal is summed up by the fact that it only deals in detail with two sectors of the Soviet economy – energy and agriculture…

‘In contrast to… ‘medium term’ recommendations for energy and agriculture none are given for Soviet manufacturing. Instead the study claims that despite a level of manufacturing trade which is ‘extraordinary low’, and therefore an obvious case for expansion: ‘It is virtually impossible to judge…underlying comparative advantages the Soviet economy might enjoy in the industrial sector’. Therefore: ‘it may be more effective to concentrate on increasing exports of energy and raw materials’.

The present author predicted:

‘it is anticipated that… industrial production will collapse. In the case of the report’s computer simulation: ‘Output… drops sharply following price liberalisation… industrial output is projected to drop 20 per cent in the first year of the radical scenario, with total output (GDP) declining something like 10 per cent.

‘With energy and agriculture exports soaring, and industry collapsing, what is proposed is that Soviet Union undergo massive deindustrialisation to become a supplier of energy and agriculture…

‘This goal is, naturally, not explicitly spelt out – it might lead to explosive resistance. But it is clear in the figures.

As a comparison it was noted:

‘IMF ‘stabilisation’ proposals both for Eastern Europe and Latin America and Africa always assert that after the initial economic collapse there will be economic recovery. Experience of such plans shows that while the initial collapse is invariably underestimated the recovery does not take place.

‘Thus western agencies are already admitting that they painted a rosy view of what would occur… But at least the IMF proposed that the main East European countries remained manufacturing/service based economies. The ex-USSR’s position as a supplier of raw materials would be far worse.

Regarding the shape of the economy that would emerge from this process in Russia the following was predicted – which is exactly what occurred:

‘Turning to those likely to benefit from such a programme… the report foresees considerable problems in “public relations” in the light of an apparently… accurate assessment by the Soviet population of what is taking place: “It is widely believed in the USSR that many of those acquiring economic power in the enterprises, and in the process taking ownership of state assets, are members of the nomenklatura, who are exploiting their rank and insider information. Another line of popular belief is that many of the new entrepreneurs are essentially criminals, emerging from the underworld of black marketeers and speculators. This negative public image could generate a “serious backlash…”

‘The perspectives of the IMF is therefore deindustrialisation of the USSR, its transformation into a supplier of raw materials.’

The result was precisely as this analysis made by the author in advance predicted. In parallel with the unprecedented economic collapse Russia’s male life expectancy dropped by six years at its worst point. Nobel Prize winner Joseph Stiglitz accurately summarised the outcome:

‘The devastation – the loss in GDP – was greater than Russia had suffered in World War II. In the period 1940-46 the Soviet Union industrial production fell 24 percent. In the period 1990-99, Russian industrial production fell by almost 60 percent.’[7]

The result, again as Stiglitz described, was as the present author had analysed before the event

‘Russia had quickly been transformed from an industrial giant – a country that had managed with Sputnik to put the first satellite into orbit – into a natural resource exporter. ‘[8]

The consequences of this geopolitical disaster were felt not only economically, in Russia’s transformation from a great industrial state into essentially a raw material producer, but in events such as war in Chechnya, war between Azerbaijan and Armenia, war between Georgia and Russia, and civil war in Ukraine. Far from it being impossible to foresee such events in advance, it was precisely possible to do so – as the author’s writing at the time showed. The contrast between the catastrophe unfolding in the former USSR and the rapid economic growth enjoyed by China is evident.

Benefitting from Russia’s economic catastrophe

If the catastrophic economic consequences of the policies supported by the World Bank in the former USSR could be predicted in advance, and literally amounted to ‘economic suicide’, why could any force in Russia support them? It is crucial to understand that although this policy was a ‘national catastrophe’ for Russia, nevertheless for a social layer within it, those who became the ‘oligarchs’, it was immensely profitable.

Russia’s committing economic ‘suicide’ was therefore achieved through aligning foreign policy interests hostile to Russia with the interests of the private oligarchs who became rich through the process of restoration of capitalism and national disintegration within Russia. These internal and external policy goals were coordinated down to detail. In particular a crucial role was played by liberalisation of Russia’s international capital account – as this made it easy for the oligarchs to take huge sums out of the country. As Stiglitz notes:

‘The [Russian] government was borrowing billions from the IMF, becoming increasingly indebted, while the oligarchs, who had received such largesse from the government, were taking billions out of the country.’[9]

Liberalisation of the capital account was synchronised with an overvalued exchange rate to serve the new capitalist oligarchs interests:

‘If for… people, and the country as a whole, the overvalued exchange rate was a disaster, for the new class of businessmen the overvalued exchange rate was a boon. They needed fewer rubles to buy their Mercedes, their Chanel handbags, and imported Italian gourmet foods. For the oligarchs trying to get their money out of the country, too, the overvalued exchange rate was a boon – it meant that they could get more dollars for their rubles, as they squirreled away their profits in foreign bank accounts.’ [10]

Even in the immediate period leading to Russia’s 1998 debt default and devaluation, external economic packages organised and promoted by the IMF and World Bank, and supported by the US, were coordinated to coincide with these sectors of internal Russian interests that were benefitting and profiting from the country’s national economic suicide. As Stiglitz notes of his experience in the World Bank at the time:

‘We felt that it would take days or even weeks for the oligarchs to bleed the money out of the country; it took merely hours and days. The Russian government even ‘allowed’ the exchange rate to appreciate. As we have seen, this meant the oligarchs would need to spend few rubles to purchase their dollars… When the IMF was confronted with the facts – the billions of dollars it had given (loaned) Russia was showing up in Cypriot and Swiss bank accounts just days after the loan was made – it claimed that these weren’t their dollars… The IMF had lent Russia the dollars – funds that allowed Russia, in turn, to give its oligarchs the dollars to take out of the country. Some of us quipped that the IMF would make life easier all around if it had simply sent the money directly into Swiss and Cyprus bank

accounts.’[11]

In short, Russia could be persuaded to carry out ‘suicide’ not only because of external forces but because it was immensely profitable for some groups inside the country – and these groups could be used in a coordinated way by those outside the country who wished to weaken it.

Notes

[1] Lin, J. Y. (2012). Demystifying the Chinese Economy. Cambridge: Cambridge University Press 2012, p. 154)

[2] Lin, J. Y. Demystifying the Chinese Economy. Cambridge: Cambridge University Press 2012, p. 154)

p. xv)

[3] Stiglitz, J, Gobalization and its Discontents. London: Penguin 2002, p. 89.

[4] For a relatively neutral account see Eichengreen, B. Globalizing Capital: A History of the International Monetary System. Princeton: Princeton University Press, 2008, pp. 192-198)

[5] For a detailed analysis see Stiglitz, 2002, pp. 89-132.

[6] For a survey of historical theories of the ‘soft budget constraint’ see Maskin, E. S. (1996). Theories of the soft budget-constraint. Japan and the World Economy, 1996 125-133.

[7] Stiglitz, 2002, p. 143

[8] Stiglitz, 2002, p. 145

[9] Stiglitz, 2002, p. 145

[10] Stiglitz, 2002, p. 146

[11] Stiglitz, 2002, p. 150

[…] positively with their memory of the economic rape, pillaging, and criminality of the 90s – catalysed, let’s admit it, by the USA and its allies. The intention of NATO was to completely dismantle the largest fragment of the broken Soviet […]